Lisa Has Recently Bought A Fixed Annuity - A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. Lisa has recently bought a. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Which of these is considered to. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing.

The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Which of these is considered to. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. Lisa has recently bought a. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Study with quizlet and memorize flashcards containing terms like 1. The taxable portion of each annuity payment is calculated using.

Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Lisa has recently bought a. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. Study with quizlet and memorize flashcards containing terms like 1. The taxable portion of each annuity payment is calculated using. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. Which of these is considered to. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of.

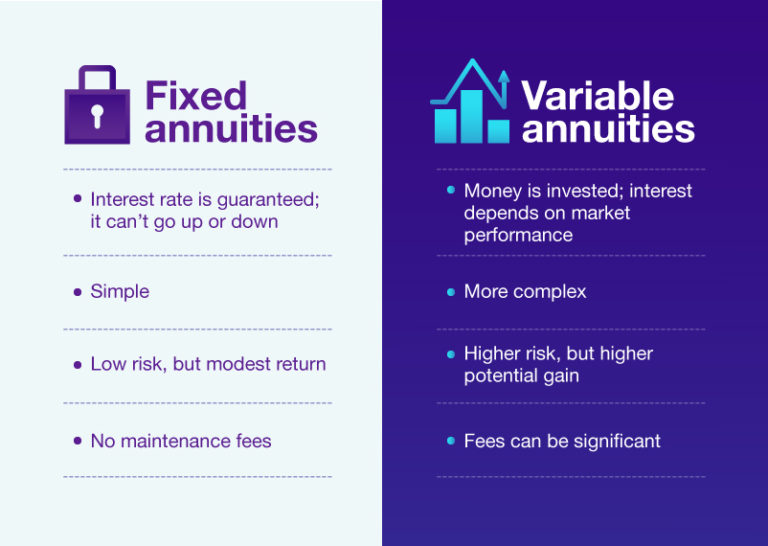

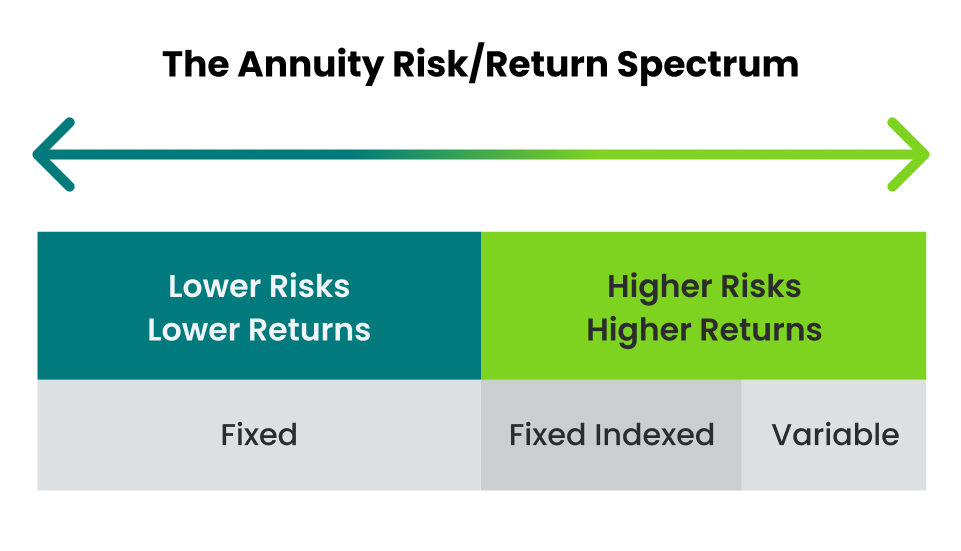

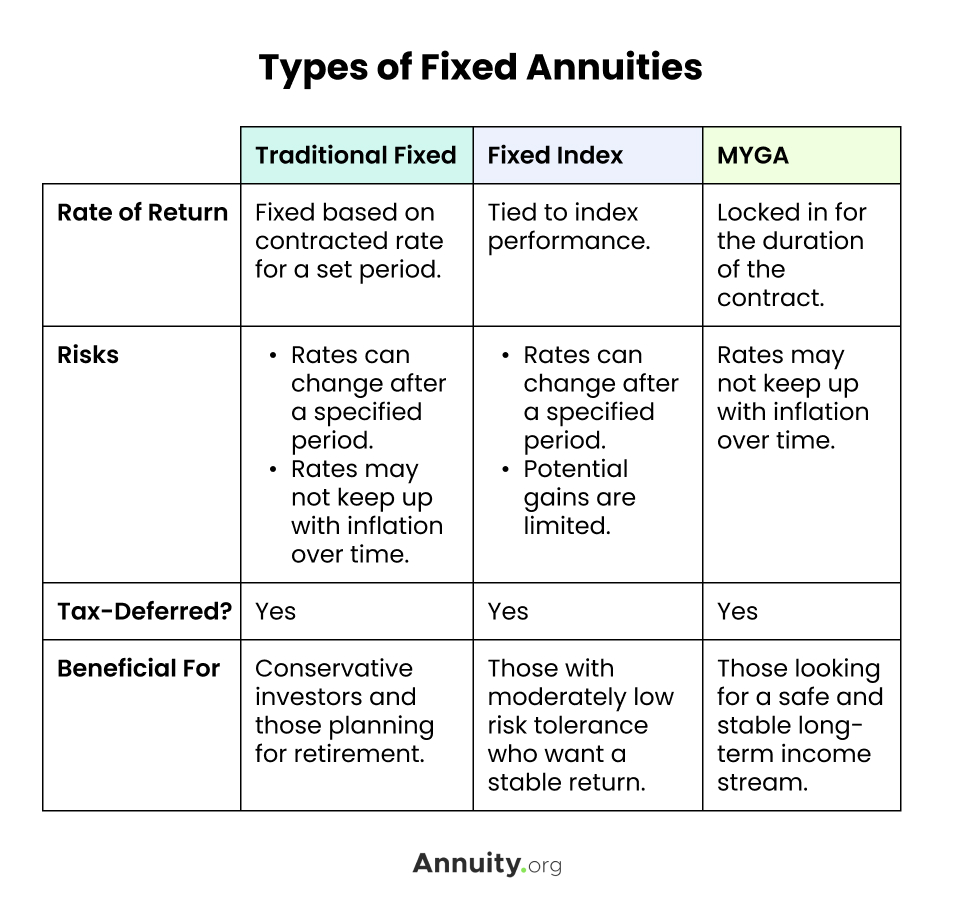

How Does An Indexed Annuity Differ From A Fixed Annuity?

Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Lisa has recently bought a. Study.

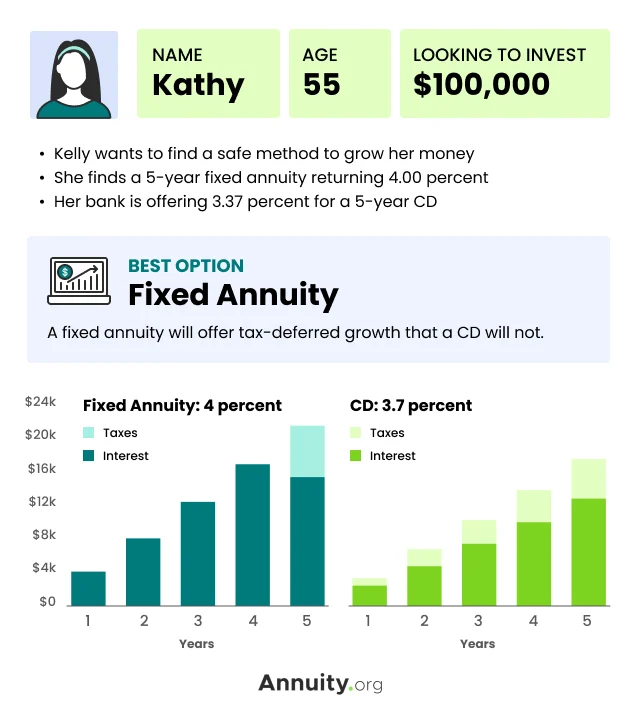

Best Current Fixed Annuity Rates May 2025

The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. Lisa has recently bought a. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments..

