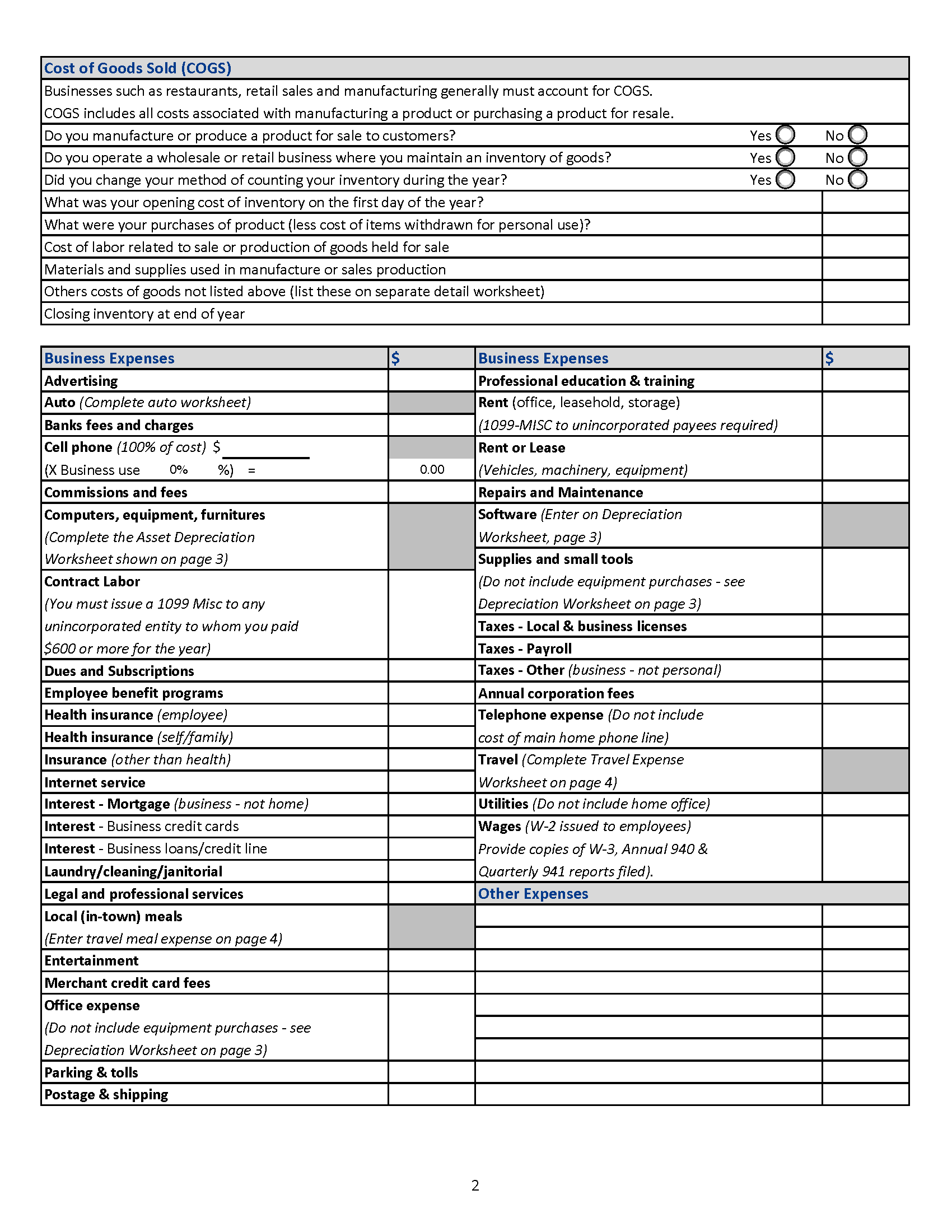

Business Tax Organizer Template - Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. Please complete a separate organizer for each entity requiring a tax return. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use.

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. This form is only for s corporations, c corporations and partnerships. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use.

Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. This form is only for s corporations, c corporations and partnerships. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring a tax return.

