Recent Leveraged Buyouts - In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The transaction will be one the major leveraged buyouts in recent years. The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed.

The transaction will be one the major leveraged buyouts in recent years. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed.

A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The merger is expected to close at the end of 2025. The transaction will be one the major leveraged buyouts in recent years.

The Ultimate Guide to Leveraged Buyouts (LBOs) + Examples

The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The transaction will be one the major leveraged buyouts in.

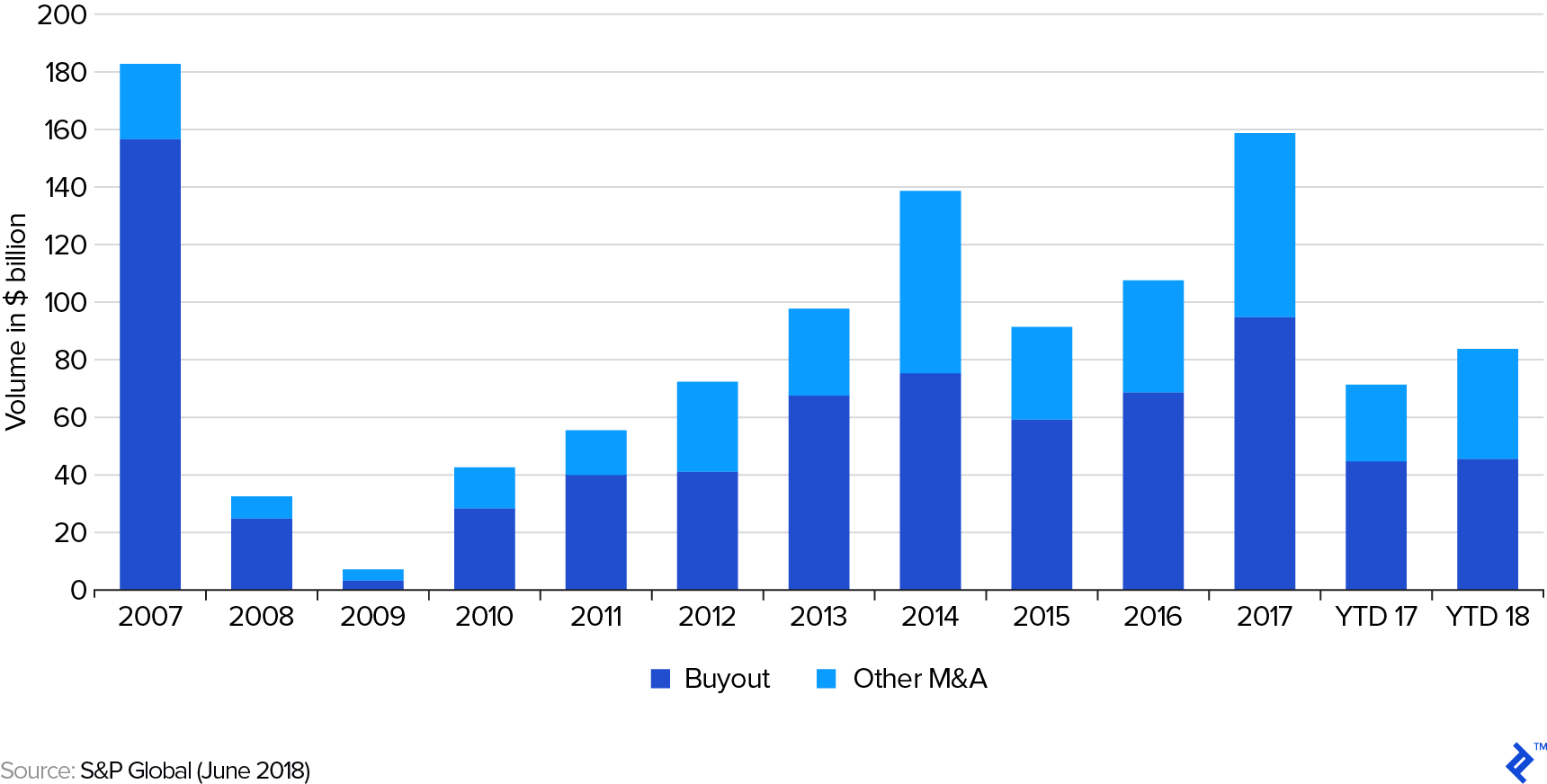

Chart What Is a Leveraged Buyout? Statista

A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. The merger is expected to close at the end of 2025. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The transaction will be one the major leveraged buyouts in.

What Are the Value Drivers of a Leveraged Buyout? Toptal®

The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The transaction will be one the major leveraged buyouts in.

