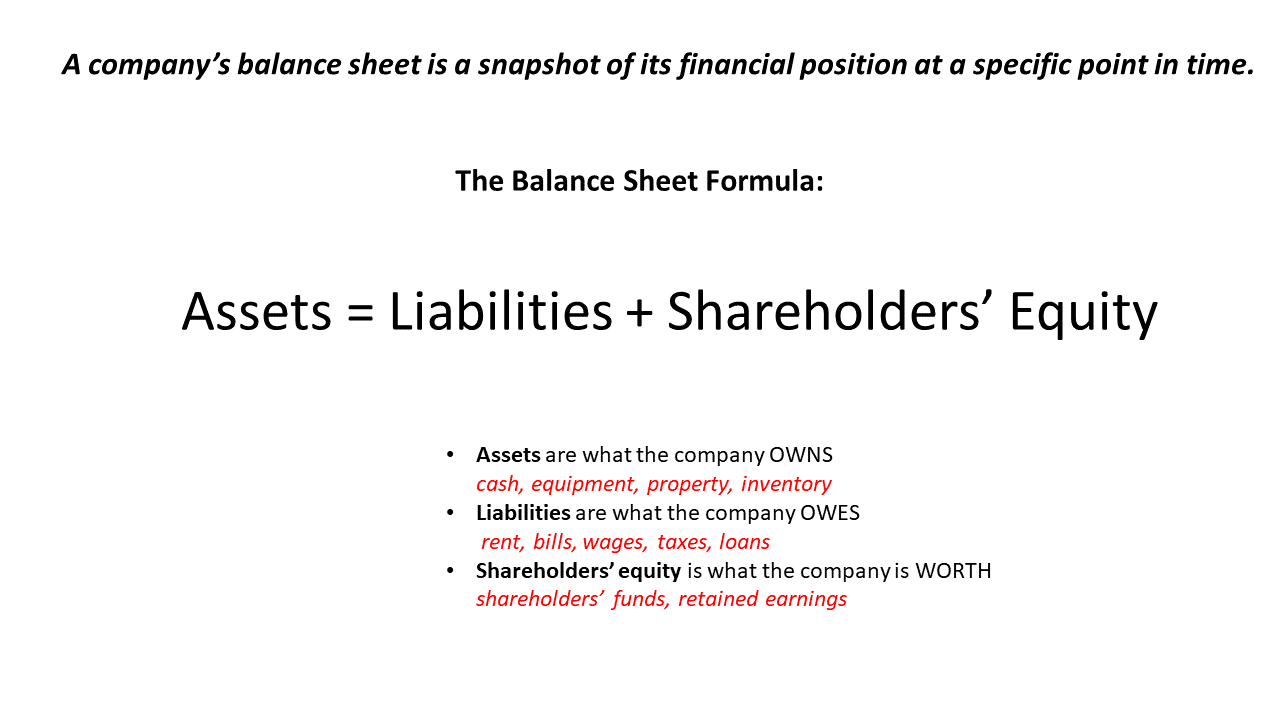

Balance Sheet Formulas - The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet. It can also be referred to as a statement of net worth or a. The balance sheet formula is assets = liabilities + shareholders' equity. Assessing these ratios can better inform your. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Fundamental analysts use balance sheets to calculate. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet. Fundamental analysts use balance sheets to calculate. The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. The balance sheet formula is assets = liabilities + shareholders' equity. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. It can also be referred to as a statement of net worth or a. Assessing these ratios can better inform your.

The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Fundamental analysts use balance sheets to calculate. It can also be referred to as a statement of net worth or a. Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet. The balance sheet formula is assets = liabilities + shareholders' equity. The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. Assessing these ratios can better inform your. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

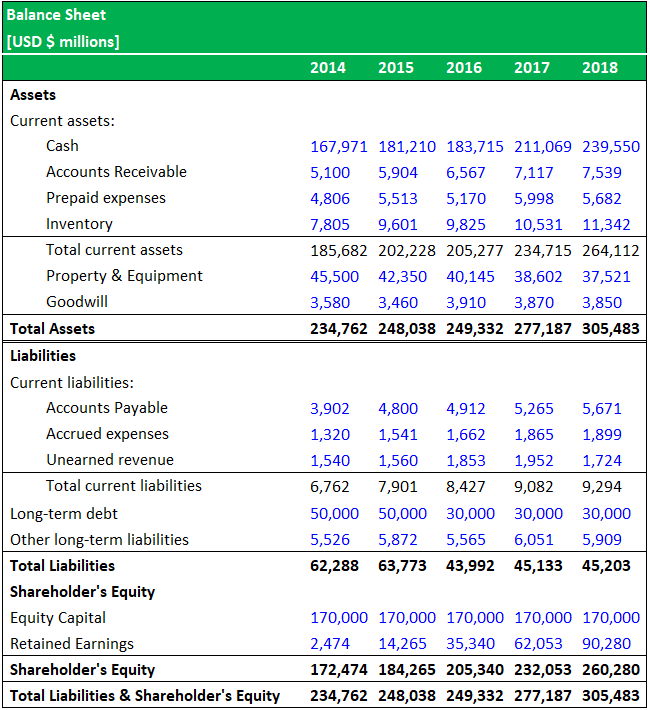

Balance Sheet Basics Accounting Education

Assessing these ratios can better inform your. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. The balance sheet formula is assets = liabilities + shareholders' equity. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The formula.

