Citi Funds Availability - The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. (cgmi), offers clients a large selection of mutual funds. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. From each fund family offered, cgmi seeks to collect. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit.

These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. (cgmi), offers clients a large selection of mutual funds. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. From each fund family offered, cgmi seeks to collect.

From each fund family offered, cgmi seeks to collect. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. (cgmi), offers clients a large selection of mutual funds.

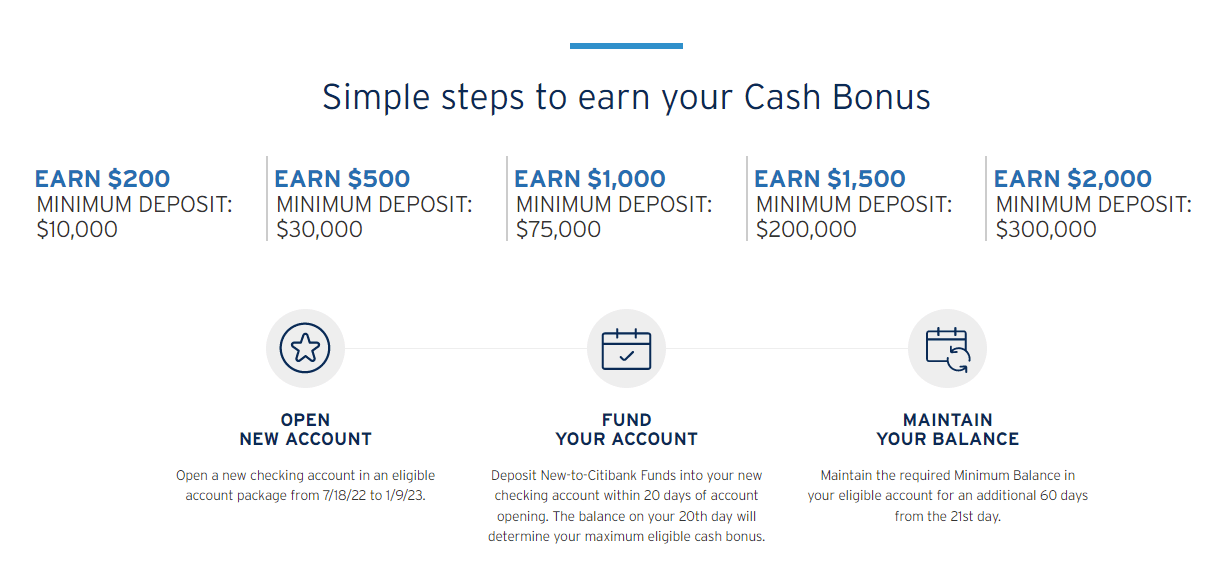

Citi Up To 2,000 Personal Checking/Savings Bonus Available

These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. Our general policy is.

Citi, Fidelity Intl combine money market fund tokenization with FX

From each fund family offered, cgmi seeks to collect. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regulation cc requires that financial institutions include a notice of funds availability on the.

How To Transfer Money CitiBank Account? YouTube

Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Regulation cc requires.

Payments and Transfers Online Cheques MEPS Inbound Funds Transfer

From each fund family offered, cgmi seeks to collect. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Regular checking account applications are available in branch, on citi online, through the citi.

