Fidelity Form 5498 Not Available Until May - You don't need form 5498 to file your taxes! 5498 records contributions, which can be done until april 15; You can record a tax deductible. This is actually completely normal and happens every year. So are generally sent in may. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed.

This is actually completely normal and happens every year. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You can record a tax deductible. 5498 records contributions, which can be done until april 15; You don't need form 5498 to file your taxes! So are generally sent in may.

This is actually completely normal and happens every year. So are generally sent in may. You don't need form 5498 to file your taxes! 5498 records contributions, which can be done until april 15; You can record a tax deductible. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed.

Fidelity 2022 Form 5498 Instructions for IRA PrintFriendly

5498 records contributions, which can be done until april 15; It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You can record a tax deductible. This is actually completely normal and happens every year. So are generally sent in may.

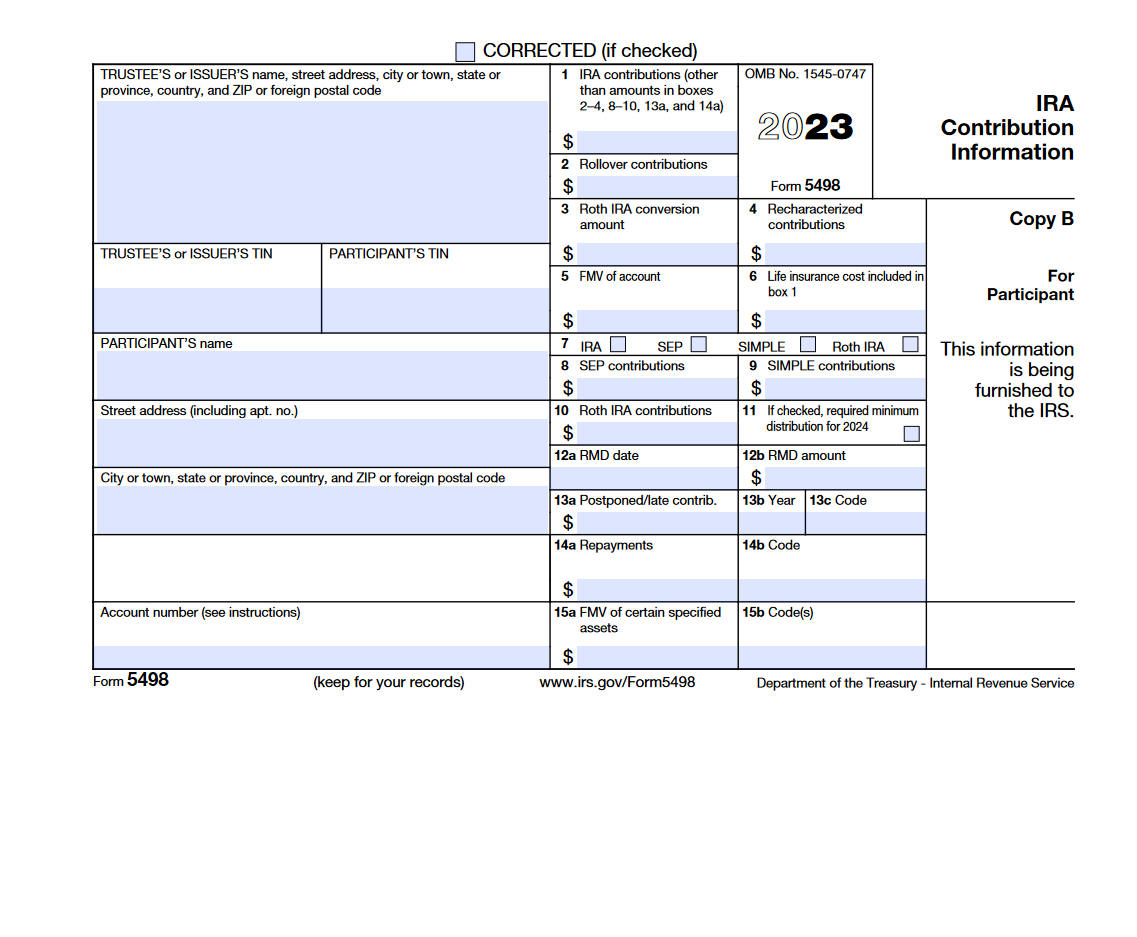

IRS Form 5498. IRA Contribution Information Forms Docs 2023

So are generally sent in may. 5498 records contributions, which can be done until april 15; You can record a tax deductible. This is actually completely normal and happens every year. You don't need form 5498 to file your taxes!

Tax form 5498SA not available until midMay? r/fidelityinvestments

It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You can record a tax deductible. This is actually completely normal and happens every year. You don't need form 5498 to file your taxes! 5498 records contributions, which can be done until april 15;

Demystifying IRS Form 5498 uDirect IRA Services, LLC

So are generally sent in may. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. 5498 records contributions, which can be done until april 15; You can record a tax deductible. You don't need form 5498 to file your taxes!

