Land On Balance Sheet - Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position.

Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn about the financial implications of land ownership and how it is reported on a balance sheet. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit.

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit.

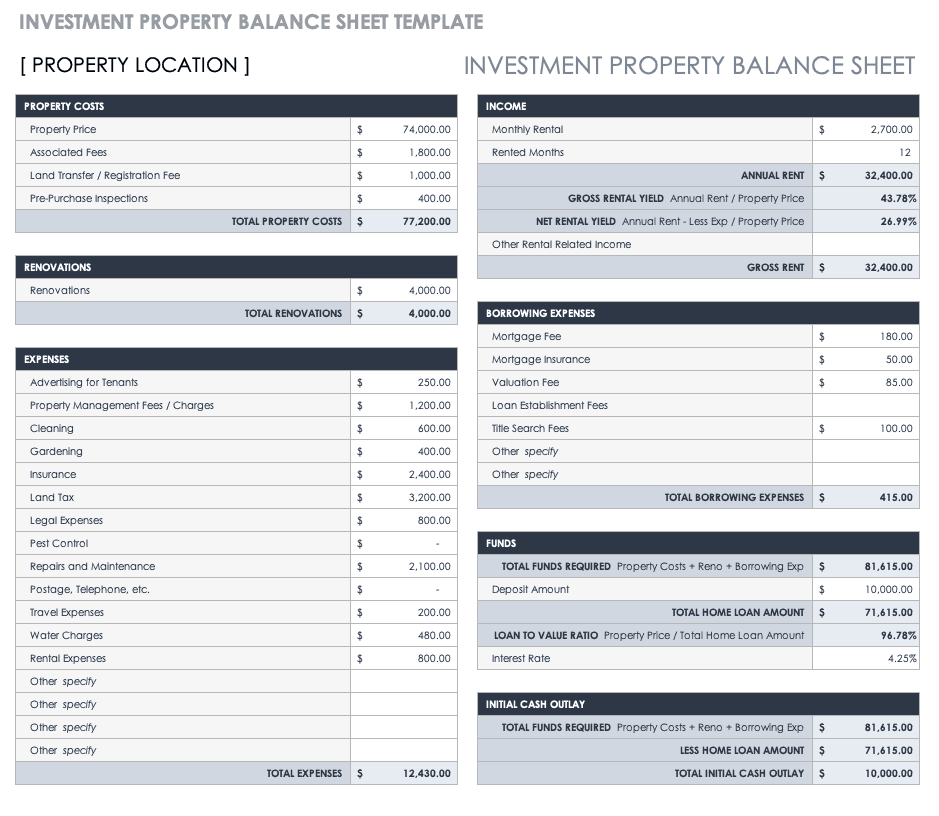

EXCEL of Investment Property Balance Sheet.xlsx WPS Free Templates

Learn about the financial implications of land ownership and how it is reported on a balance sheet. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. Current assets, unlike land, are items.

