Irs Says No Information Available About Amended Tax Return - Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. We’ll outline what you need to do to. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You should generally allow 8 to 12 weeks for your form. You can check the status of an amended return around 3 weeks after you submit it. The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now. When i check the status with where's my amended return, i get we cannot provide any information on your amended. Were you notified by the irs that it needs more information before they can process your return?

When i check the status with where's my amended return, i get we cannot provide any information on your amended. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You can check the status of an amended return around 3 weeks after you submit it. Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now. Were you notified by the irs that it needs more information before they can process your return? You should generally allow 8 to 12 weeks for your form. We’ll outline what you need to do to.

You should generally allow 8 to 12 weeks for your form. You can check the status of an amended return around 3 weeks after you submit it. We’ll outline what you need to do to. Were you notified by the irs that it needs more information before they can process your return? If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now. When i check the status with where's my amended return, i get we cannot provide any information on your amended.

Amended Return r/IRS

When i check the status with where's my amended return, i get we cannot provide any information on your amended. We’ll outline what you need to do to. Were you notified by the irs that it needs more information before they can process your return? If you’ve received a notification from the irs saying your tax return doesn’t match their.

1040 Form

Were you notified by the irs that it needs more information before they can process your return? Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went..

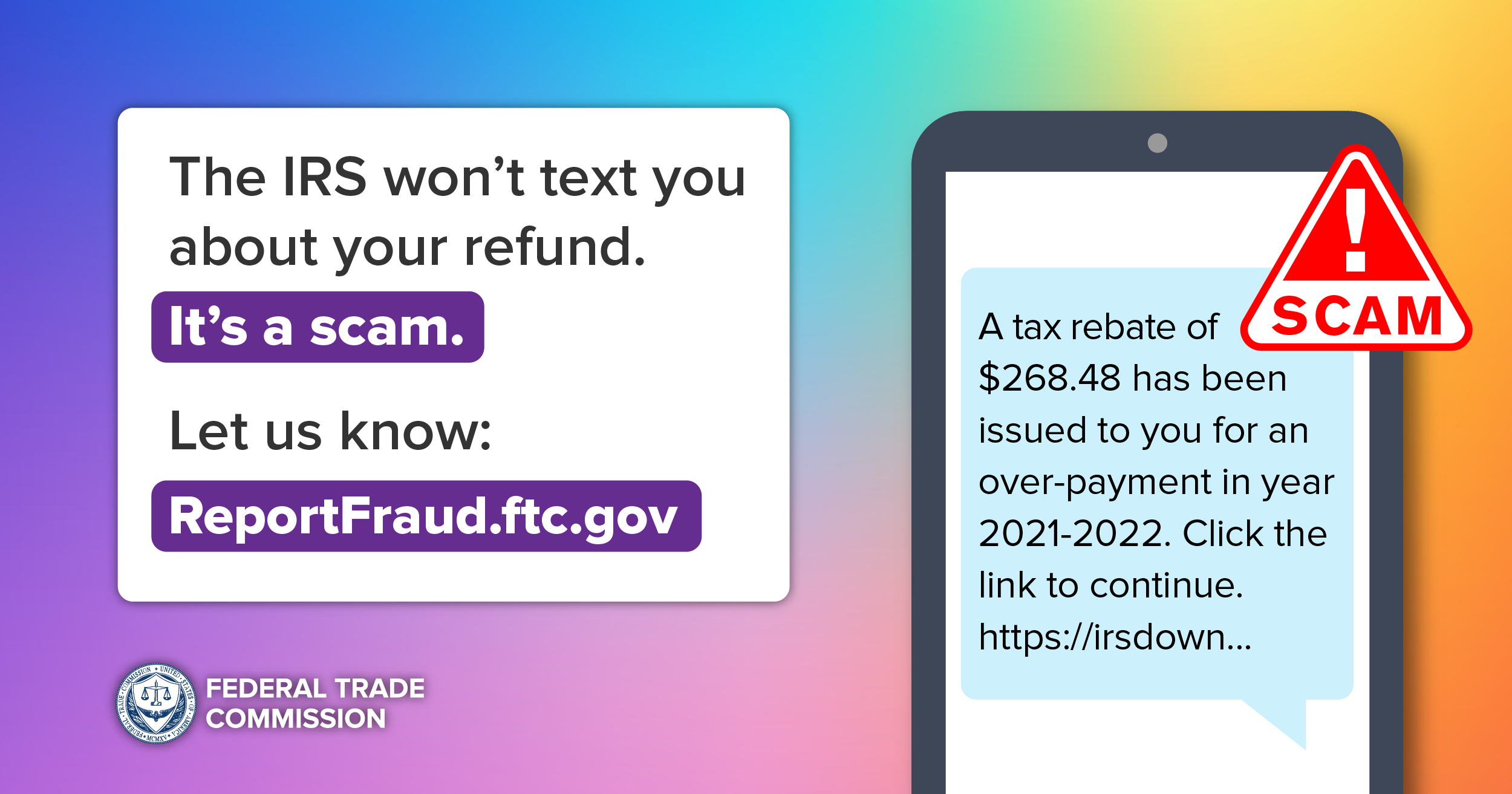

No, that’s not the IRS texting about a tax refund or rebate. It’s a

Were you notified by the irs that it needs more information before they can process your return? We’ll outline what you need to do to. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. When i check the status with where's my amended return, i get we cannot.

