P&L Statement Vs Balance Sheet - The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

The Difference Between a Balance Sheet and P&L Infographic

Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

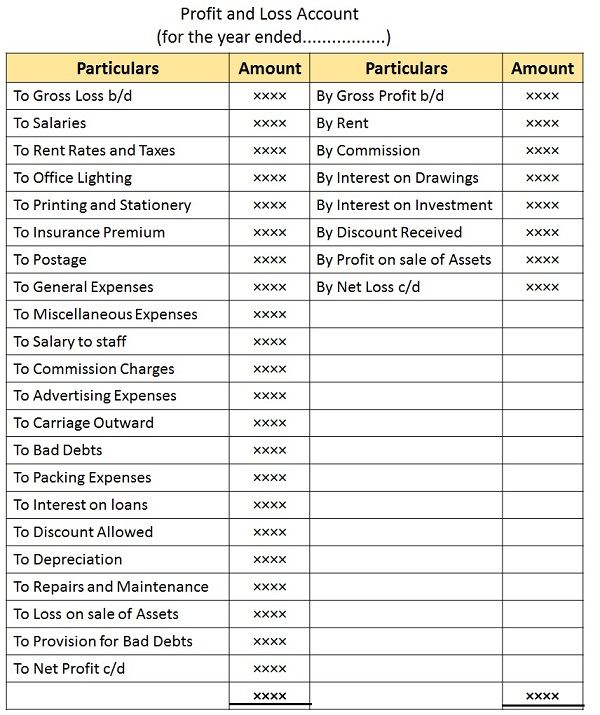

Differences between Balance Sheet and ProfitLoss Account. YouTube

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

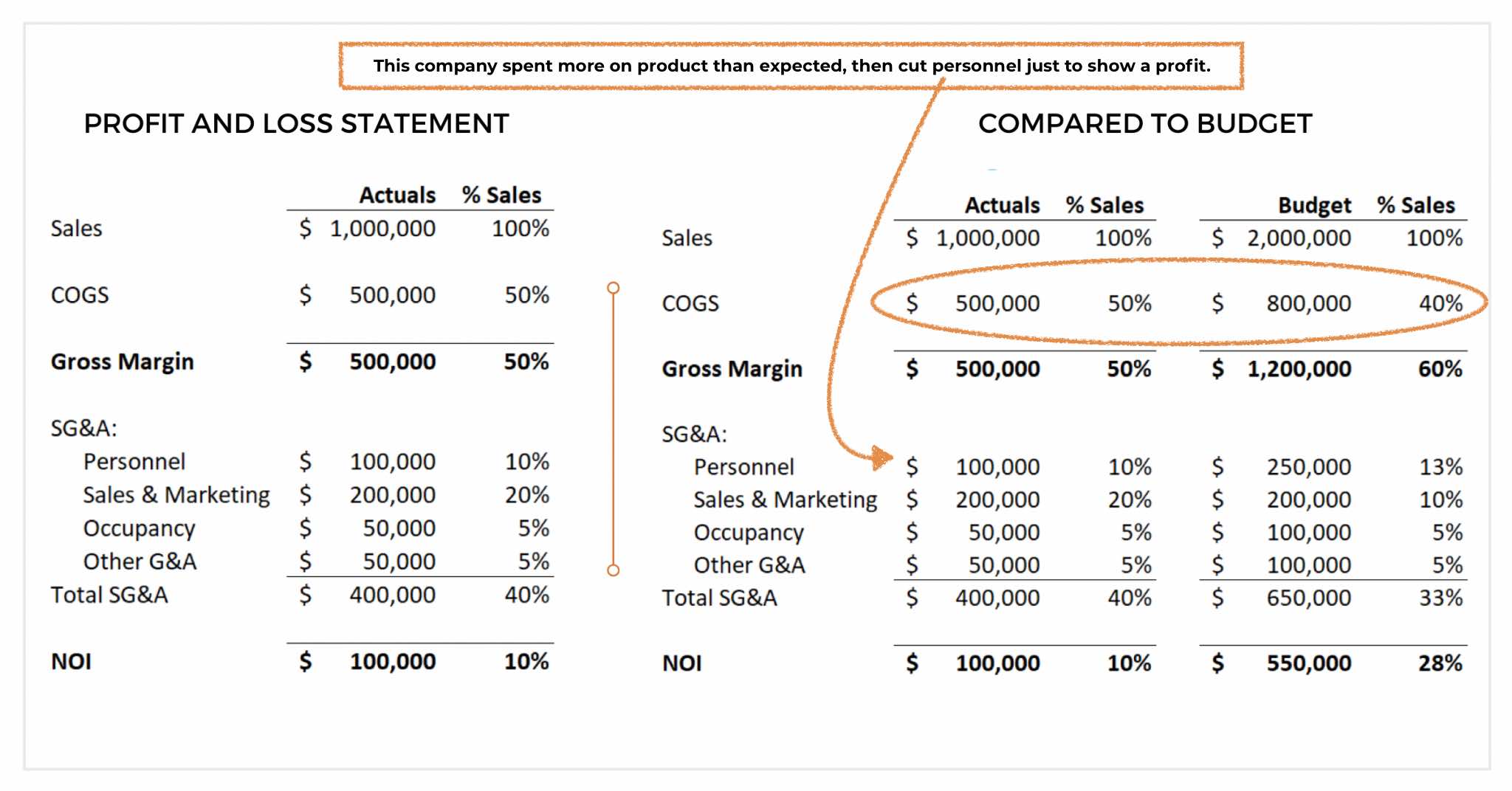

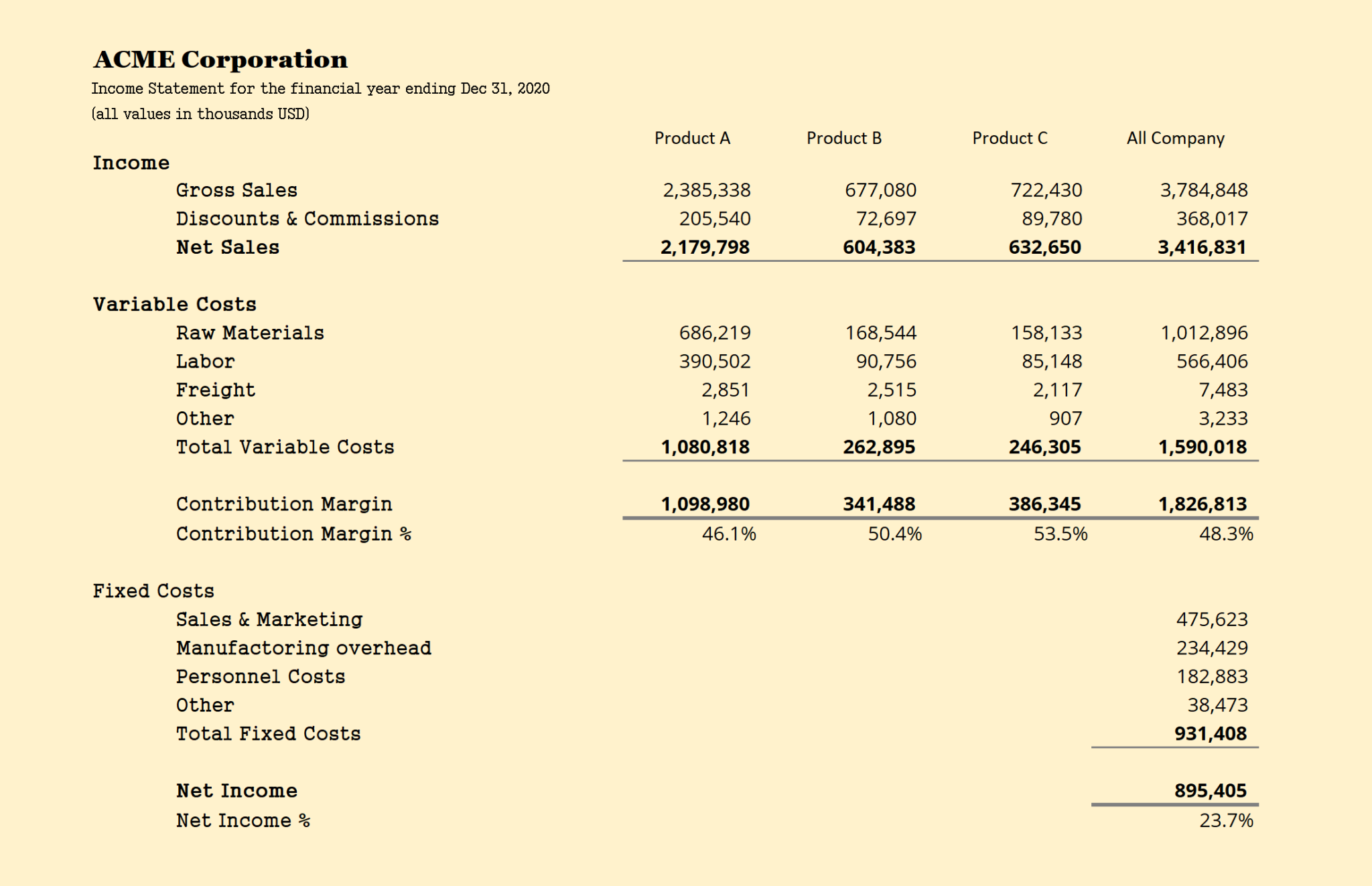

