2016 Tax Sheet - Mail the forms to the address listed on the irs and state forms. Accurately list all amounts and sources of income i received during the tax year. The income tax return.4 1filing. Download, complete, print, and sign the 2016 irs tax forms. Declaration of preparer (other than taxpayer) is based on all. See what the 2016 tax brackets were, what the standard and personal exemptions were, and whether you qualified for the earned. Individual income tax return 2016 omb no. Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. See the instructions for line 44 to see if you must use the worksheet below to figure your tax.

The income tax return.4 1filing. Individual income tax return 2016 omb no. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Download, complete, print, and sign the 2016 irs tax forms. Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. Mail the forms to the address listed on the irs and state forms. See what the 2016 tax brackets were, what the standard and personal exemptions were, and whether you qualified for the earned. Accurately list all amounts and sources of income i received during the tax year.

The income tax return.4 1filing. Mail the forms to the address listed on the irs and state forms. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. See what the 2016 tax brackets were, what the standard and personal exemptions were, and whether you qualified for the earned. Download, complete, print, and sign the 2016 irs tax forms. Individual income tax return 2016 omb no. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Accurately list all amounts and sources of income i received during the tax year. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file.

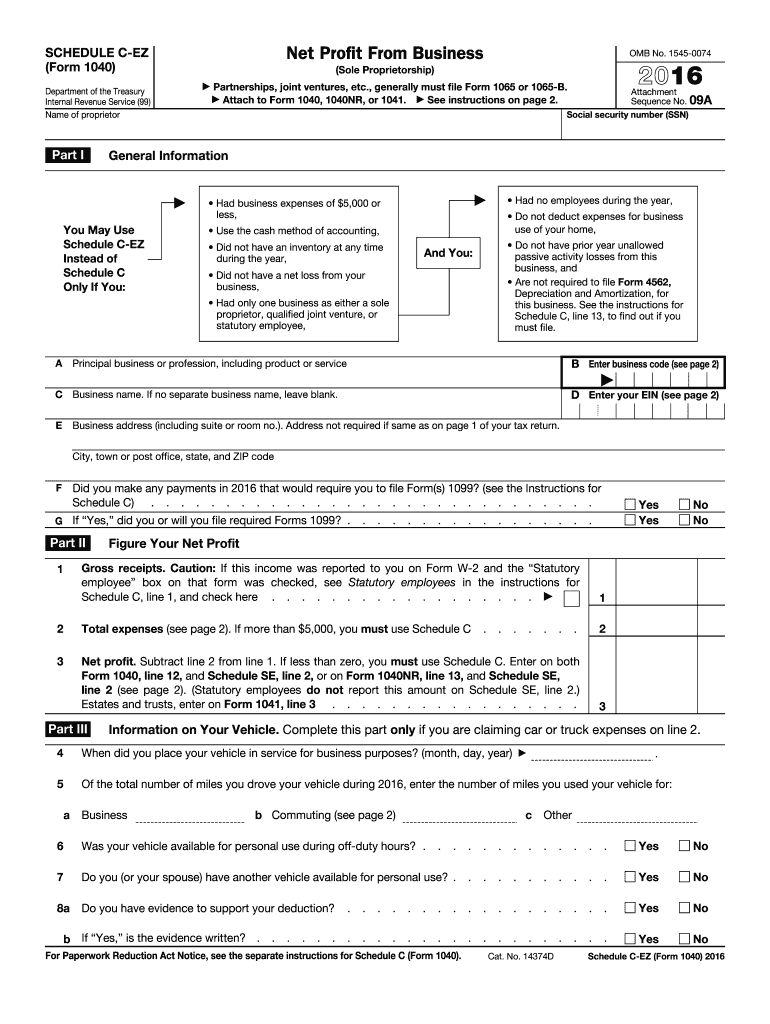

2016 Form IRS 1040 Schedule CEZ Fill Online, Printable, Fillable

Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. The income tax return.4 1filing. Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file. Individual income tax return 2016 omb no. Declaration of preparer (other than taxpayer) is based on all.