Amended return & no information r/IRS

You should generally allow 8 to 12 weeks for your form. When i check the status with where's my amended return, i get we cannot provide any information on your amended. Were you notified by the irs that it needs more information before they can process your return? The irs is backlogged with millions of tax returns and millions of.

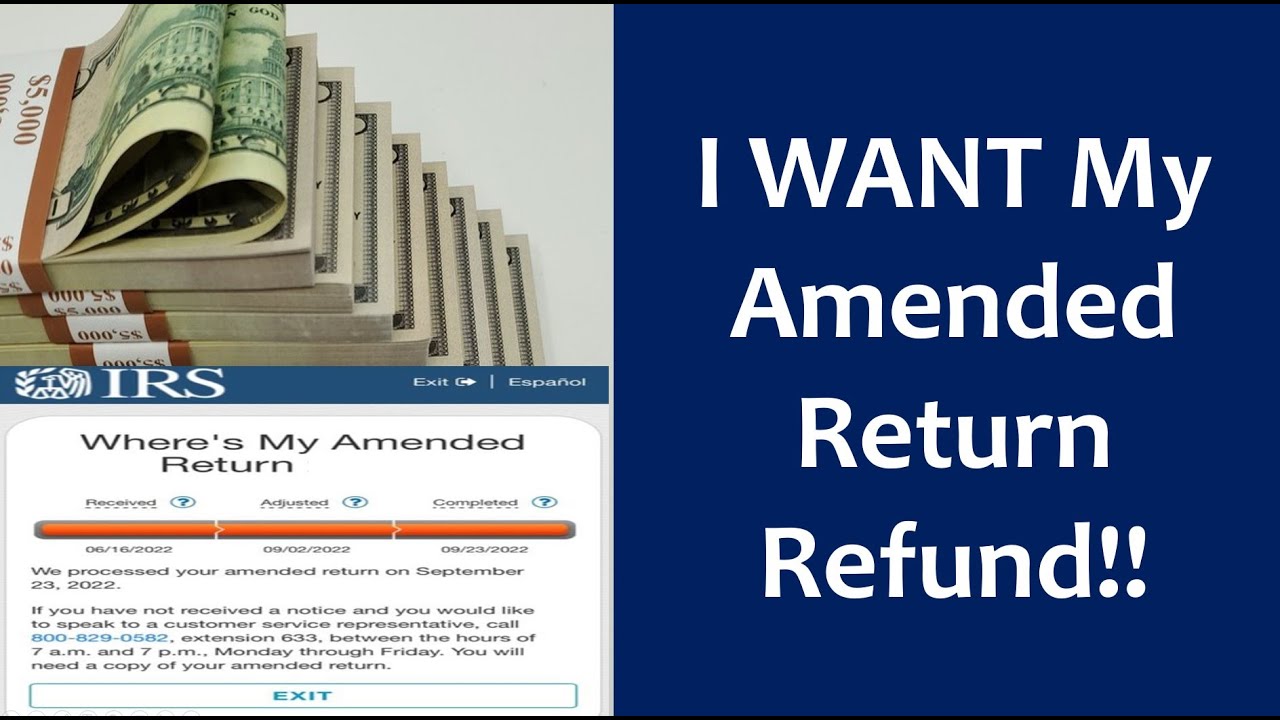

Where My Irs Refund Amended Return S

The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You should generally allow 8 to 12 weeks for your form. Learn why the irs may not have information on your.

Where My Irs Refund Amended Return S

When i check the status with where's my amended return, i get we cannot provide any information on your amended. You can check the status of an amended return around 3 weeks after you submit it. Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. If you’ve.

IRS Codes 570 & 971 Tax Refund Delayed or Reduced? aving to Invest

We’ll outline what you need to do to. You should generally allow 8 to 12 weeks for your form. When i check the status with where's my amended return, i get we cannot provide any information on your amended. You can check the status of an amended return around 3 weeks after you submit it. If you’ve received a notification.

IRS Tax Update DO NOT file an amended return. For those who have not

Learn why the irs may not have information on your amended return, what factors affect processing times, and how to check your. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You should generally allow 8 to 12 weeks for your form. We’ll outline what you need to.

Amended Return AwesomeFinTech Blog

The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now. We’ll outline what you need to do to. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You should generally allow 8 to 12 weeks for your form. Learn why.

UPDATE IRS says no amended returns needed for federal unemployment tax

Were you notified by the irs that it needs more information before they can process your return? If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. When i check the status with where's my amended return, i get we cannot provide any information on your amended. We’ll outline.

We’ll Outline What You Need To Do To.

You should generally allow 8 to 12 weeks for your form. If you’ve received a notification from the irs saying your tax return doesn’t match their records, you’re probably wondering what went. You can check the status of an amended return around 3 weeks after you submit it. When i check the status with where's my amended return, i get we cannot provide any information on your amended.

Learn Why The Irs May Not Have Information On Your Amended Return, What Factors Affect Processing Times, And How To Check Your.

Were you notified by the irs that it needs more information before they can process your return? The irs is backlogged with millions of tax returns and millions of stimulus checks to process right now.