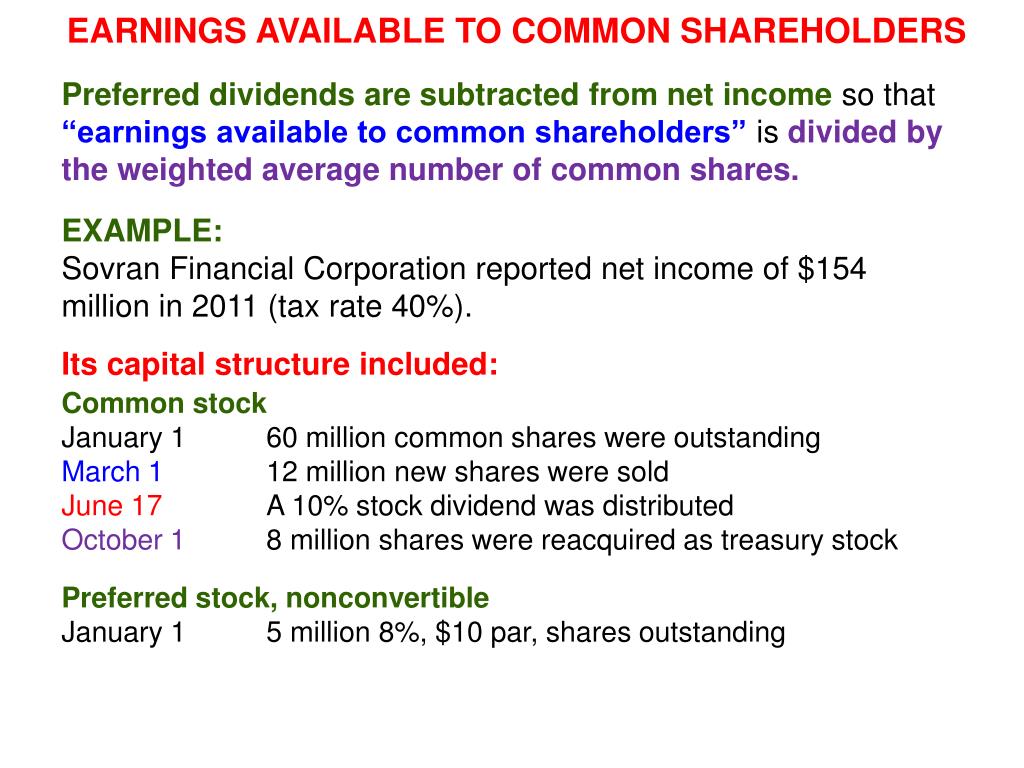

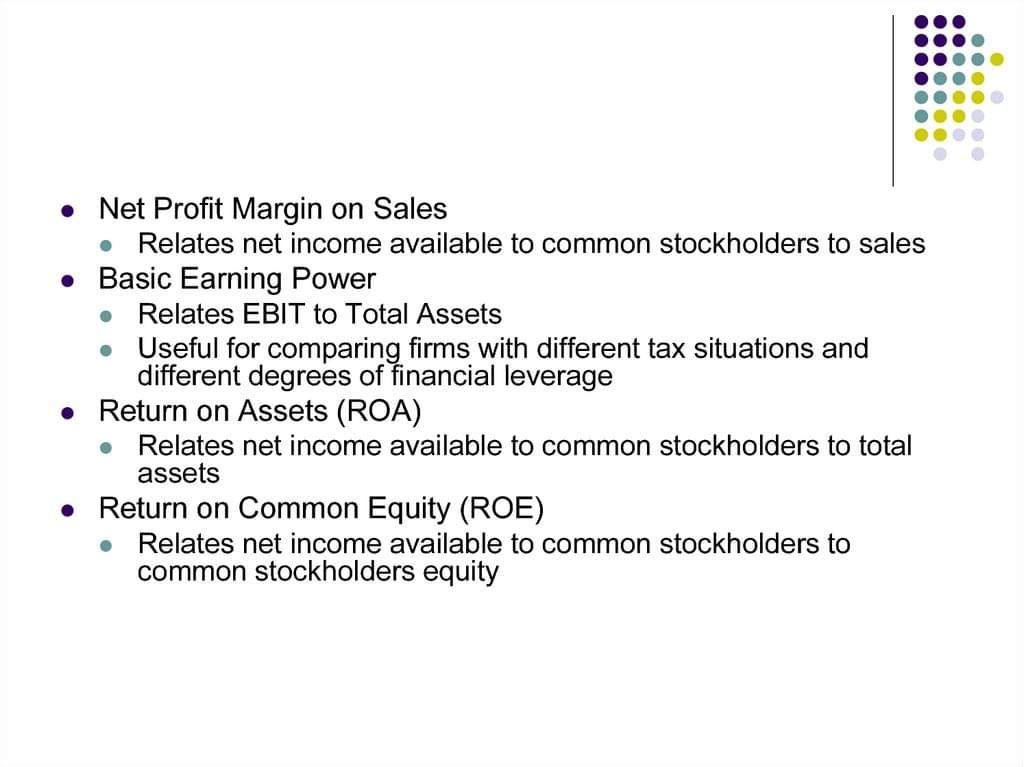

Earnings Available To Common Shareholders - Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends. Calculate earnings per share by subtracting preferred stock dividends from income. At the beginning of the year, 200 million common.

Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Factors in both cumulative & noncumulative dividends. Calculate earnings per share by subtracting preferred stock dividends from income. The company's tax rate is 40%. At the beginning of the year, 200 million common.

Calculate earnings per share by subtracting preferred stock dividends from income. At the beginning of the year, 200 million common. Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends.

Reporting and Analyzing Shareholders’ Equity ppt download

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; The company's tax rate is 40%. At the beginning of the year, 200 million common. Calculate earnings per share by subtracting preferred stock dividends from income.

Reporting and Analyzing Shareholders’ Equity ppt download

The company's tax rate is 40%. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Calculate earnings per share by subtracting preferred stock dividends from income. Salt company reports net income of $360 million for 2017;

What are Earnings Available for Common Stockholders? SuperfastCPA CPA

Factors in both cumulative & noncumulative dividends. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; The company's tax rate is 40%. Calculate earnings per share by subtracting preferred stock dividends from income.

Chapter 19 ShareBased Compensation ASC 718 (SFAS 123R) ppt download

At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends. Salt company reports net income of $360 million for 2017;

PPT Chapter 19 ShareBased Compensation ASC 718 (SFAS 123R

The company's tax rate is 40%. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. Salt company reports net income of $360 million for 2017; Calculate earnings per share by subtracting preferred stock dividends from income.

How to Find Net After Tax on a Balance Sheet AccountingCoaching

At the beginning of the year, 200 million common. Salt company reports net income of $360 million for 2017; The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Factors in both cumulative & noncumulative dividends.

ShareBased Compensation and Earnings Per Share ppt download

At the beginning of the year, 200 million common. Calculate earnings per share by subtracting preferred stock dividends from income. Factors in both cumulative & noncumulative dividends. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%.

PPT Statement and Statement of Stockholders’ Equity PowerPoint

Calculate earnings per share by subtracting preferred stock dividends from income. Factors in both cumulative & noncumulative dividends. At the beginning of the year, 200 million common. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%.

Module 9 Earnings per share ppt download

The company's tax rate is 40%. The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. At the beginning of the year, 200 million common. Factors in both cumulative & noncumulative dividends. Salt company reports net income of $360 million for 2017;

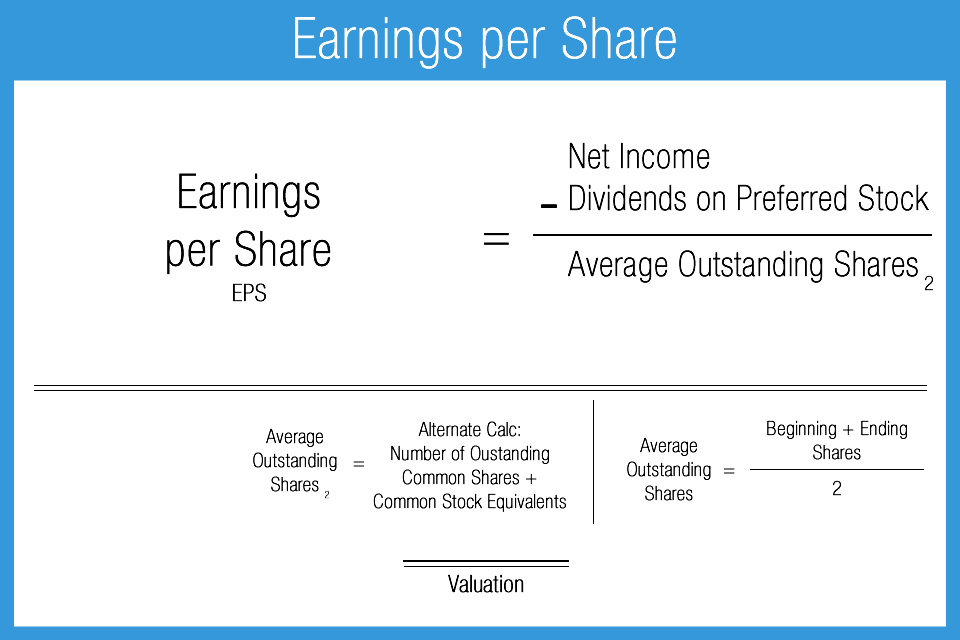

Earnings per Share Accounting Play

The retained earnings account on the corporate balance sheet is the source of earnings available for common stockholders. The company's tax rate is 40%. Calculate earnings per share by subtracting preferred stock dividends from income. Factors in both cumulative & noncumulative dividends. Salt company reports net income of $360 million for 2017;

The Company's Tax Rate Is 40%.

Salt company reports net income of $360 million for 2017; Factors in both cumulative & noncumulative dividends. Calculate earnings per share by subtracting preferred stock dividends from income. At the beginning of the year, 200 million common.