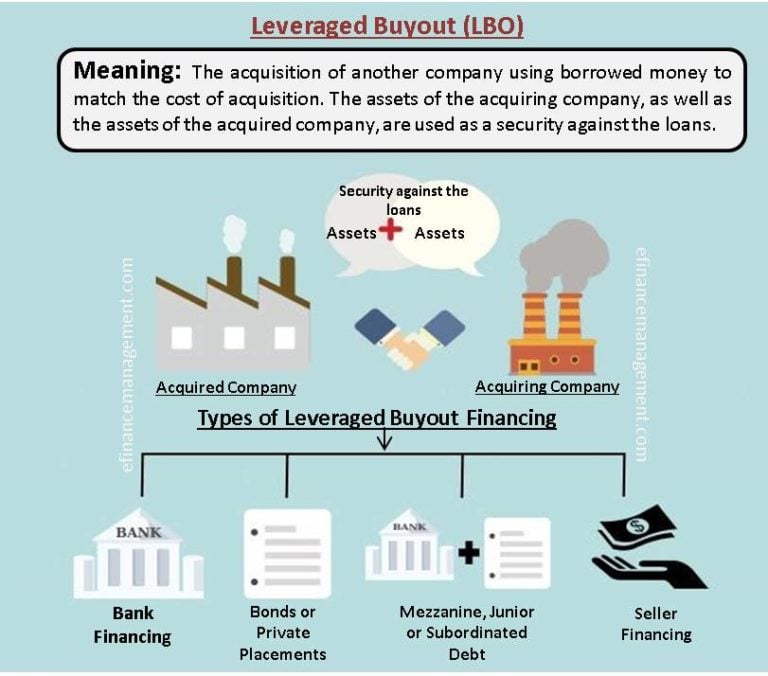

Leveraged Buyout (LBO) Definition, How It Works, and Examples

The transaction will be one the major leveraged buyouts in recent years. The merger is expected to close at the end of 2025. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts.

Table 1 from The Evolution of Leveraged Buyouts and Recent Overheated

The transaction will be one the major leveraged buyouts in recent years. The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money.

PPT MERGERS AND ACQUISITIONS PowerPoint Presentation ID35967

In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. The merger is expected to close at the end of 2025. The transaction will be one the major leveraged buyouts in.

Leveraged Buyout Meaning, Analysis, Example

The transaction will be one the major leveraged buyouts in recent years. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. The merger is expected to close at the end.

Leveraged Buyout Model Leveraged Buyout Model with Structures

A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. The merger is expected to close at the end of 2025. The transaction will be one the major leveraged buyouts in recent years. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money.

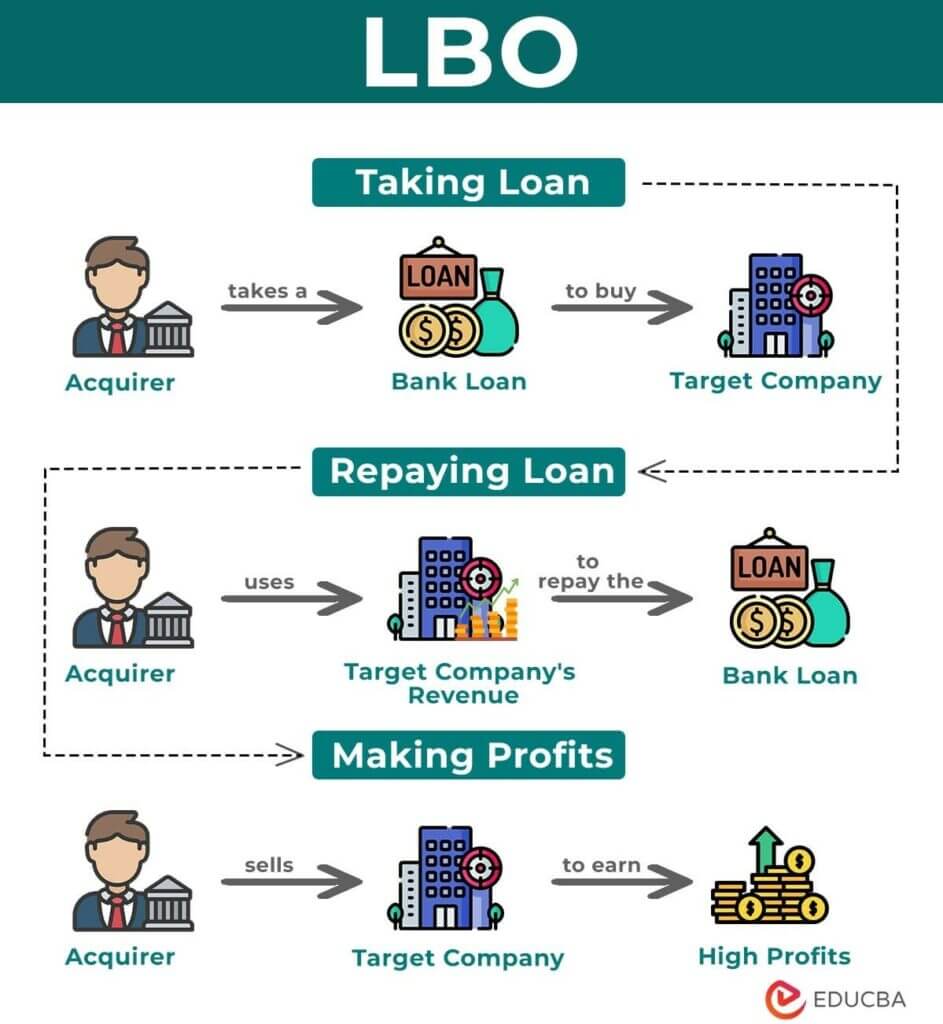

What is Leveraged Buyout (LBO) How it Works (with Examples)

The merger is expected to close at the end of 2025. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. The transaction will be one the major leveraged buyouts in.

What is Leveraged Buyout(LBO)? Types, How it Works & Examples

The merger is expected to close at the end of 2025. A leveraged buyout (lbo) is a financial strategy where one company acquires another using substantial amounts of borrowed. In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The transaction will be one the major leveraged buyouts in.

A Leveraged Buyout (Lbo) Is A Financial Strategy Where One Company Acquires Another Using Substantial Amounts Of Borrowed.

In recent weeks, a swath of deals shows how far the pendulum is swinging, with equity outweighing borrowed money in multiple. The merger is expected to close at the end of 2025. The transaction will be one the major leveraged buyouts in recent years.

:max_bytes(150000):strip_icc()/Leveraged-Buyout-V2-e108bff825ab4892afd2f22c7aa7b088.jpg)