Book Value Balance Sheet - It is the value at which the assets are valued in the. Book value is the term which means the value of the firm as per the books of the company. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. It represents the total value of a company's. Book value refers to the net asset value of a company as recorded on its balance sheet.

The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Book value refers to the net asset value of a company as recorded on its balance sheet. Book value is the term which means the value of the firm as per the books of the company. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. It is the value at which the assets are valued in the. It represents the total value of a company's.

Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. Book value refers to the net asset value of a company as recorded on its balance sheet. Book value is the term which means the value of the firm as per the books of the company. It is the value at which the assets are valued in the. It represents the total value of a company's. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the.

What Is Book Value Per Share With Example at Richard Mckillip blog

Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. It is the value at which the assets are valued in the. It represents the total.

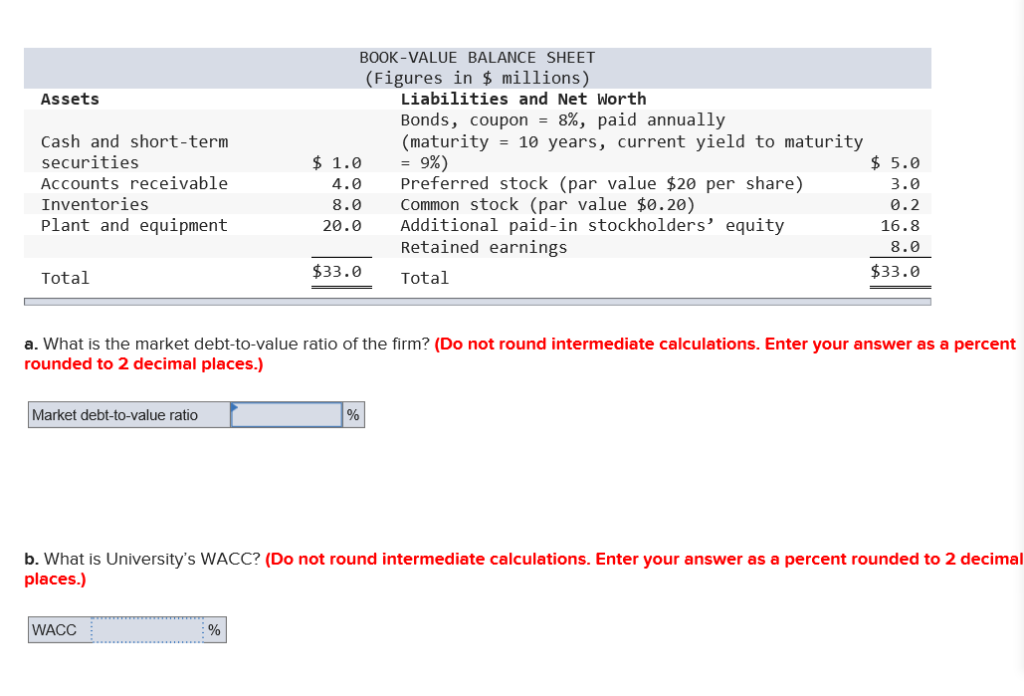

Questions Download Free PDF Book Value Balance Sheet

It represents the total value of a company's. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Book value is the term which means the value of the firm as per the books of the company. It is the value at which the assets are valued in.

Solved Examine the following bookvalue balance sheet for

The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. It represents the total value of a company's. It is the value at which the assets are valued in the. Book value refers to the net asset value of a company as recorded on its balance sheet. Carrying.

Book Value of Shares Meaning, Calculation & Importance

It is the value at which the assets are valued in the. Book value refers to the net asset value of a company as recorded on its balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Carrying value or book value is the value of.

How to calculate Earning per share (EPS) from Balance Sheet ? YouTube

Book value refers to the net asset value of a company as recorded on its balance sheet. It is the value at which the assets are valued in the. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. It represents the total value of a company's. Carrying.

Unit 1 PartnershipAccounting PDF Book Value Balance Sheet

It is the value at which the assets are valued in the. Book value refers to the net asset value of a company as recorded on its balance sheet. It represents the total value of a company's. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Carrying.

Accounting Dissolution Exercise PDF Book Value Balance Sheet

The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. It represents the total value of a company's. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. Book value refers to the net asset value.

( CR.) ( CR.) ( CR.) ( CR.) ( CR.) PDF Book Value Balance Sheet

The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Book value is the term which means the value of the firm as per the books of the company. Carrying value or book value is the value of an asset according to the figures shown (carried) in a.