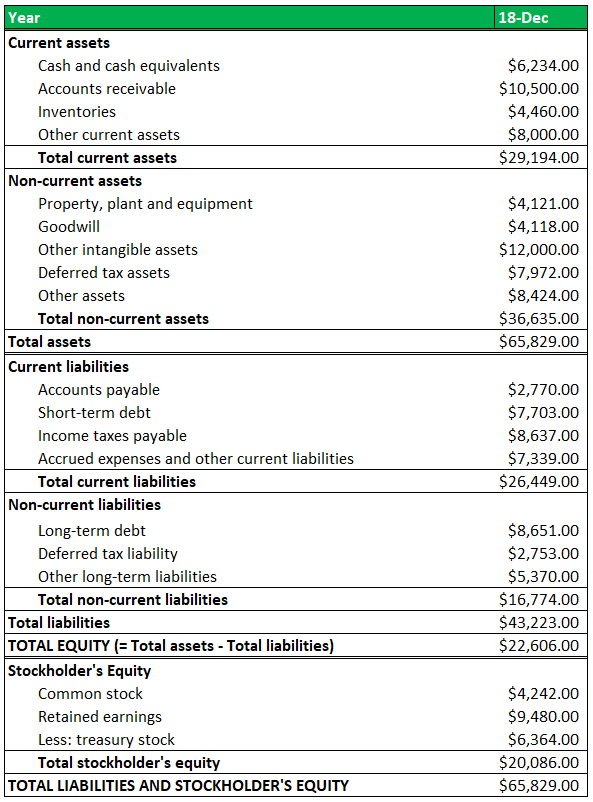

Balance Sheet Formula Assets = Liabilities + Equity

The balance sheet formula is assets = liabilities + shareholders' equity. Assessing these ratios can better inform your. The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. Fundamental analysts use balance sheets to calculate. It can also be referred to as a statement of net worth or a.

Balance Sheet Formula Step by Step Calculations

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Assessing these ratios can better inform your. The balance sheet formula is assets = liabilities + shareholders' equity. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle..

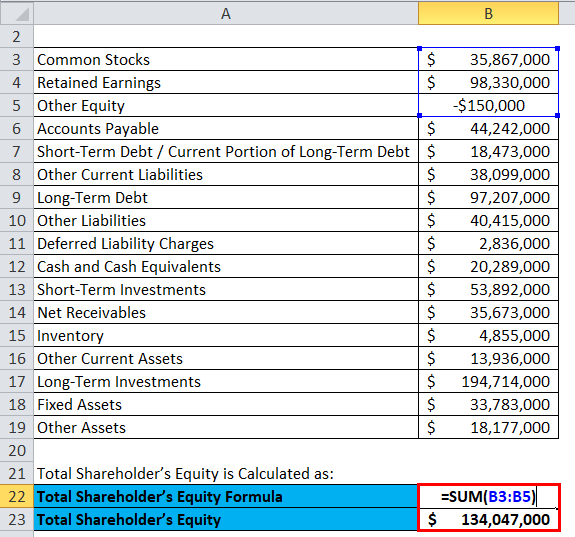

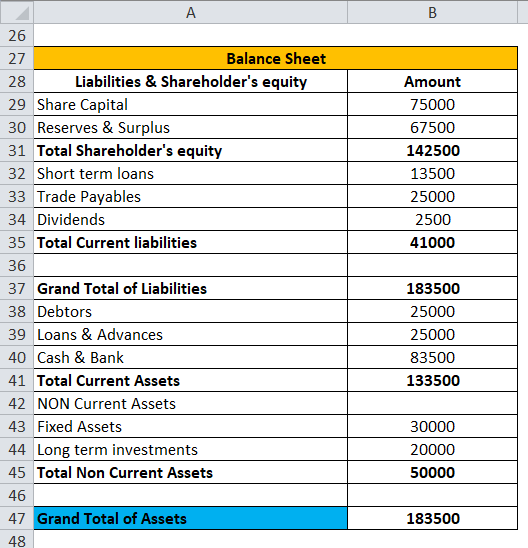

Balance Sheet Formula Calculator (Excel template)

It can also be referred to as a statement of net worth or a. The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. Assessing these ratios can better inform your. The balance.

