How To Find Number Of Shares Outstanding On Balance Sheet - To find the total number of outstanding shares, follow these steps: These include company insiders, retail, and. Go to the balance sheet of the company in question and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Shares outstanding are the total number of a company’s shares held by all shareholders.

Shares outstanding are the total number of a company’s shares held by all shareholders. To find the total number of outstanding shares, follow these steps: Go to the balance sheet of the company in question and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. These include company insiders, retail, and.

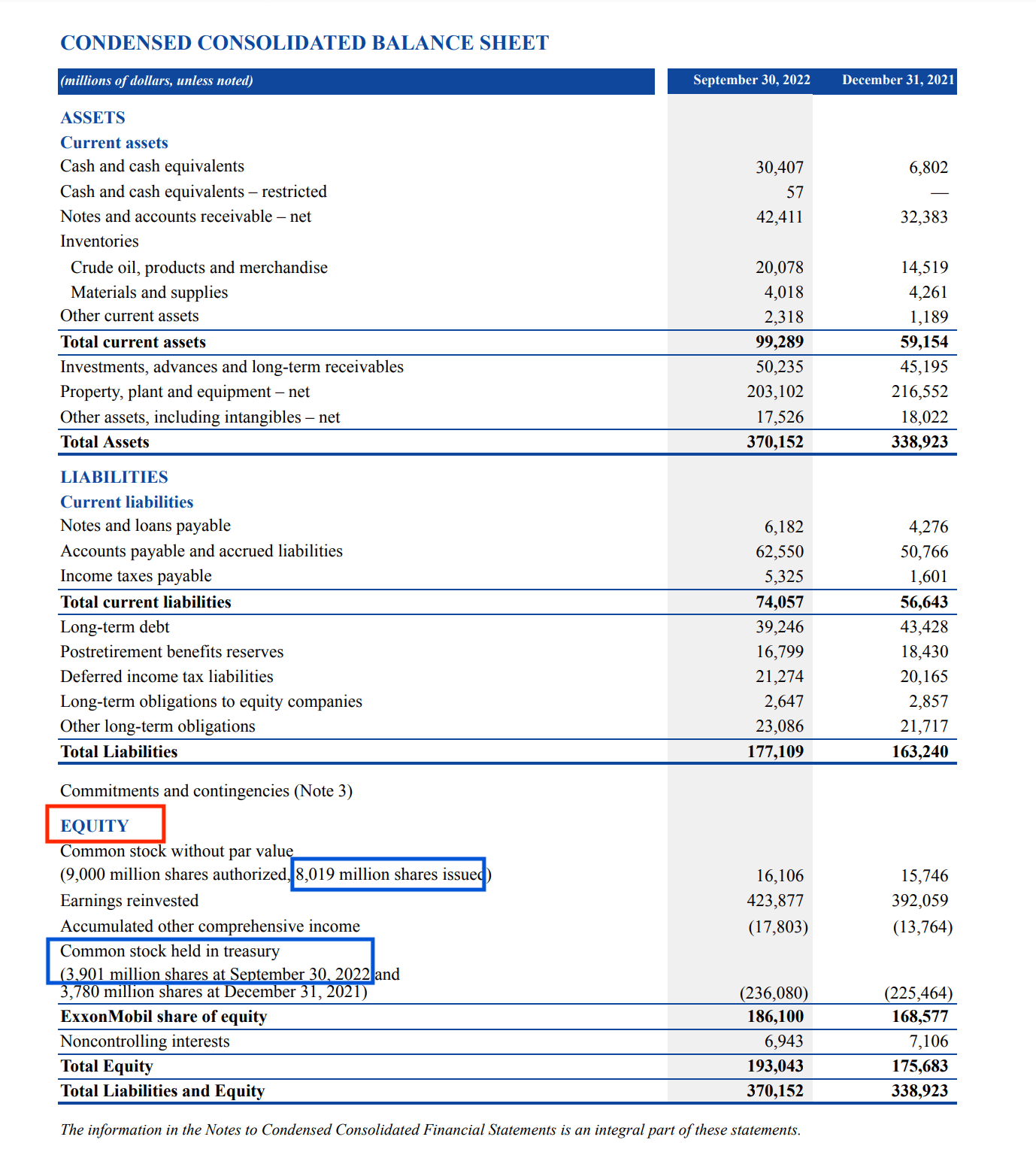

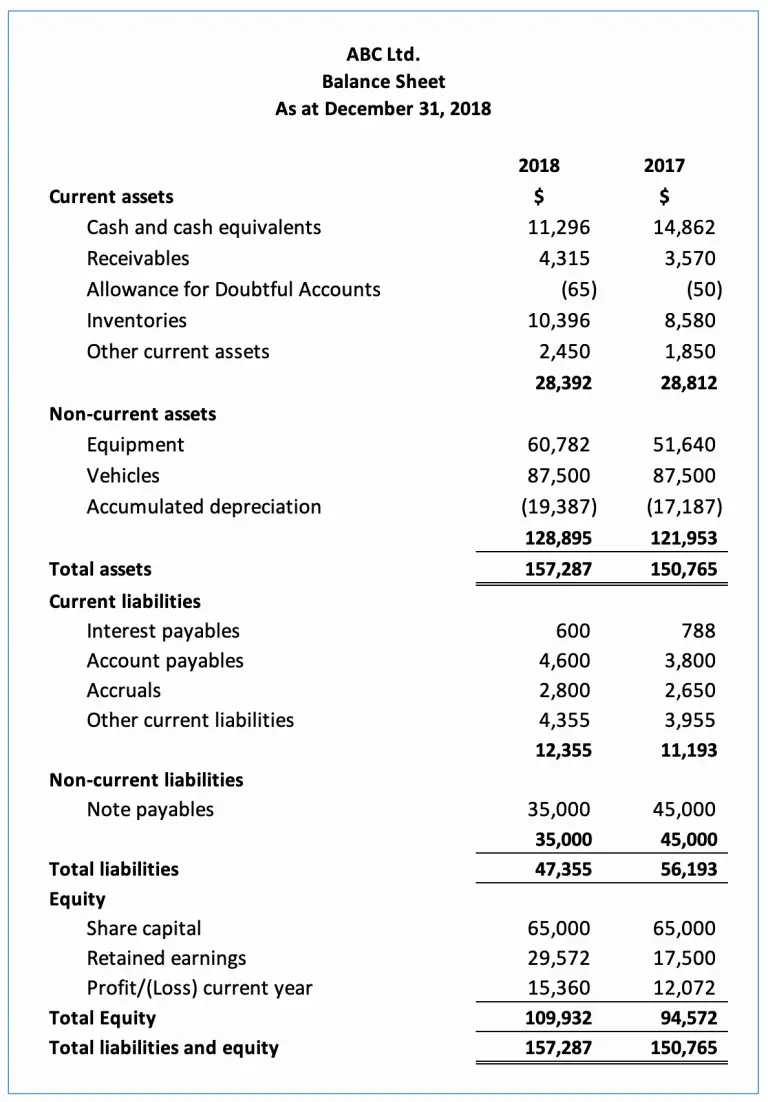

The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Shares outstanding are the total number of a company’s shares held by all shareholders. Go to the balance sheet of the company in question and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. These include company insiders, retail, and. To find the total number of outstanding shares, follow these steps:

How to Calculate Common Stock Outstanding From a Balance Sheet The

The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. To find the total number of outstanding shares, follow these steps: Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. Go to the balance sheet of the company in question and. These include company insiders, retail, and.

Solved The stockholders' equity section of Culver

Shares outstanding are the total number of a company’s shares held by all shareholders. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Go to the balance sheet of the company in question and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. To find the.

Shares Outstanding Types, How to Find, and Float Stock Analysis

These include company insiders, retail, and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. To find the total number of outstanding shares, follow these steps: Shares outstanding are the total number of a company’s shares held by all shareholders. The balance sheet provides a snapshot of a company’s financial position,.

How To Work For Balance Sheet at Sara Nelson blog

To find the total number of outstanding shares, follow these steps: Go to the balance sheet of the company in question and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. These include company insiders, retail, and.

