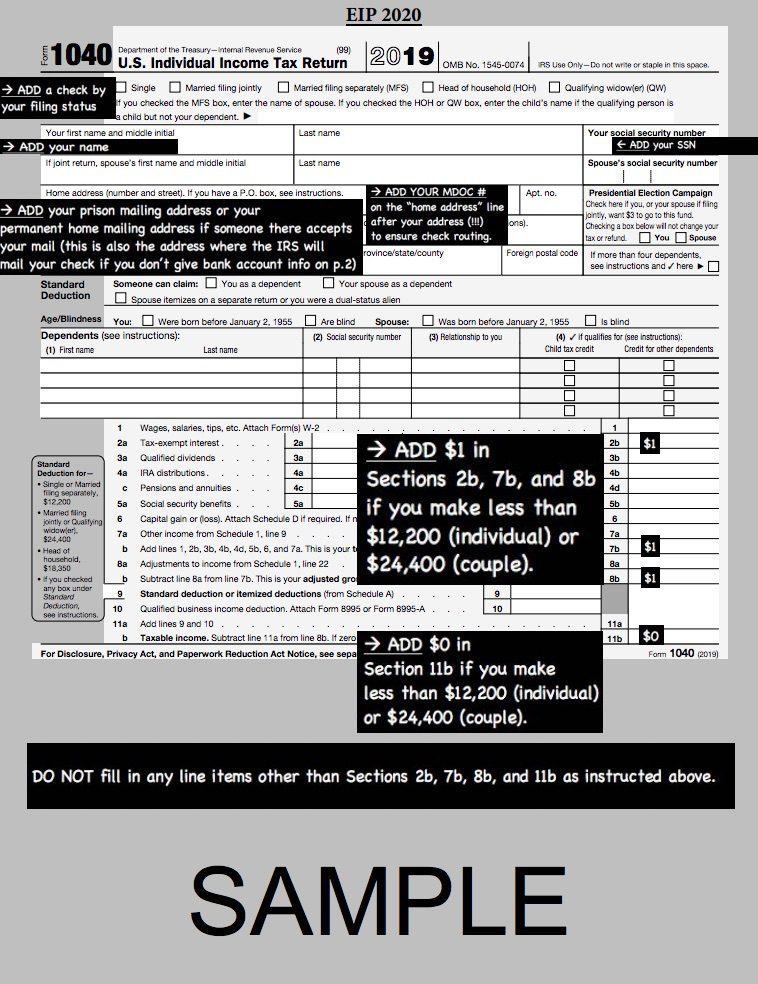

1040 Form For Inmates Stimulus 2021 - 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus.

If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in.

If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print.

Prisoners Stand To Receive Upwards of 2.6 Billion In Stimulus Payments

If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. The primary purpose of this form is to provide incarcerated individuals.