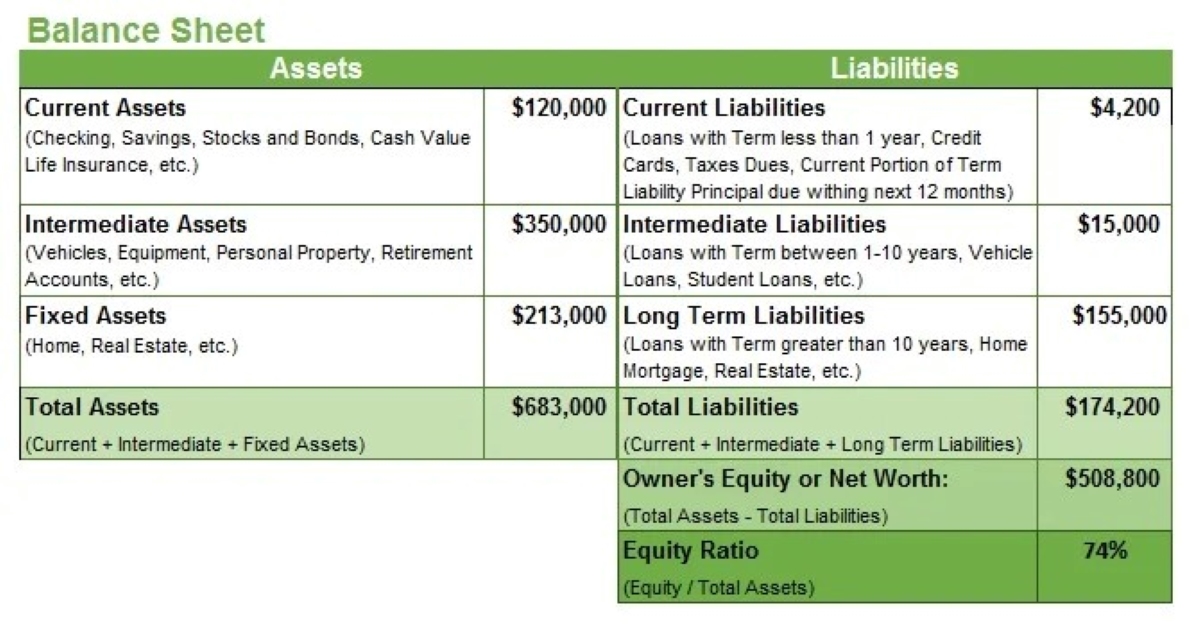

Land on balance sheet

Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or.

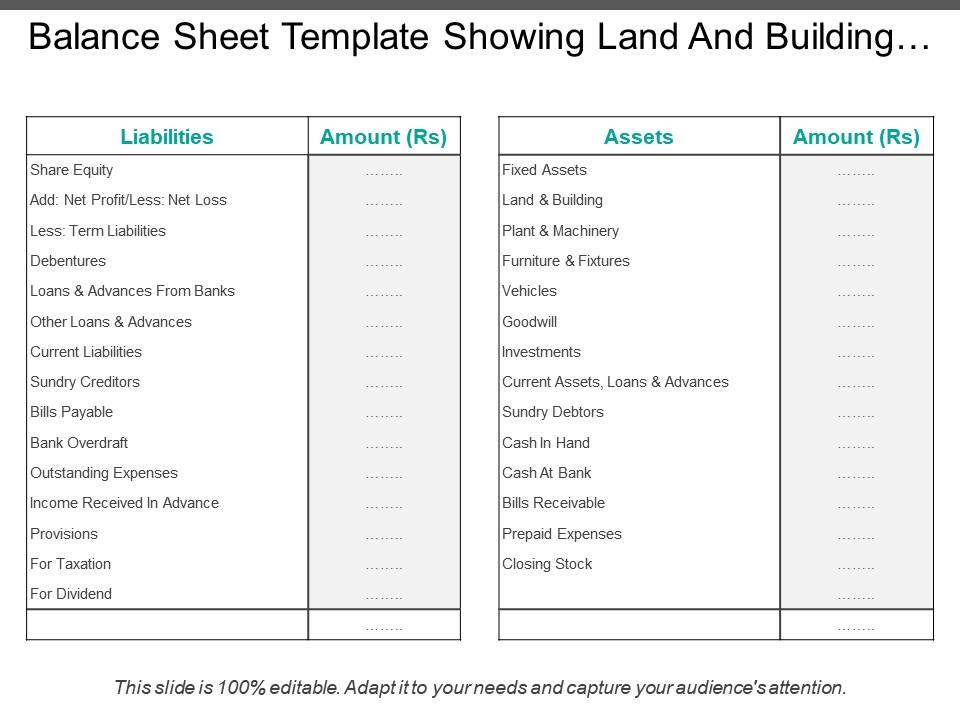

Balance Sheet Template Showing Land And Building Loans Advances

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs,.