8 Types of P&L (Profit & Loss) / Statements

The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

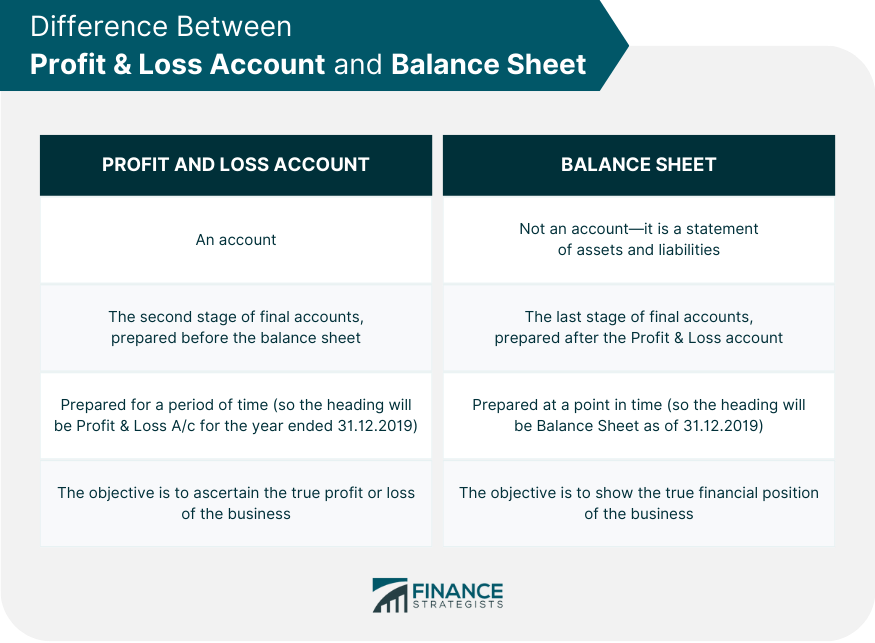

Difference between the Profit and Loss account and Balance Sheet

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow

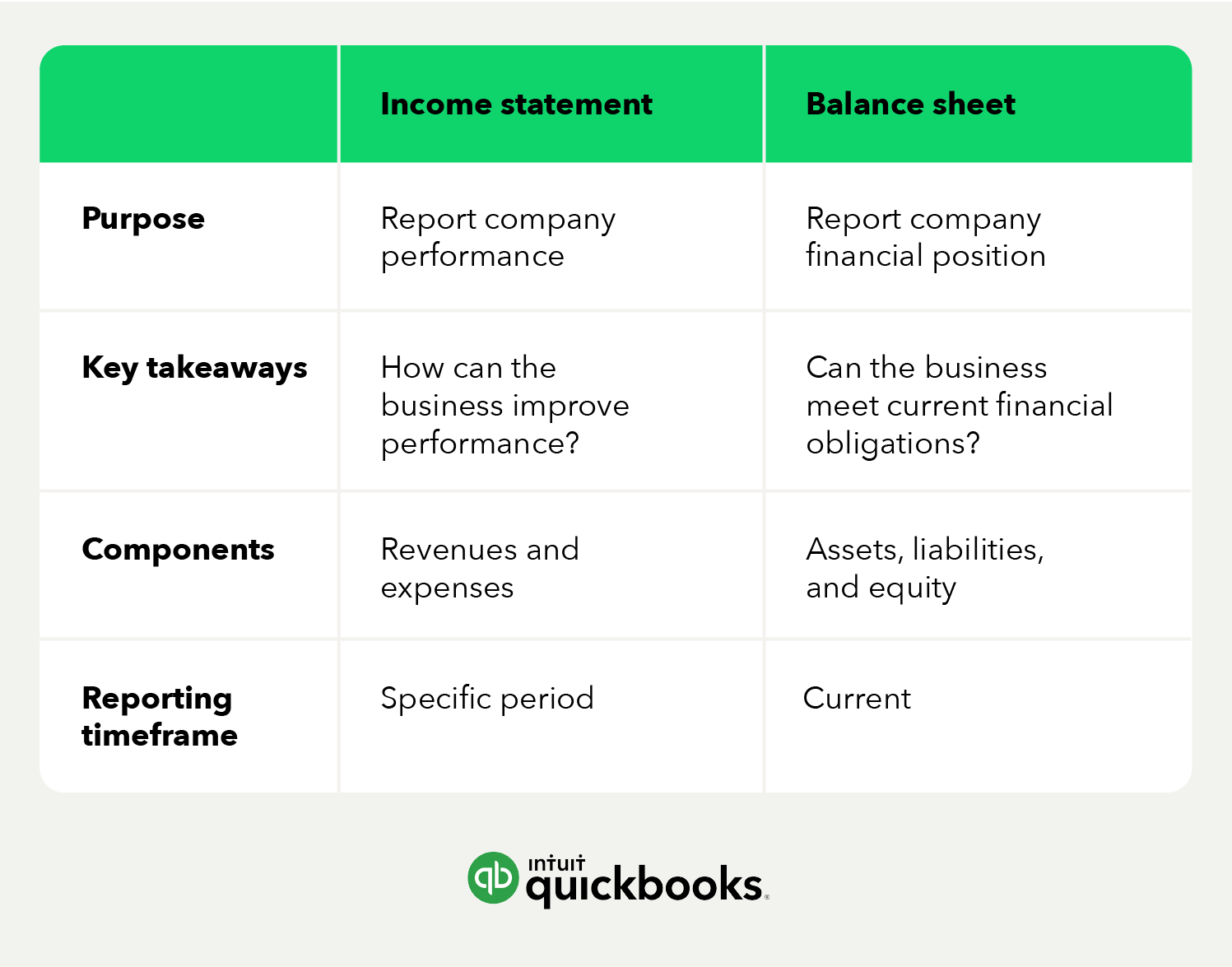

Difference Between a Balance Sheet and a P&L Statement

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow