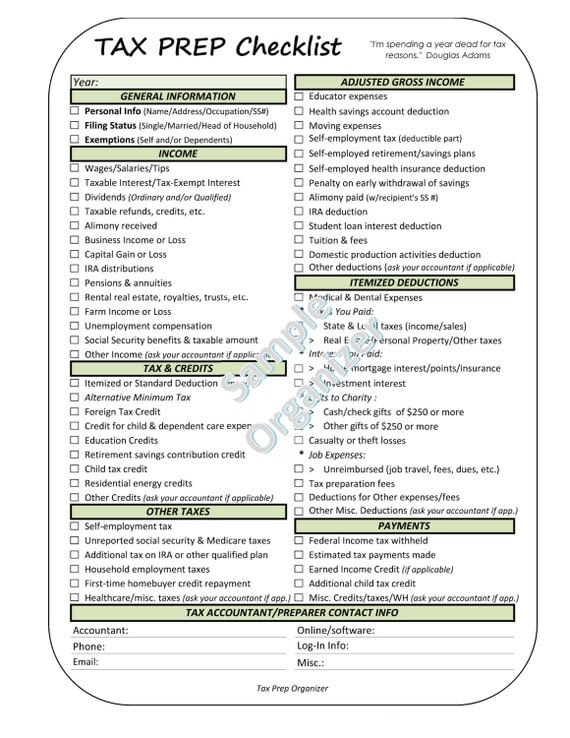

Profit & Loss Tax Organizer Template for Small Businesses Etsy

This form is only for s corporations, c corporations and partnerships. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring.

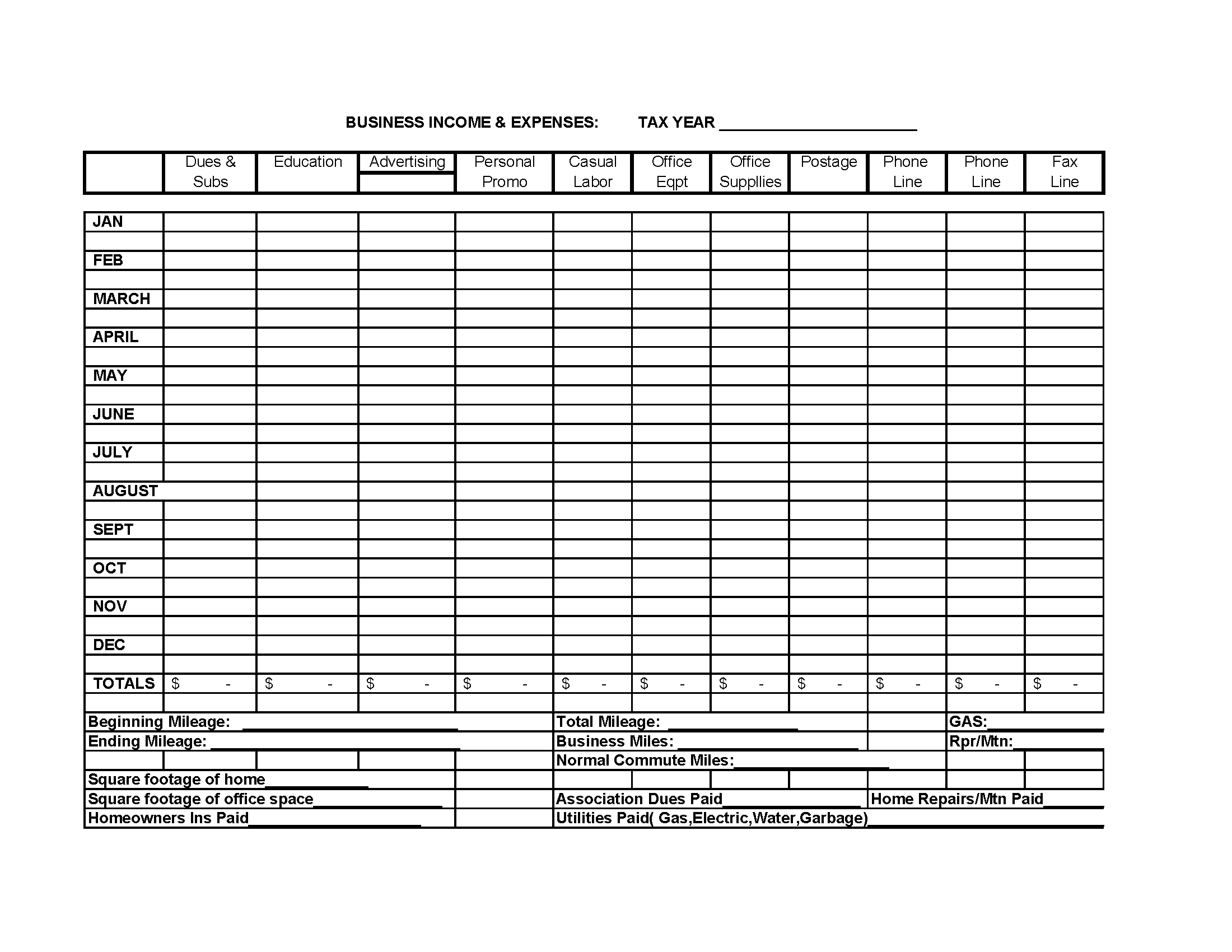

Excel Tax Organizer Template For Your Needs

This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. If you had.