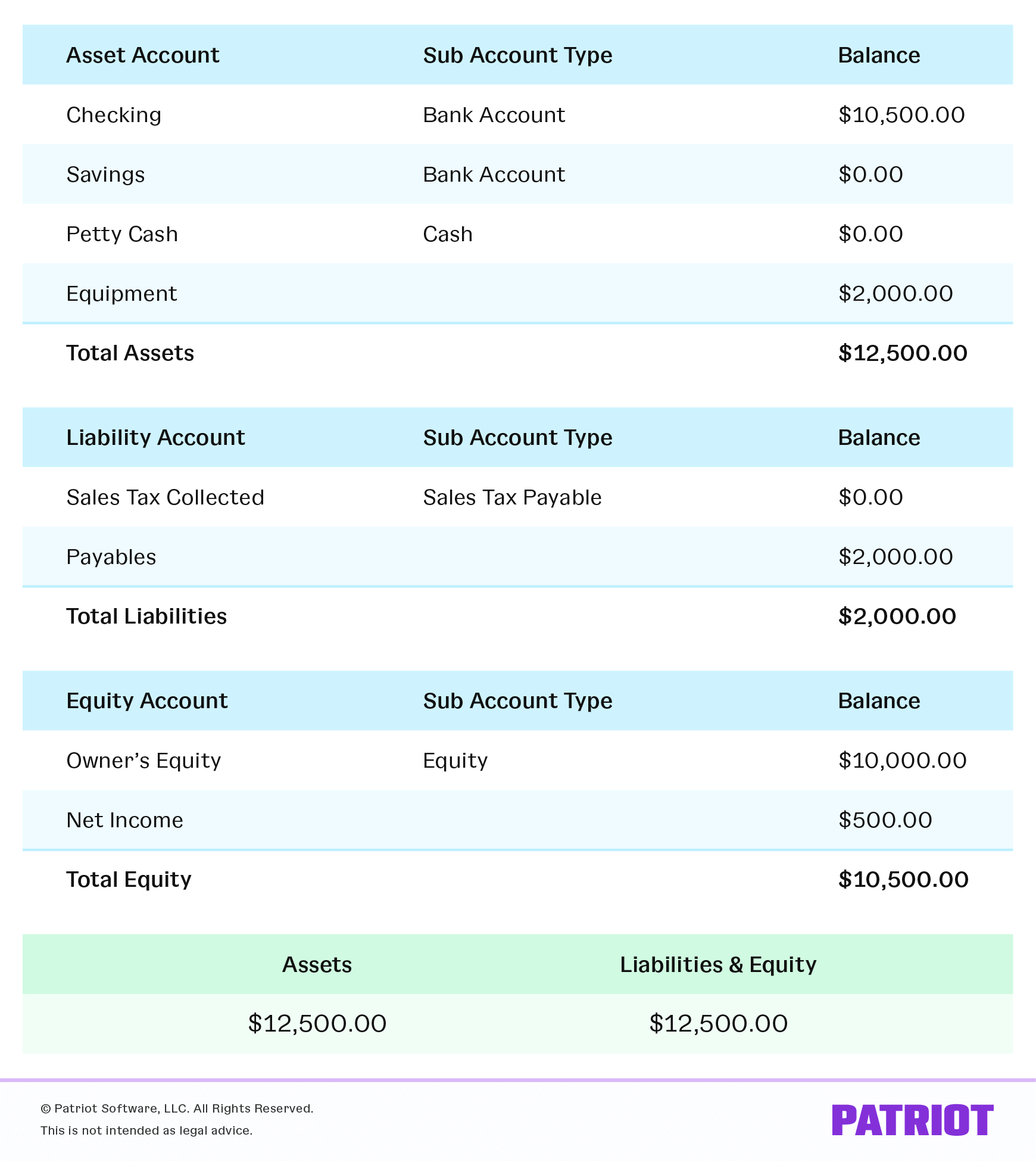

What Is the Accounting Equation? Examples & Balance Sheet

The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. Assessing these ratios can better inform your. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet adheres to an equation that equates assets with the.

Balance Sheet Defined Key Elements, Examples and Formulas NetSuite

Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet. Fundamental analysts use balance sheets to calculate. The balance sheet formula is assets = liabilities + shareholders' equity. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The.

Balance Sheet Formula Calculator (Excel template)

The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet..

Balance Sheet Formula Calculator (Excel template)

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity..

Balance Sheet Ratios Types Formula Example Accountinguide

The balance sheet formula is assets = liabilities + shareholders' equity. Assessing these ratios can better inform your. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity..

Balance Sheet Format in Excel with Formulas (Create with Easy Steps)

The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Assessing these ratios can better inform your. The balance sheet formula is assets = liabilities + shareholders' equity. Balance sheet formulas are used to assess a company's financial health, by calculating ratios derived from the balance sheet. The.

Balance Sheet Formulas Are Used To Assess A Company's Financial Health, By Calculating Ratios Derived From The Balance Sheet.

Assessing these ratios can better inform your. The balance sheet formula is assets = liabilities + shareholders' equity. It can also be referred to as a statement of net worth or a. Fundamental analysts use balance sheets to calculate.

The Balance Sheet Adheres To An Equation That Equates Assets With The Sum Of Liabilities And Shareholder Equity.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The formula reflects the fundamental accounting principle that the total value of a company's assets equals the sum of. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.