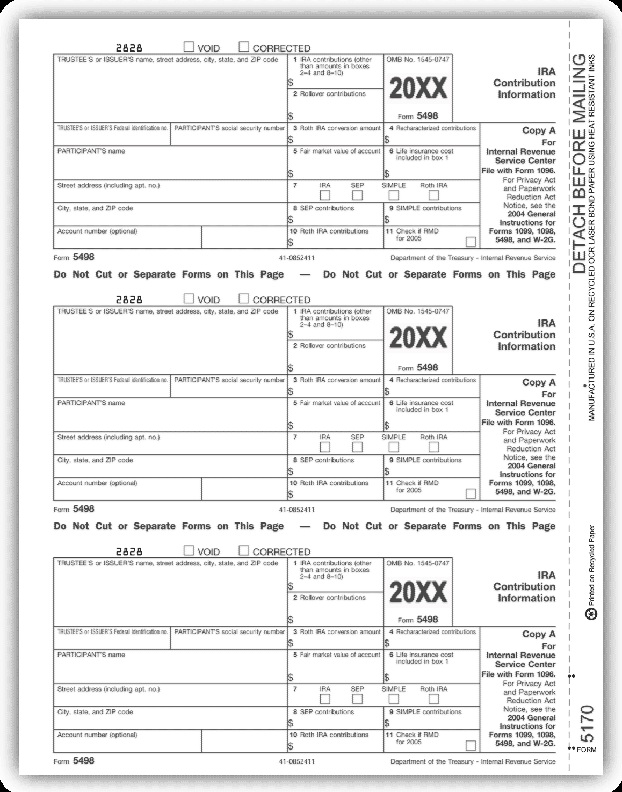

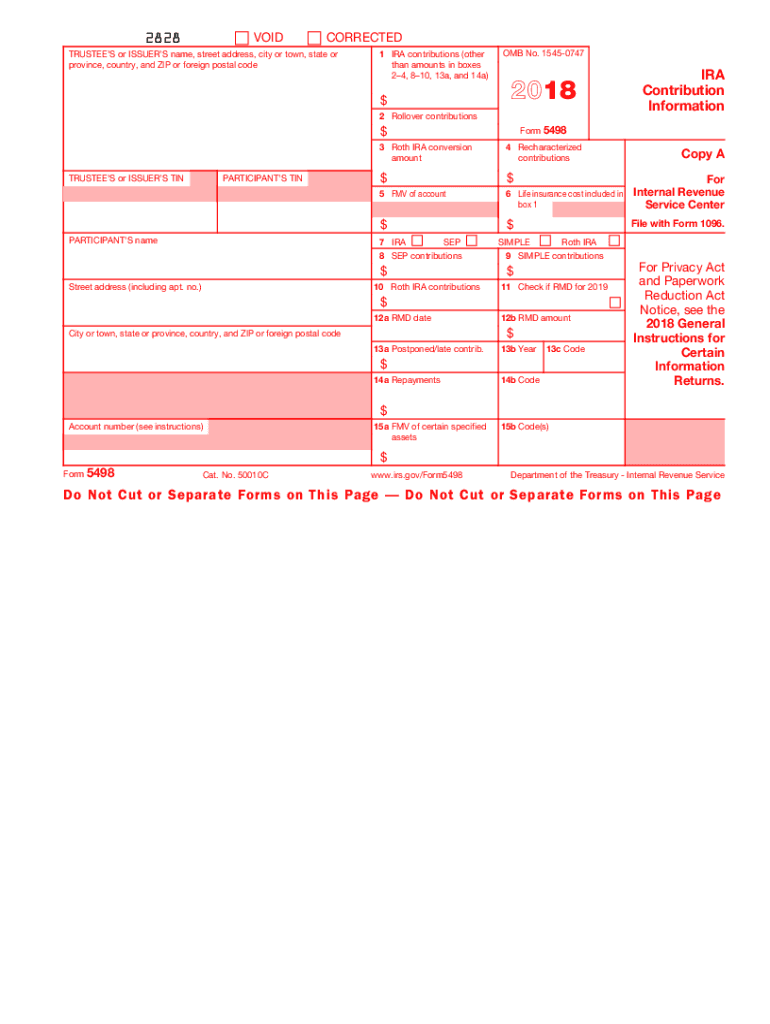

5498 20182025 Form Fill Out and Sign Printable PDF Template

5498 records contributions, which can be done until april 15; You don't need form 5498 to file your taxes! It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You can record a tax deductible. So are generally sent in may.

2020 Form IRS 5498SA Fill Online, Printable, Fillable, Blank pdfFiller

You can record a tax deductible. So are generally sent in may. This is actually completely normal and happens every year. 5498 records contributions, which can be done until april 15; You don't need form 5498 to file your taxes!

Fillable Online Form 5498SAHealth Savings Account Fidelity

You don't need form 5498 to file your taxes! 5498 records contributions, which can be done until april 15; This is actually completely normal and happens every year. You can record a tax deductible. So are generally sent in may.

Reporting Contributions on Forms 5498 and 5498SA — Ascensus

This is actually completely normal and happens every year. So are generally sent in may. You can record a tax deductible. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You don't need form 5498 to file your taxes!

Understanding Your Form 5498SA for

It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. You can record a tax deductible. So are generally sent in may. 5498 records contributions, which can be done until april 15; You don't need form 5498 to file your taxes!

IRS Form 5498 Instructions

This is actually completely normal and happens every year. It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. So are generally sent in may. You don't need form 5498 to file your taxes! 5498 records contributions, which can be done until april 15;

This Is Actually Completely Normal And Happens Every Year.

It is pretty much an fyi note, and fidelity can't know yet how much everyone contributed. 5498 records contributions, which can be done until april 15; So are generally sent in may. You can record a tax deductible.