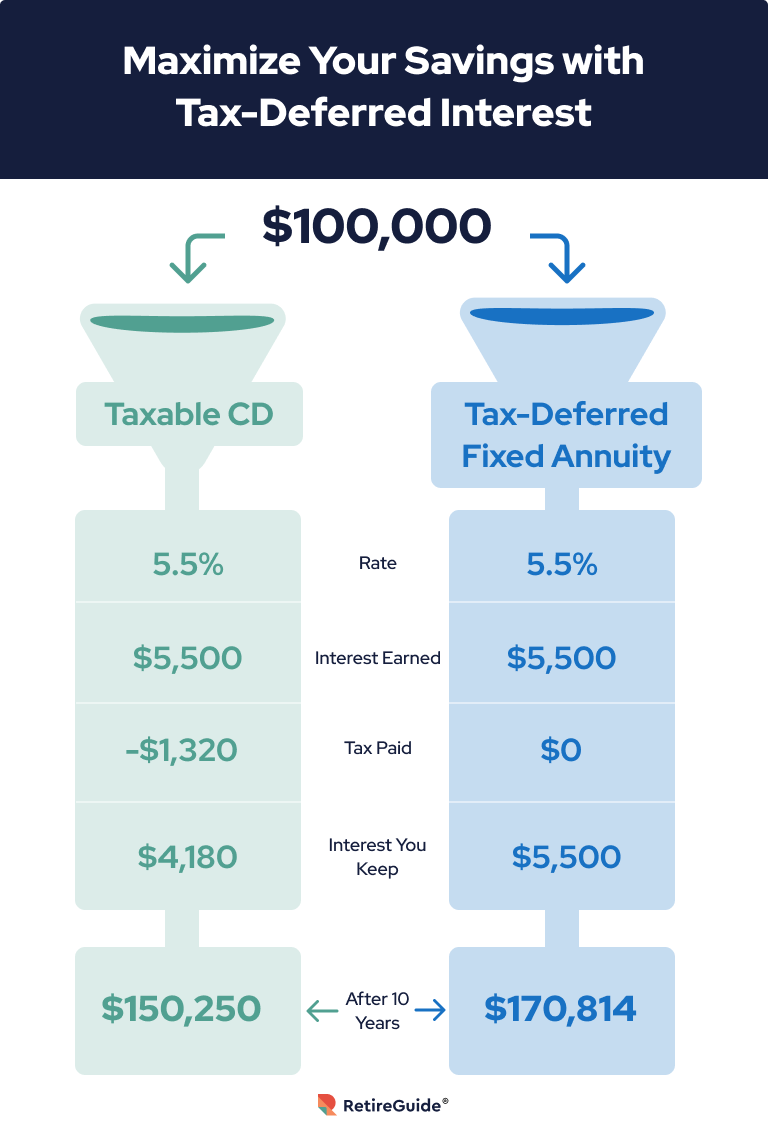

Fixed Annuities LowRisk Product, Guaranteed Returns

Which of these is considered to. Lisa has recently bought a. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. The taxable portion of each annuity.