Fillable Online Green 2016 tax form.qxp Fax Email Print pdfFiller

Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. See what the 2016 tax brackets were, what the standard and personal exemptions were, and whether you qualified for the earned. Individuals can select the link for their place.

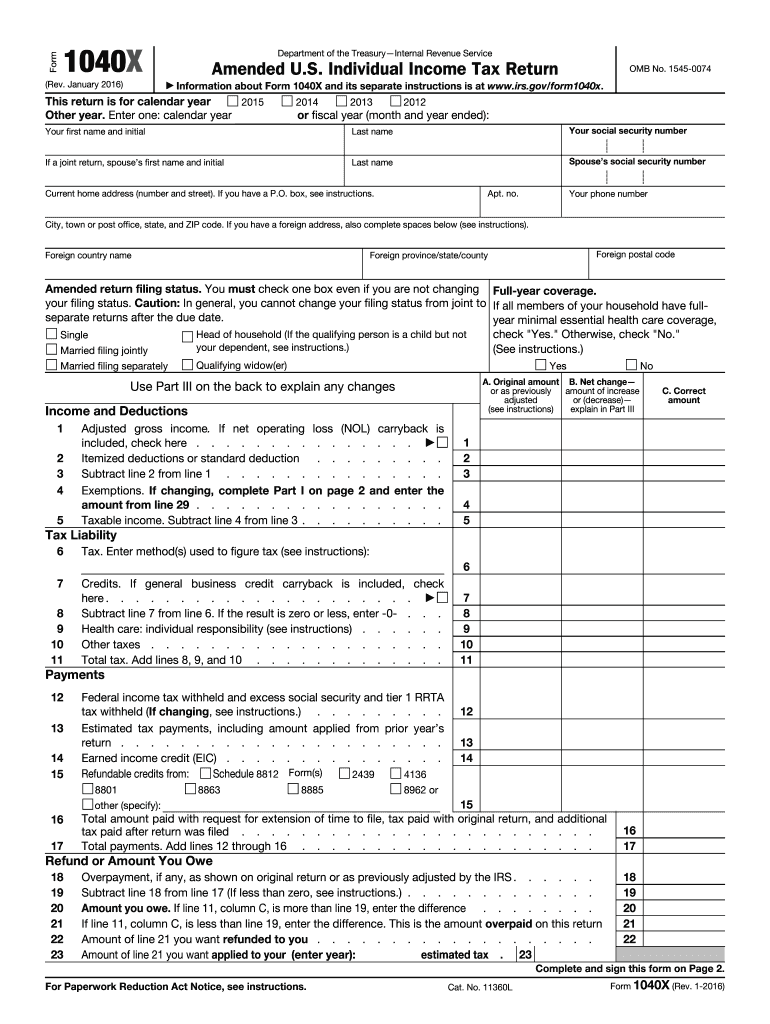

2016 Form IRS 1040X Fill Online, Printable, Fillable, Blank pdfFiller

The income tax return.4 1filing. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Download, complete, print, and sign the 2016 irs tax forms. Accurately list all amounts and sources.