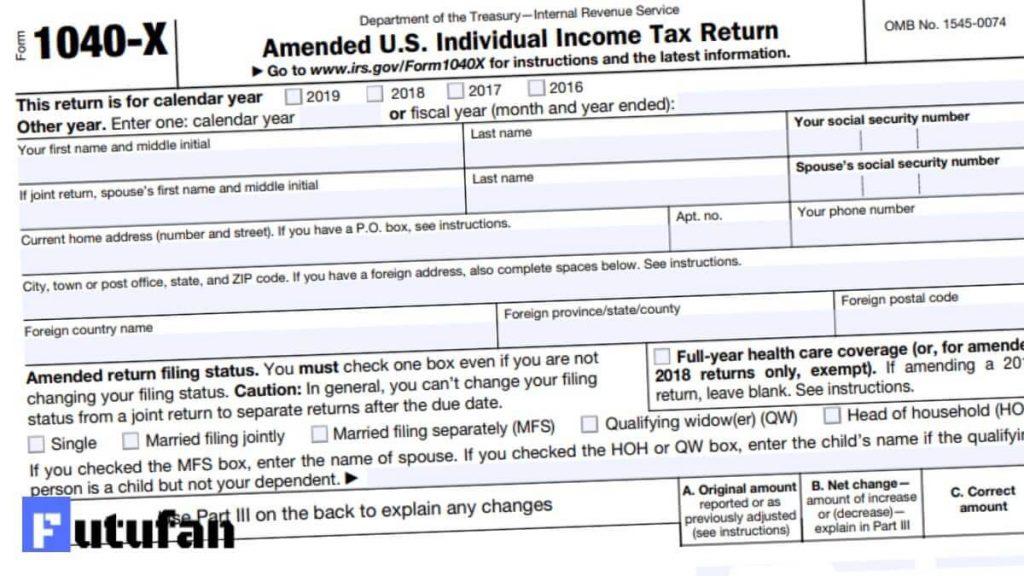

The second covid 19 stimulus checks

The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing.

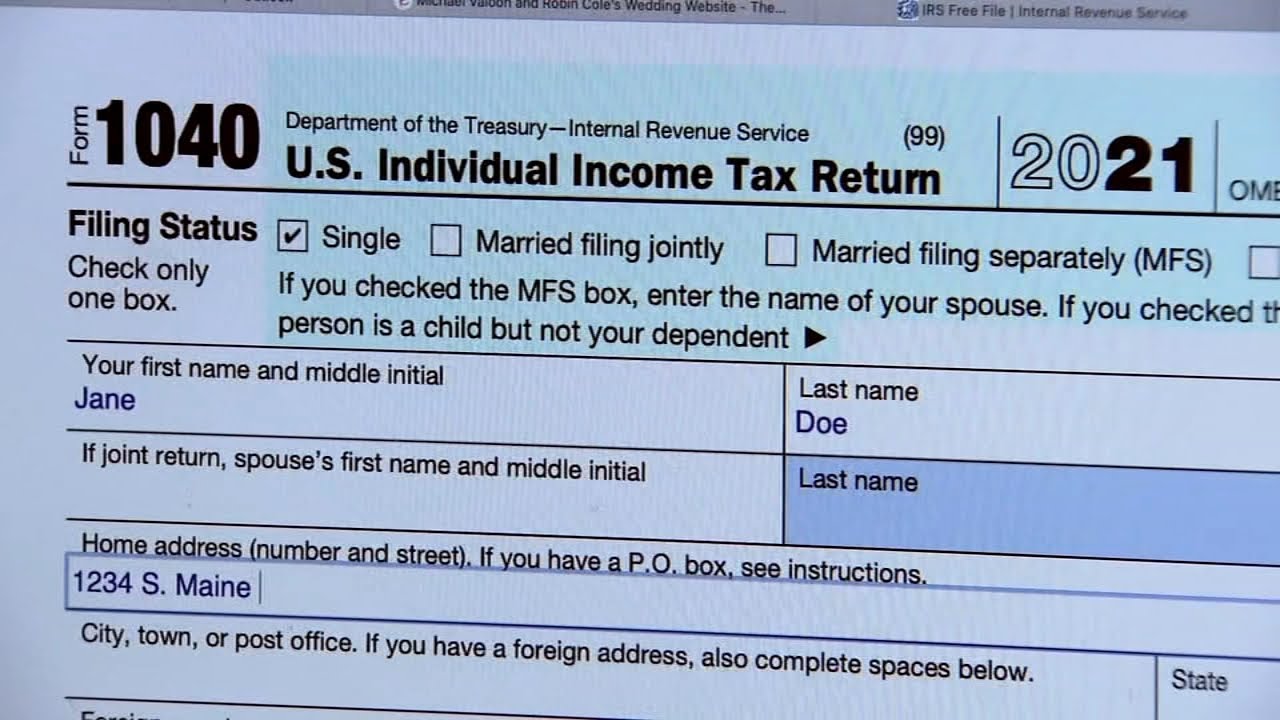

Tax tips Claiming stimulus check on IRS 2021 return ABC7 Chicago

1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. If the irs sent to the wrong address but it was not returned, you can file a payment.