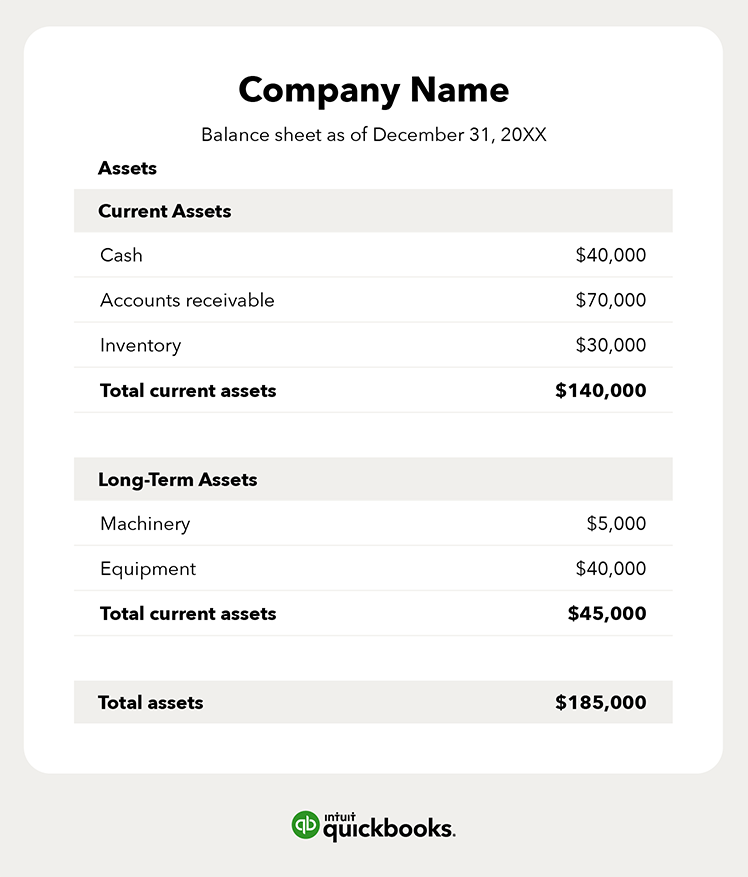

Great Tips About Sheet Balance And P&l Format Citysum

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow

Difference Between Balance Sheet & Worksheet at Gregorio Davis blog

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

Difference Between Profit & Loss Account and Balance Sheet

The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow

Balance sheet vs. profit and loss statement Understanding the

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow

Difference Between Balance Sheet and Profit & Loss Account (with

Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

Your Balance Sheet And P&L Statement Both Provide Key Pieces Of Information That Can Be Helpful In Determining Your Long.

Format versionsee your business grow The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.