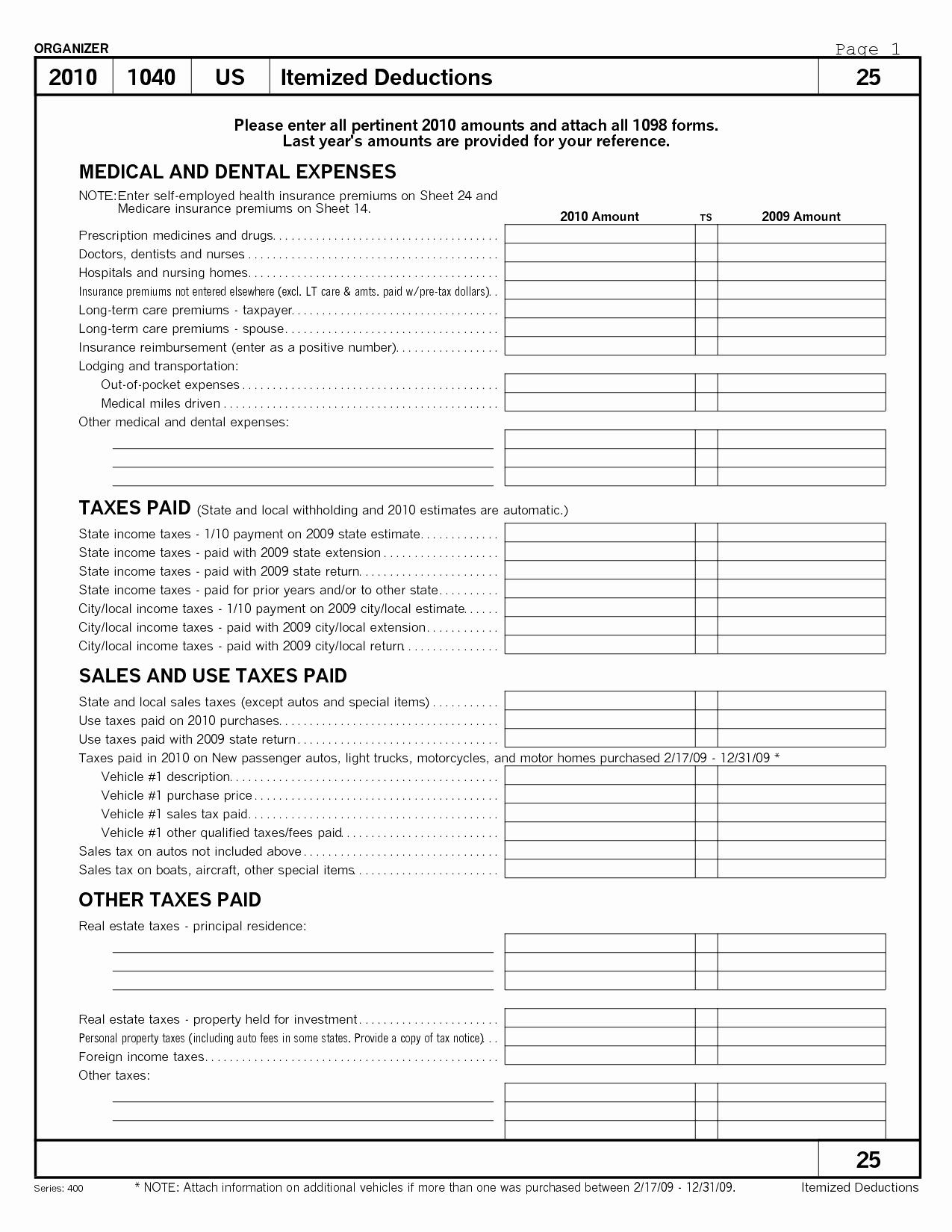

Self Employed Tax Deductions Worksheet 2016 —

Download, complete, print, and sign the 2016 irs tax forms. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. Declaration of preparer (other than taxpayer) is based on all. Accurately list all amounts and sources of income i received during the tax year. See what the 2016 tax brackets were, what the standard and personal exemptions were, and.