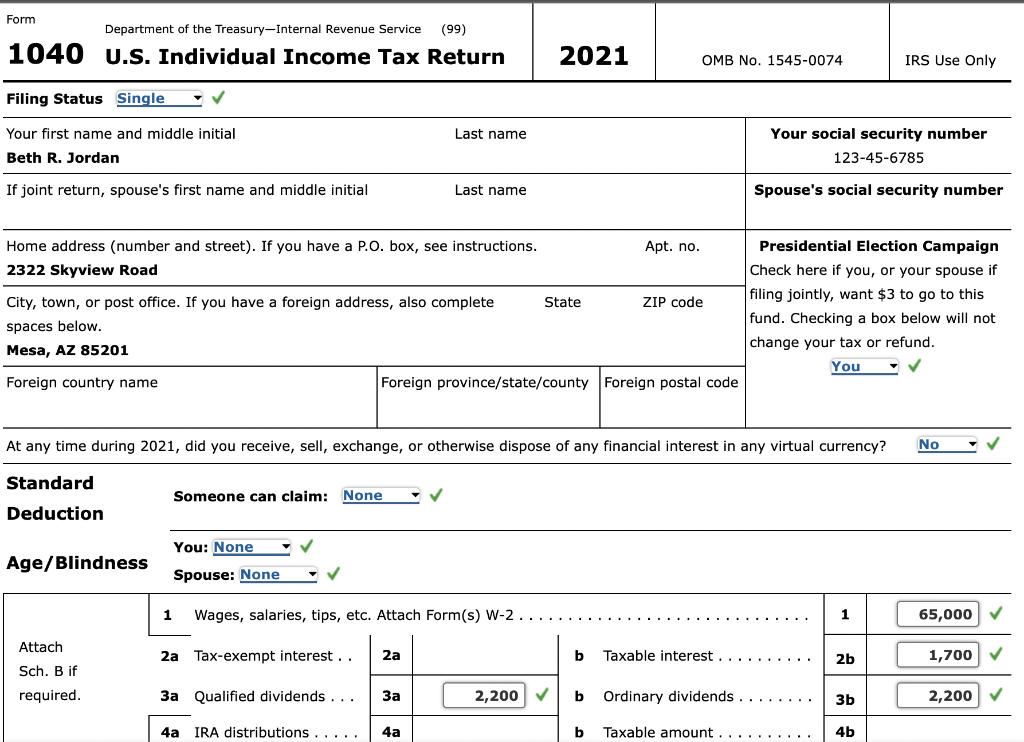

Form 1040V 2025 Bianca Jessop

The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. If the irs sent to the wrong address but it was not returned,.

1040 2021 P PDF

If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. If you did not receive the 3rd stimulus check, you can get.

IRS Form 1040 (2021) U.S. Individual Tax Return

If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. The primary purpose of this form is to provide incarcerated.

Fillable Online 2021 Form 1040 Fax Email Print pdfFiller

If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. The march 2021 third stimulus law provided a payment of $1,400 for an.

Form 1040 U.S. Individual Tax Return 2021 OMB

The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. 1) request an irs form 1040 from your counselor or the business office (prisons should provide these) or have someone print. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing.

How To Fill Out IRS Form 1040 For 2021 / Text “ENROLL” to 9047520766

If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. If you did not receive the 3rd stimulus check, you.

Printable 1040 Form 2021 Download Printable Form 2024

If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. If the irs sent to the wrong address but it was.

1) Request An Irs Form 1040 From Your Counselor Or The Business Office (Prisons Should Provide These) Or Have Someone Print.

The march 2021 third stimulus law provided a payment of $1,400 for an individual ($2,800 if married filing jointly) plus $1,400 for each. The primary purpose of this form is to provide incarcerated individuals with the necessary information to claim federal and state stimulus. If you did not receive the 3rd stimulus check, you can get it by filing a 2021 tax return and use the recovery rebate credit in. If the irs sent to the wrong address but it was not returned, you can file a payment trace (form 3911) with the irs, in addition to.