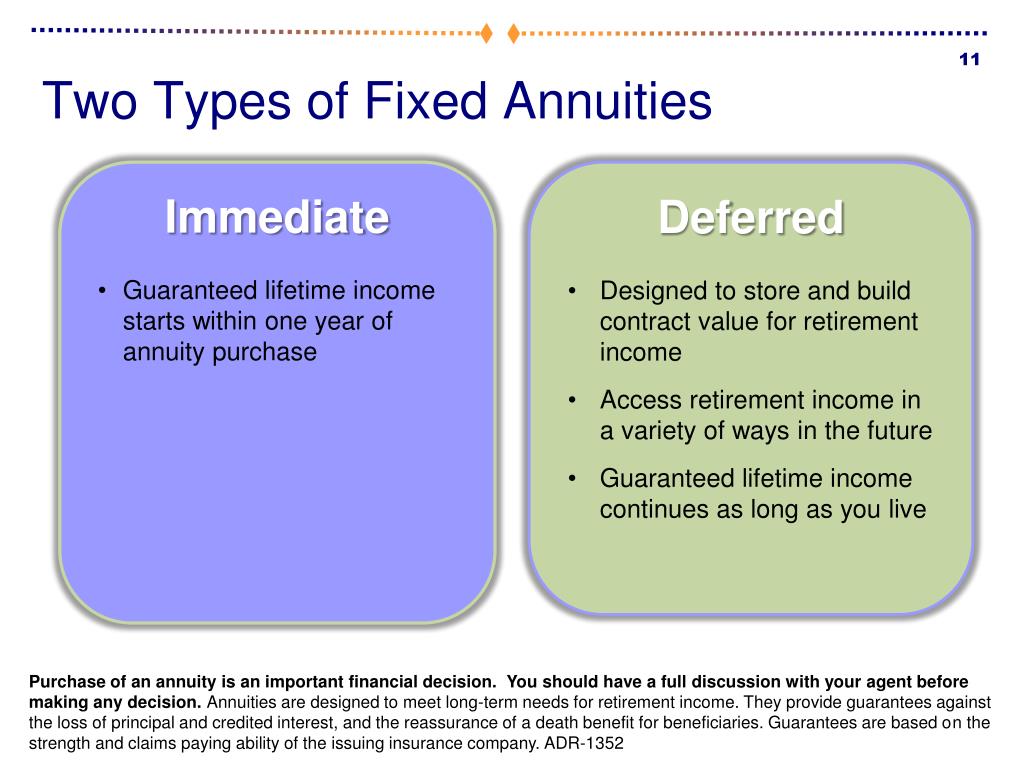

Fixed Annuities Introduction to Fixed Annuities

Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. A fixed annuity provides a predetermined,.