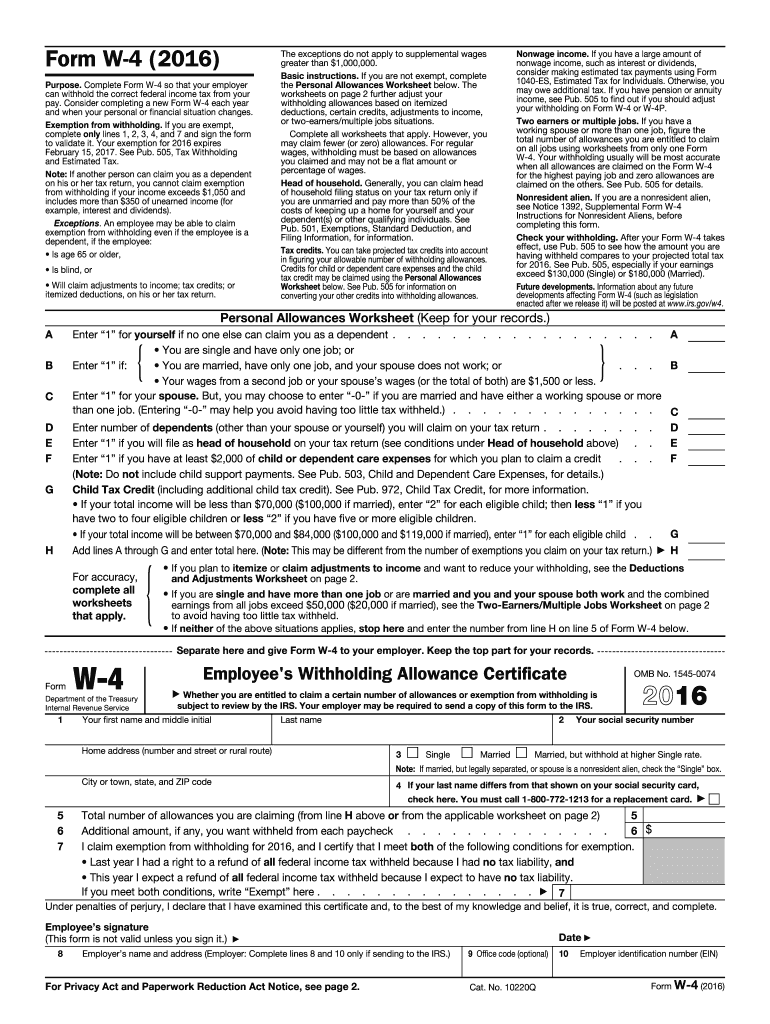

W4 form 2016 Fill out & sign online DocHub

Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file. Individual income tax return 2016 omb no. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. Mail the forms to the address listed on the irs and state forms. Download, complete, print, and sign.

Which 1040 Form To Use 2016 Tax Tips YouTube

Declaration of preparer (other than taxpayer) is based on all. Individual income tax return 2016 omb no. Mail the forms to the address listed on the irs and state forms. Download, complete, print, and sign the 2016 irs tax forms. The income tax return.4 1filing.

SX Tax Return Form A 20162021 Fill and Sign Printable Template

Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file. Mail the forms to the address listed on the irs and state forms. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Individual income tax return.

