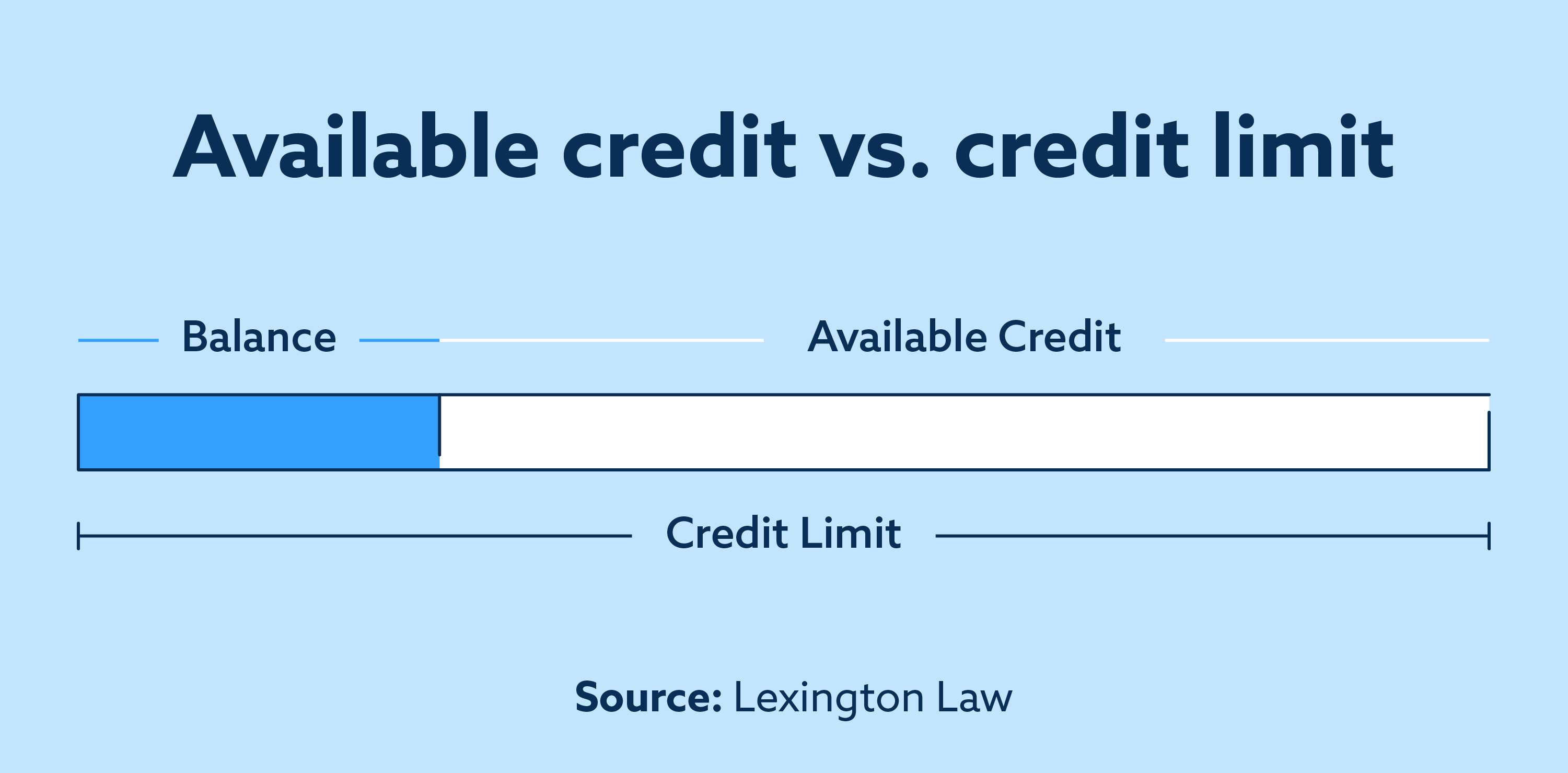

Available Credit For Cash Credit One - When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not. If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4.

If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

Credit One Platinum X5 Visa Calculator 5 Cashback on Everyday Essentials

When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not. If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4.

cash credit JSBL Financial Blog

Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

What is available credit for cash? Leia aqui What does credit

Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

Credit One Bank American Express Benefits & Cash Back Calculator

Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

What Is Available Credit and How Much Should You Use?

Say your friend loans you $10 and you spend $4. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not. If the original $10 you borrowed represents your credit limit, the $4 you spent is.

What is available credit for cash? Leia aqui What does credit

Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

Credit One Bank® Cash Back Rewards Credit Card Credit Karma

If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

What does Available Credit Mean on a Credit Card? YouTube

If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.

Cash Credit Loan What is CCL? Documents, Advantages

When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not. If the original $10 you borrowed represents your credit limit, the $4 you spent is. Say your friend loans you $10 and you spend $4.

What is Cash Credit Features of Cash Credit Benefits of Cash Credit

When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not. Say your friend loans you $10 and you spend $4. If the original $10 you borrowed represents your credit limit, the $4 you spent is.

If The Original $10 You Borrowed Represents Your Credit Limit, The $4 You Spent Is.

Say your friend loans you $10 and you spend $4. When using available credit to acquire cash, one increases their financial leverage, but this can also lead to further debt obligations if not.