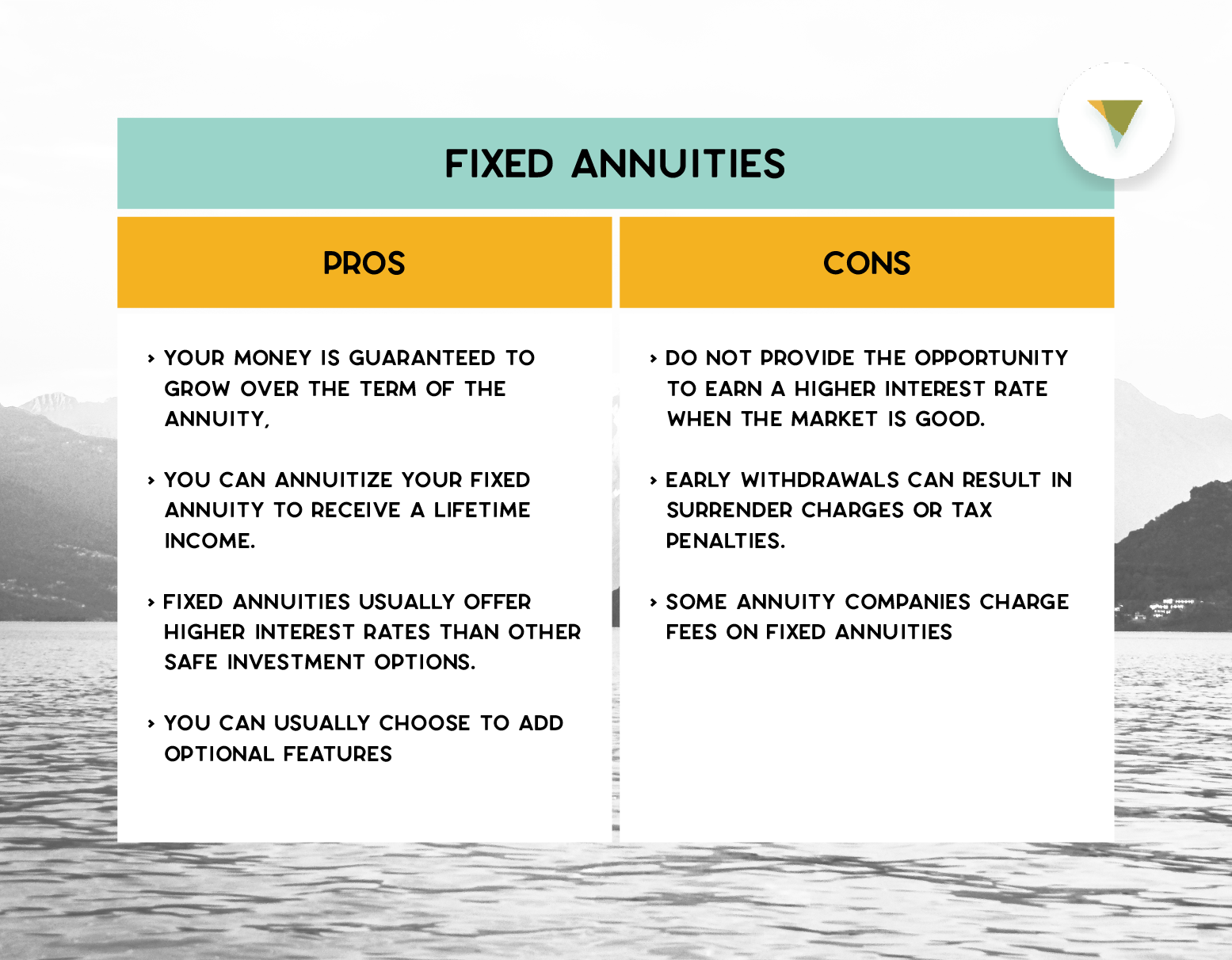

Fixed Annuities Definition, How It Works, Types, Pros, & Cons

A fixed annuity provides a predetermined, regular payment for the duration of the annuitant’s life (. Which of these is considered to. The taxable portion of each annuity payment is calculated using. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Study with quizlet and memorize flashcards.

What Is a Fixed Annuity? Liberty Group, LLC

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Lisa has recently bought a. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Study with quizlet and memorize flashcards containing terms like lisa has.

PPT A Closer Look at Fixed Annuities PowerPoint Presentation, free

A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity, such as lisa's, is.

PPT Annuity & Planing PowerPoint Presentation, free download ID886379

The taxable portion of each annuity payment is calculated using. A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Study with quizlet and memorize flashcards containing terms like lisa has recently bought a fixed annuity. The disadvantage of owning a fixed annuity,.