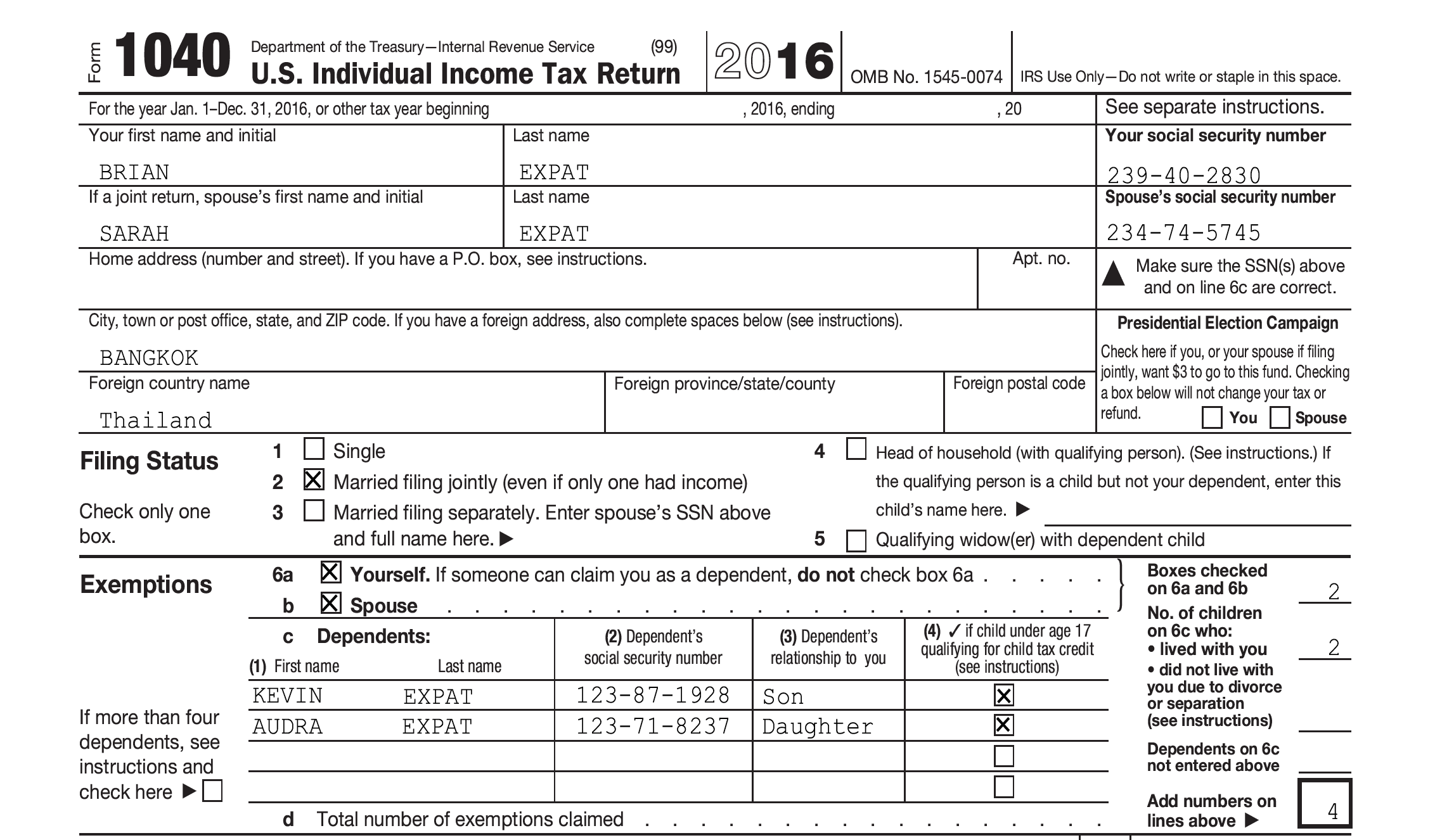

Completing Form 1040 The Face of your Tax Return US Expat Taxes

Download, complete, print, and sign the 2016 irs tax forms. Declaration of preparer (other than taxpayer) is based on all. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. Mail the forms to the address listed on the irs and state forms. Individuals can select the link for their place of residence as of december 31, 2016, to.

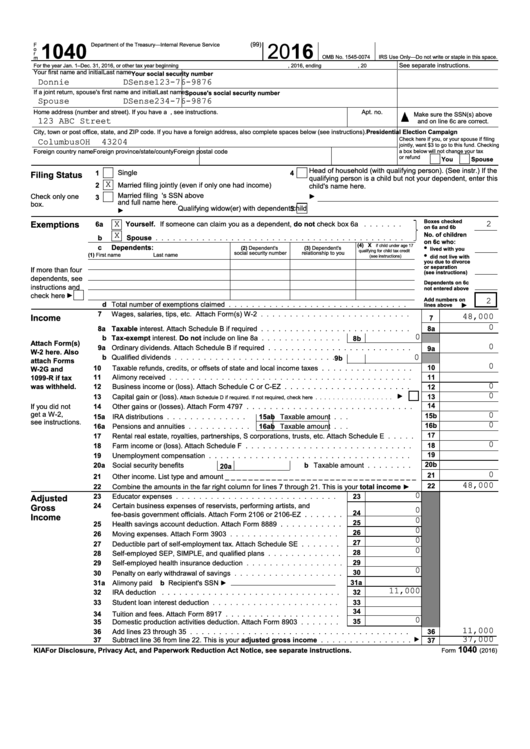

Form 1040 U.s. Individual Tax Return 2016 printable pdf download

Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Accurately list all amounts and sources of income i received during the tax year. Download, complete, print, and sign the 2016 irs tax forms. See the instructions for line.