Understanding Your Balance Sheet Financial Accounting Protea

To find the total number of outstanding shares, follow these steps: Go to the balance sheet of the company in question and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. These include company insiders, retail, and.

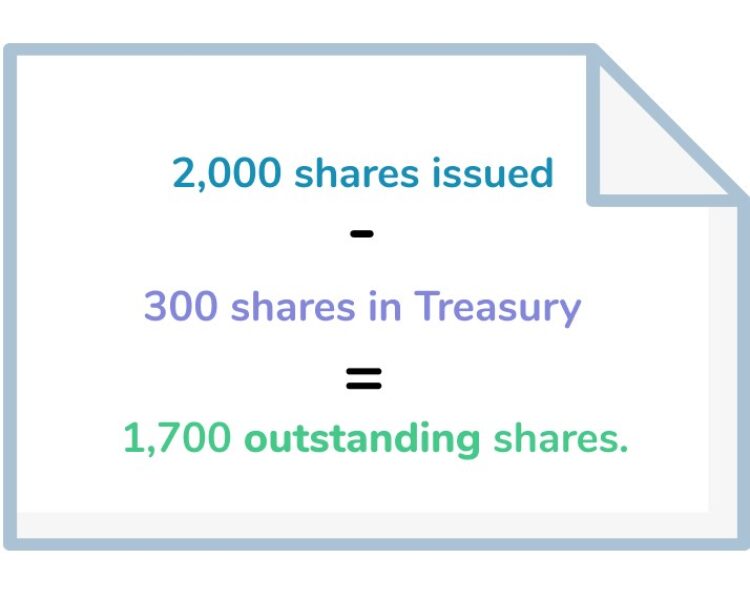

What Are Outstanding Shares?

Shares outstanding are the total number of a company’s shares held by all shareholders. These include company insiders, retail, and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. To find the total number of outstanding shares, follow these steps: Go to the balance sheet of the company in question and.

Balance Sheet Ratios Types Formula Example Accountinguide

These include company insiders, retail, and. To find the total number of outstanding shares, follow these steps: Go to the balance sheet of the company in question and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding.

How to read and understand financial statements

To find the total number of outstanding shares, follow these steps: Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. These include company insiders, retail, and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Go to the balance sheet of the company in question and.

Shares Outstanding Meaning & Formula InvestingAnswers

To find the total number of outstanding shares, follow these steps: Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. Go to the balance sheet of the company in question and. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. These include company insiders, retail, and.

Outstanding Shares Definition and How to Locate the Number

Go to the balance sheet of the company in question and. Shares outstanding are the total number of a company’s shares held by all shareholders. The balance sheet provides a snapshot of a company’s financial position, detailing its assets,. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding. These include company.

The Balance Sheet Provides A Snapshot Of A Company’s Financial Position, Detailing Its Assets,.

Go to the balance sheet of the company in question and. Shares outstanding are the total number of a company’s shares held by all shareholders. These include company insiders, retail, and. Use the formula earnings per share equals net income divided by shares outstanding to calculate the shares outstanding.

:max_bytes(150000):strip_icc()/Outstanding-Shares-66e3dfdfa97140b59e4ad86fb2e70905.jpg)