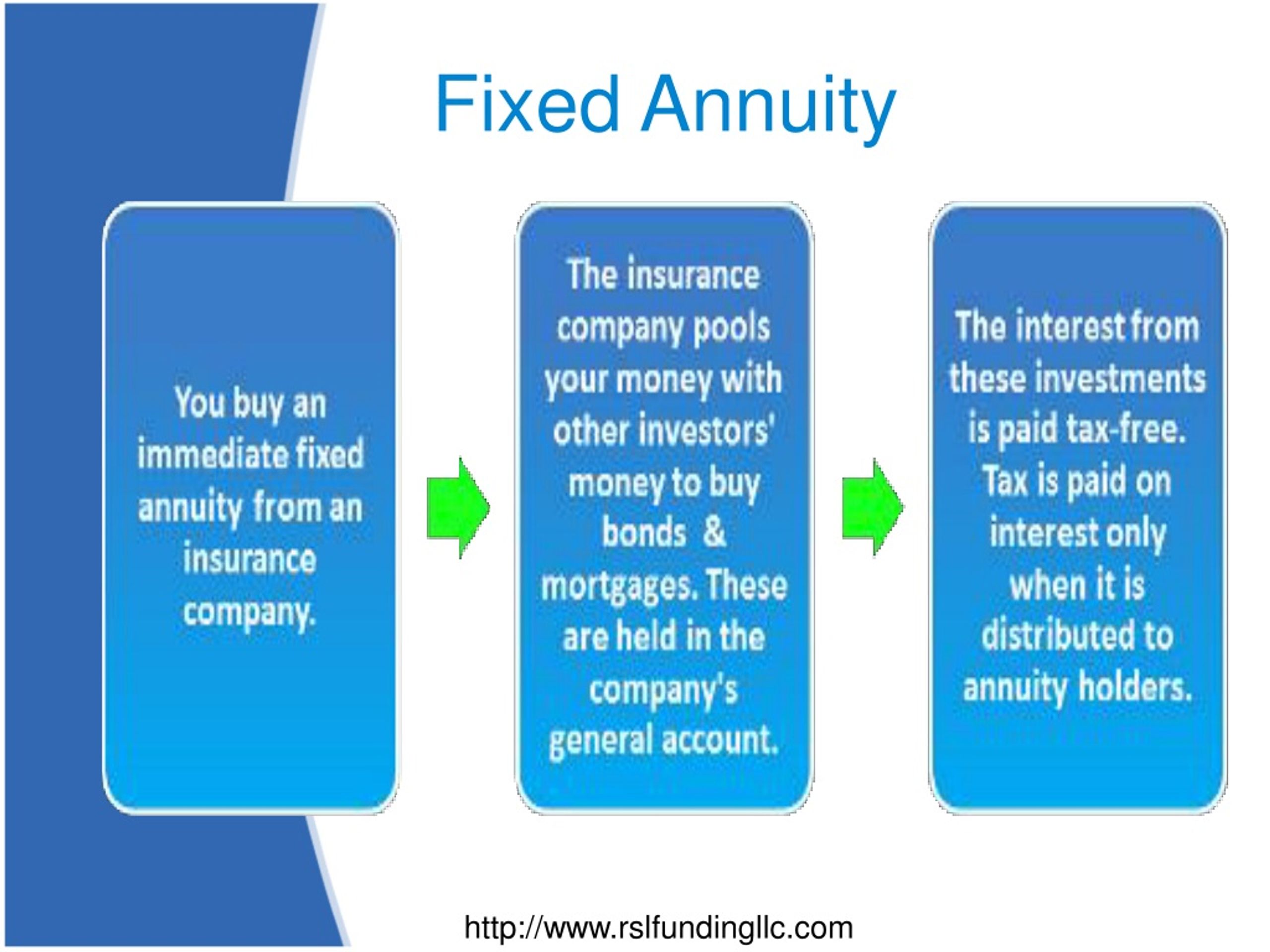

What Is a Fixed Annuity & How Does It Work?

Which of these is considered to. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Lisa has recently bought a. The taxable portion of each annuity payment is calculated using.

Fixed Annuity What are Fixed Annuities & How Do They Work?

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The taxable portion of each annuity payment is calculated using. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. Lisa has recently bought a. Study with quizlet and memorize flashcards containing terms.

Lisa Has Recently Bought A.

The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. Which of these is considered to. During periods of inflation, annuitants will experience a decrease in purchasing power of their payments. The taxable portion of each annuity payment is calculated using.

A Fixed Annuity Provides A Predetermined, Regular Payment For The Duration Of The Annuitant’s Life (.

A fixed annuity is a type of financial product that pays a guaranteed amount of money over a set period of time or for the lifetime of. Study with quizlet and memorize flashcards containing terms like 1. The disadvantage of owning a fixed annuity is that during periods of inflation, annuitants will experience a decrease in purchasing power of. The disadvantage of owning a fixed annuity, such as lisa's, is that during periods of inflation, she will experience a decrease in the purchasing.