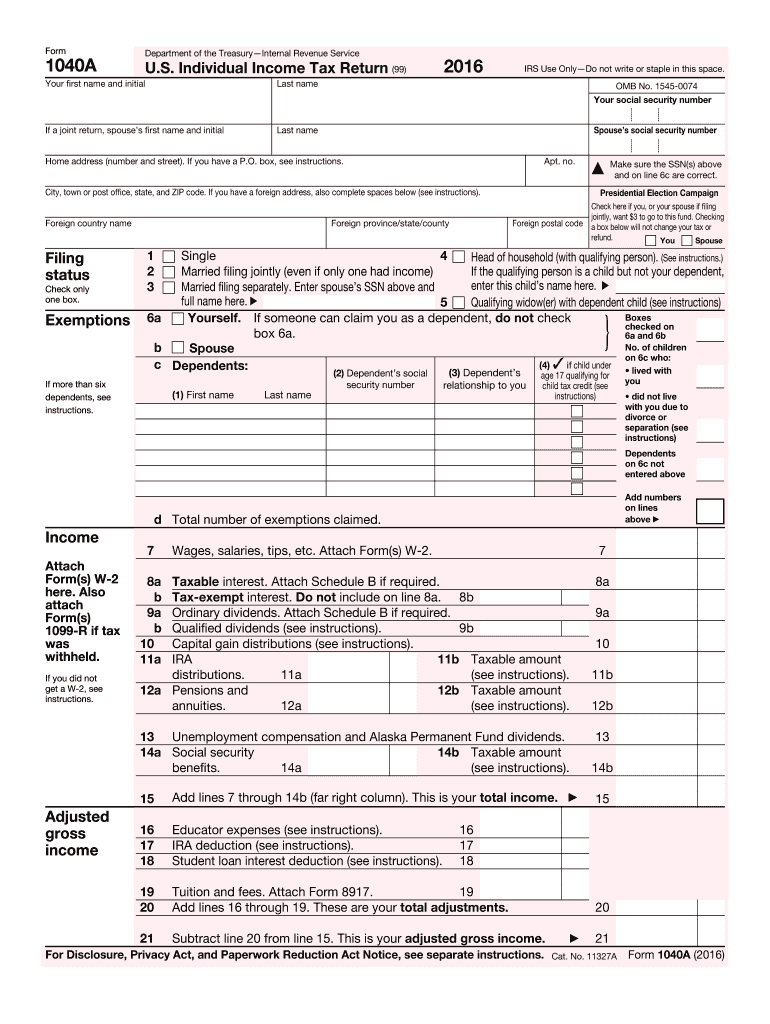

2016 tax return form Fill out & sign online DocHub

The income tax return.4 1filing. Download, complete, print, and sign the 2016 irs tax forms. Individual income tax return 2016 omb no. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health.

See What The 2016 Tax Brackets Were, What The Standard And Personal Exemptions Were, And Whether You Qualified For The Earned.

Accurately list all amounts and sources of income i received during the tax year. Mail the forms to the address listed on the irs and state forms. See the instructions for line 44 to see if you must use the worksheet below to figure your tax. Individuals can select the link for their place of residence as of december 31, 2016, to get the forms and information needed to file.

Declaration Of Preparer (Other Than Taxpayer) Is Based On All.

The income tax return.4 1filing. Requirement to reconcile advance payments of the premium tax credit the premium tax credit helps pay premiums for health insurance. Download, complete, print, and sign the 2016 irs tax forms. Income tax for individuals contents what's new.1 reminders.1 introduction.2 part one.