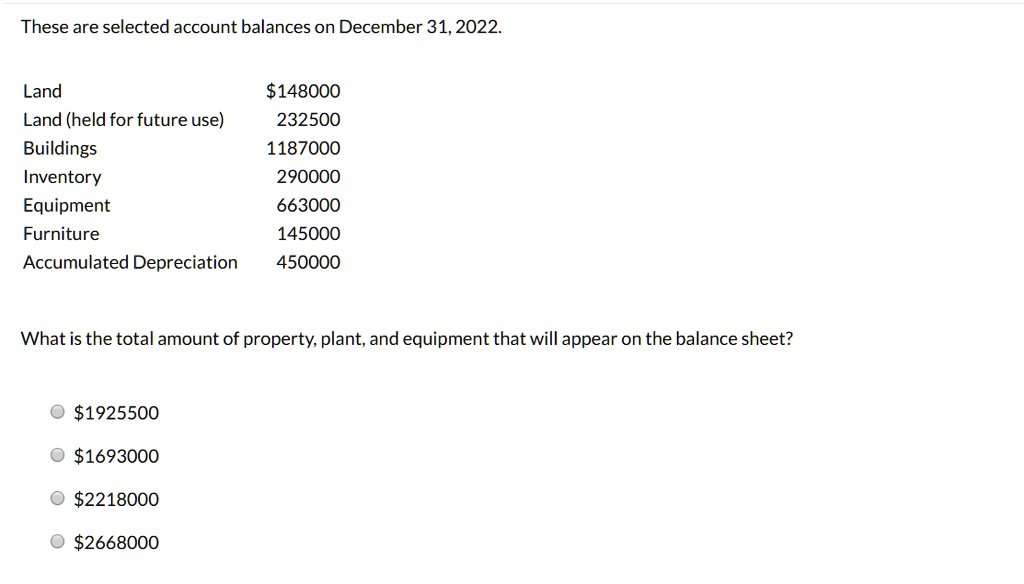

SOLVED What is the total amount of property, plant, and equipment that

Current assets, unlike land, are items that can be converted. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn about the financial implications of land ownership and how it is reported.

Free Balance Sheet Templates — Multiple Formats Smartsheet

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs,.

Land Values on the Balance Sheet YouTube

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs,.

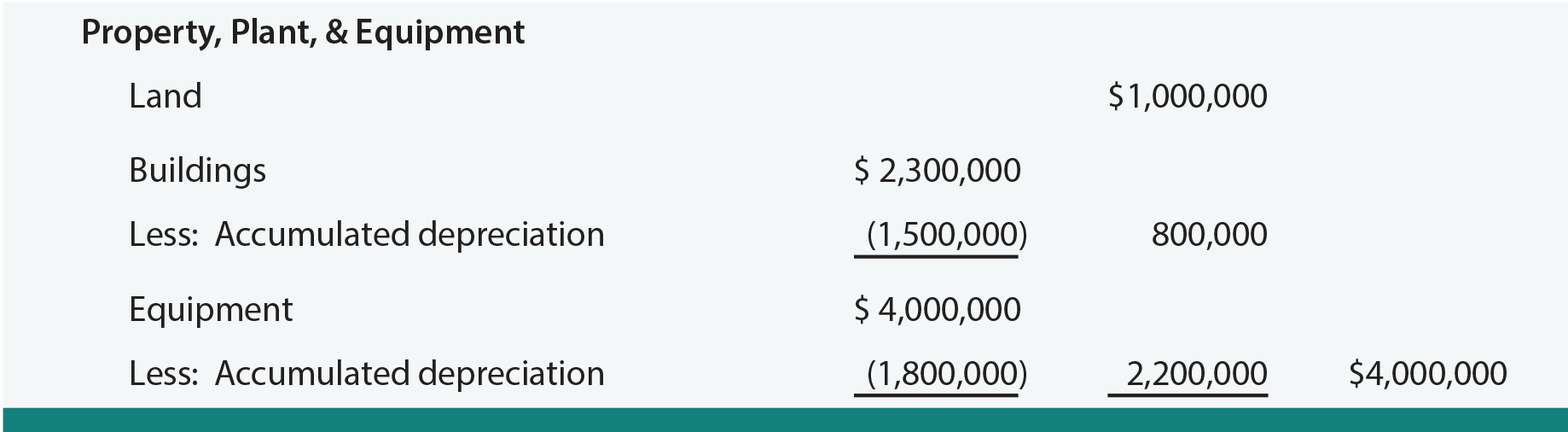

What Costs Are Included In Property, Plant, & Equipment

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Current assets, unlike land, are items.

Where Does Land Go On A Balance Sheet LiveWell

Current assets, unlike land, are items that can be converted. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. Learn about the financial implications of land ownership and how it is reported.

Balance Sheet Fy 18 Mortgage Land Ppt Powerpoint Presentation File

Learn about the financial implications of land ownership and how it is reported on a balance sheet. A business reports land as a tangible resource on its report on financial condition, or statement of financial position. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. Current assets, unlike land, are items.

How to Create Real Estate Balance Sheet in Excel (2 Easy Ways)

Current assets, unlike land, are items that can be converted. Learn about the financial implications of land ownership and how it is reported on a balance sheet. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. A business reports land as a tangible resource on its report on financial condition, or.

Current Assets, Unlike Land, Are Items That Can Be Converted.

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Learn how to accurately account for land on financial statements, covering valuation, acquisition costs, tax treatment, and profit. A business reports land as a tangible resource on its report on financial condition, or statement of financial position.