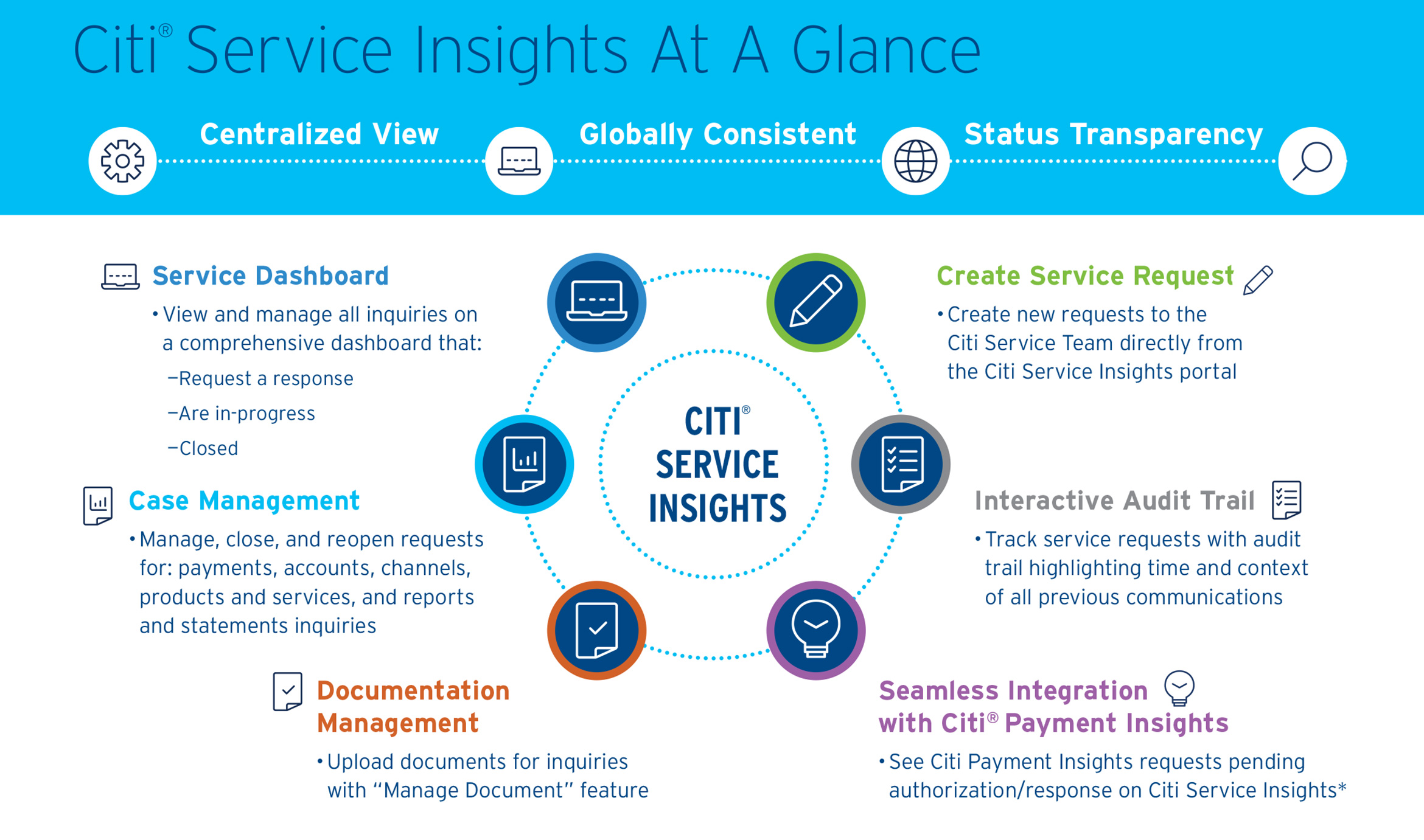

Citi® Service Insights Payments Treasury and Trade Solutions

Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. (cgmi), offers clients a.

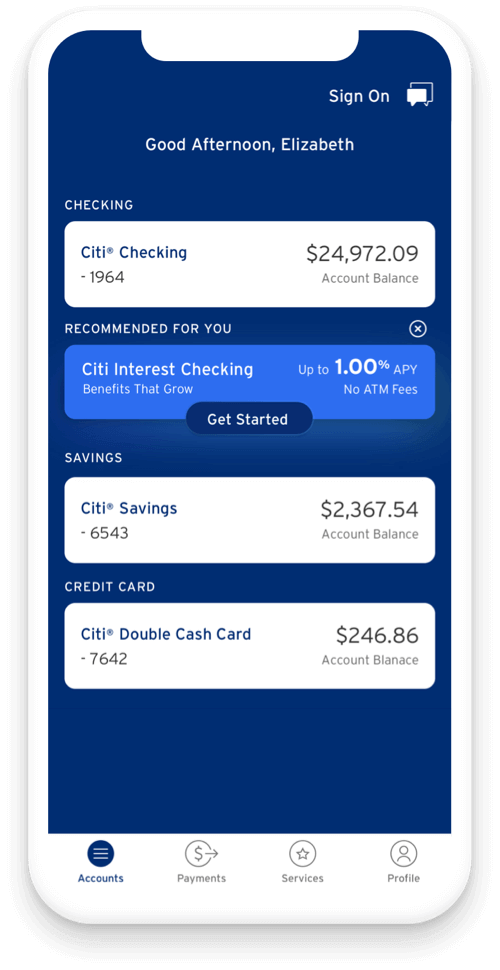

Citibank Online

The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. Regulation cc requires that financial institutions include a notice of funds availability on the.

Citi Says Hedge Funds Are Using Dollars for New Carry Trades

(cgmi), offers clients a large selection of mutual funds. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check.

Citi Impact Fund Team

Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. (cgmi), offers clients a.

How to add a payee to transfer funds on the Citi Mobile App YouTube

Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. From each fund family offered, cgmi seeks to collect. (cgmi), offers.

Citibank Money Lock Secure Your Funds Easily

From each fund family offered, cgmi seeks to collect. These rules reduce the risk to depositary banks of having to make funds from check deposits available for withdrawal before. Our general policy is to make funds from any type of check deposit available to you no later than the first business day after the day of your deposit. Regulation cc.

Our General Policy Is To Make Funds From Any Type Of Check Deposit Available To You No Later Than The First Business Day After The Day Of Your Deposit.

The regulation sets forth the requirements that depositary institutions (“banks”) make funds deposited into transaction accounts available. Regulation cc requires that financial institutions include a notice of funds availability on the front of all preprinted deposit. (cgmi), offers clients a large selection of mutual funds. From each fund family offered, cgmi seeks to collect.

These Rules Reduce The Risk To Depositary Banks Of Having To Make Funds From Check Deposits Available For Withdrawal Before.

Regular checking account applications are available in branch, on citi online, through the citi mobile app or by calling the.