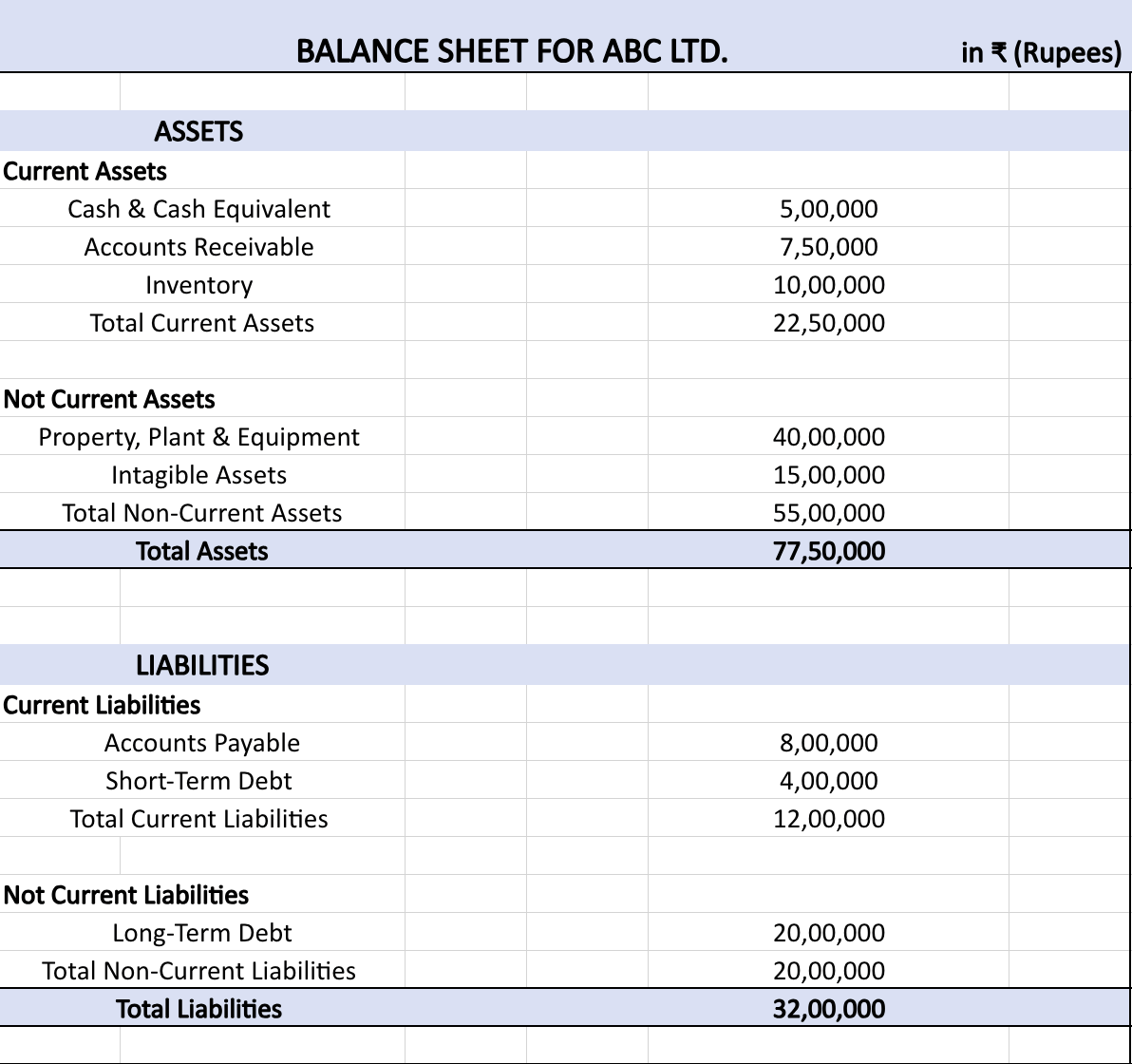

Company Accounts Balance Sheet Format PDF Book Value Balance Sheet

It represents the total value of a company's. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company's balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the. Book value is the term which means the.

Solution MC Installment Liquidation PDF Book Value Balance Sheet

Book value is the term which means the value of the firm as per the books of the company. It represents the total value of a company's. Book value refers to the net asset value of a company as recorded on its balance sheet. Carrying value or book value is the value of an asset according to the figures shown.

Carrying Value Or Book Value Is The Value Of An Asset According To The Figures Shown (Carried) In A Company's Balance Sheet.

It represents the total value of a company's. It is the value at which the assets are valued in the. Book value refers to the net asset value of a company as recorded on its balance sheet. The book value figure is typically viewed in relation to the company’s stock value (market capitalization) and is determined by taking the.