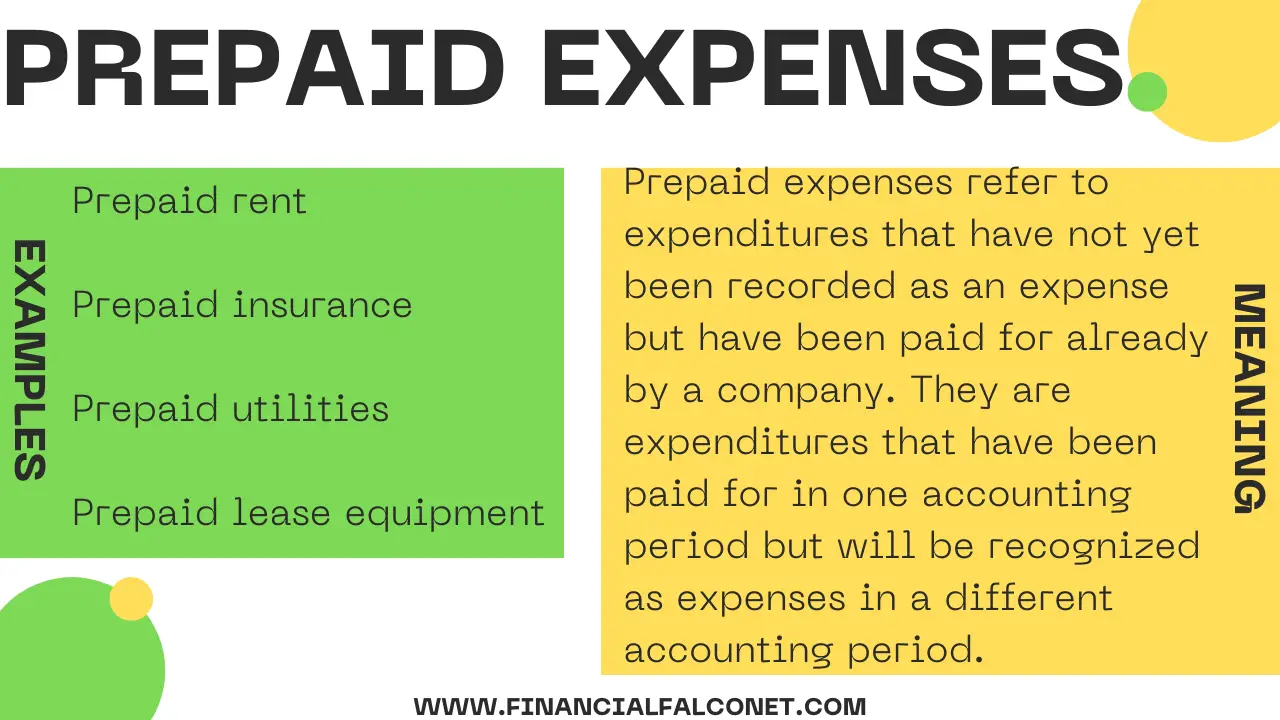

Prepaid Expenses Appear In What Section Of The Balance Sheet - Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. As the benefits of the expenses are. Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet.

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Learn how to treat prepaid.

Prepaid Expenses Appear in the Section of the Balance Sheet

Learn how to treat prepaid. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current assets section of.

Prepaid Expenses on the Balance Sheet Quant RL

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses are expenses that are paid in advance and recorded as current assets on.

Is Prepaid Expense a Liability Quant RL

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Learn how.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. As the benefits of the expenses are. Learn how.

Balance sheet example track assets and liabilities

Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn how.

Prepaid Expenses Appear Where On The Balance Sheet LiveWell

Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. As the benefits of.

Help, cant balance sheet, see prepaid insurance and accumulated

As the benefits of the expenses are. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. As the benefits of the expenses are. Learn how.

Prepaid Expenses Appear in the Section of the Balance Sheet

As the benefits of the expenses are. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Learn how to treat prepaid. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially.

Understanding Prepaid Expenses on the Balance Sheet

As the benefits of the expenses are. Learn how to treat prepaid. Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The “prepaid expenses” line item is recorded in the current assets section of.

As The Benefits Of The Expenses Are.

Prepaid expenses are expenses that are paid in advance and recorded as current assets on the balance sheet. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Learn how to treat prepaid. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.