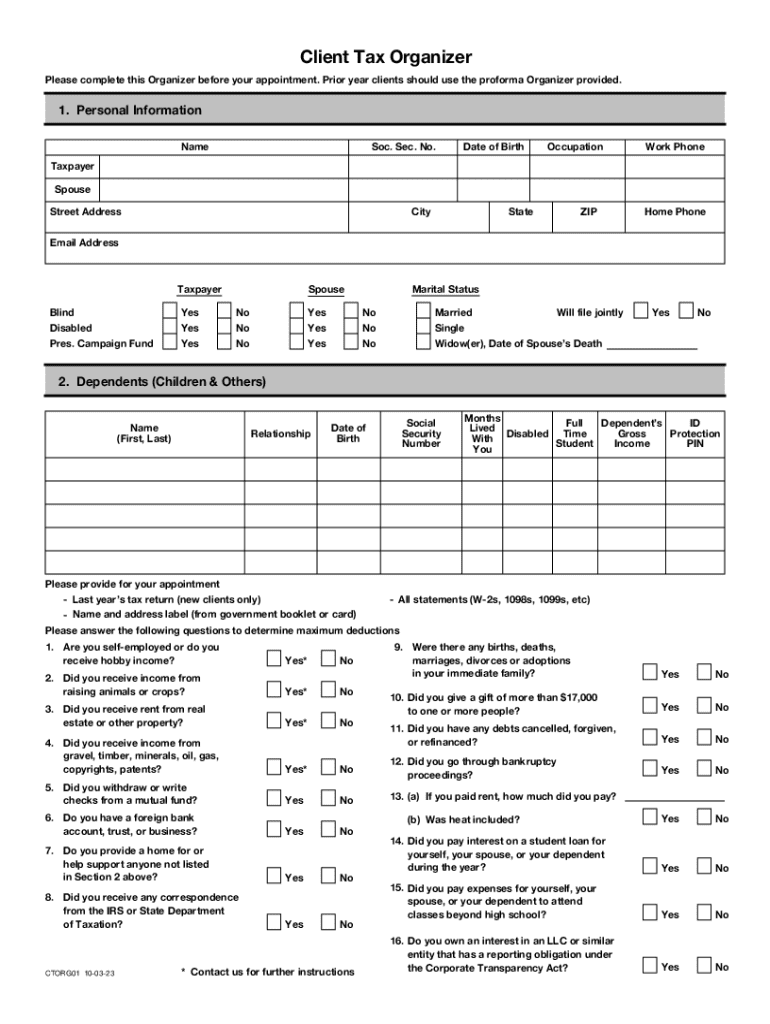

Printable Tax Organizer Template

Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. This form is only for s corporations, c corporations and partnerships. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Please complete a separate organizer for each entity requiring a tax return. If you had.

Business Tax Organizer Template

Please complete a separate organizer for each entity requiring a tax return. This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member.

Printable Tax Deduction Tracker, Business Tax Log, Purchase Records

This form is only for s corporations, c corporations and partnerships. Please complete a separate organizer for each entity requiring a tax return. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. If you had.

Printable Tax Organizer Template

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. This form is only for s corporations, c corporations and partnerships. Download a tax organizer for your 1040, 1004ez, schedule.

Printable Tax Return Binder for Personal and Business Taxes, Tax Return

If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and.

Business Tax Organizer Template

Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. This form is only for s corporations, c corporations and partnerships. If you had.

Tax Organizer Template Excel Fill Online, Printable, Fillable, Blank

Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Please complete a separate organizer for each entity requiring a tax return. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. If you had.

Business Tax Organizer Template

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. Please complete a separate organizer for each entity requiring a tax return. Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. If you had.

Please Complete A Separate Organizer For Each Entity Requiring A Tax Return.

Download a tax organizer for your 1040, 1004ez, schedule c, corporate, small business, or non profit tax filings. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This form is only for s corporations, c corporations and partnerships. If you had a business in 2024, in which you were a 1099 contractor, sole proprietor or single member llc, and did not use.