State Of Kansas Tax Warrants - In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. If any tax due to the state of. In kansas, tax warrants are issued based on criteria outlined in state statutes. What are my payment options? Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. Kdor seizes assets in execution of johnson county tax warrants;. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. The kansas department of revenue (kdor) can.

If any tax due to the state of. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. The kansas department of revenue (kdor) can. What are my payment options? In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Kdor seizes assets in execution of douglas county tax warrants; In kansas, tax warrants are issued based on criteria outlined in state statutes. Kdor seizes assets in execution of johnson county tax warrants;. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a.

In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Kdor seizes assets in execution of douglas county tax warrants; (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. If any tax due to the state of. Kdor seizes assets in execution of johnson county tax warrants;. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. What are my payment options? In kansas, tax warrants are issued based on criteria outlined in state statutes.

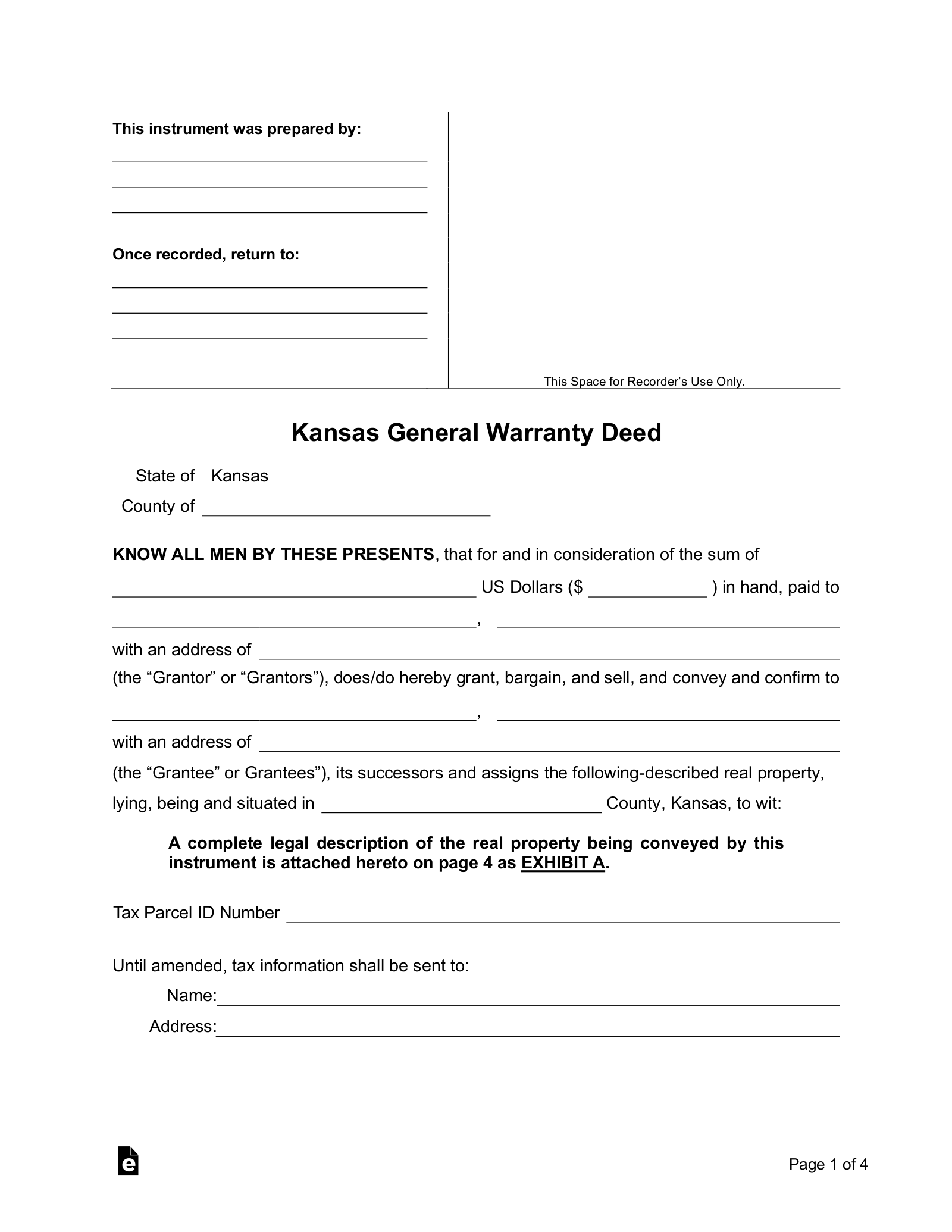

Free Kansas General Warranty Deed Form PDF Word eForms

The kansas department of revenue (kdor) can. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. Kdor seizes assets in execution of johnson county tax warrants;. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. If any tax due to.

Kansas Department of Revenue KW100 Kansas withholding Tax Guide

Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Kdor seizes assets in execution of johnson county tax warrants;. The kansas department of revenue (kdor) can. Kdor seizes assets in execution of douglas county tax warrants; If any tax due to the state of.

Kansas Department of Revenue KW100 Kansas withholding Tax Guide

Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Kdor seizes assets in execution of douglas county tax warrants; Kdor seizes assets in execution of johnson county tax warrants;..

How To Check For Warrants In Wichita, Kansas? YouTube

In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant.

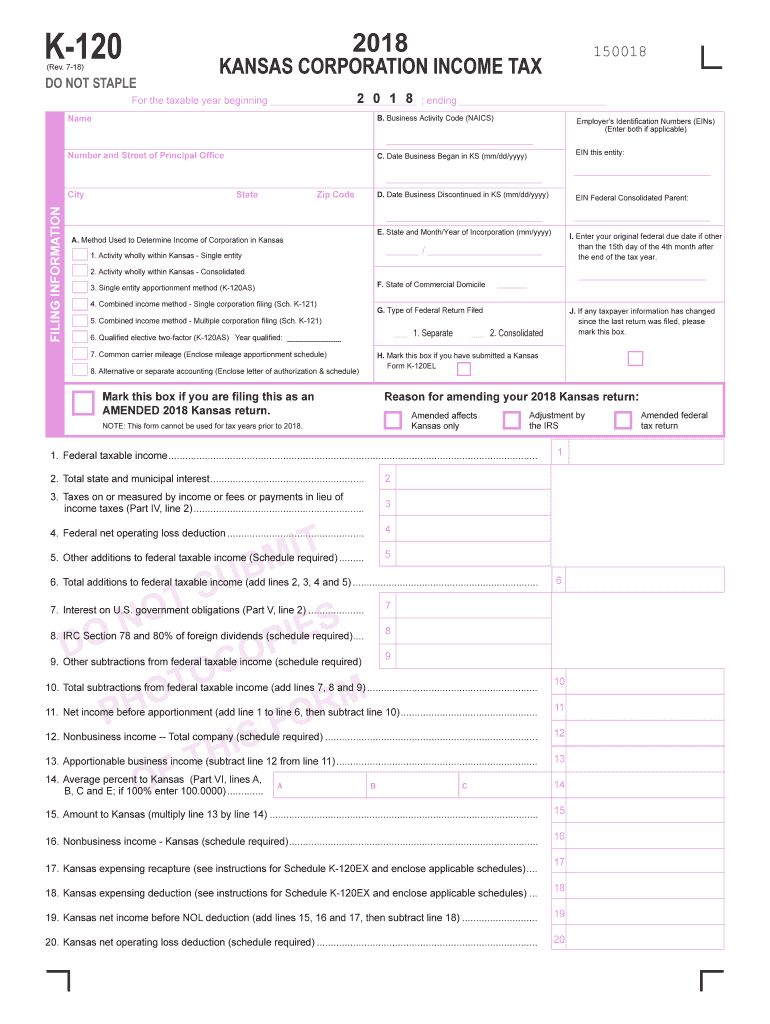

K 120s Instructions 20182025 Form Fill Out and Sign Printable PDF

The kansas department of revenue (kdor) can. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. What are my payment options? Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or..

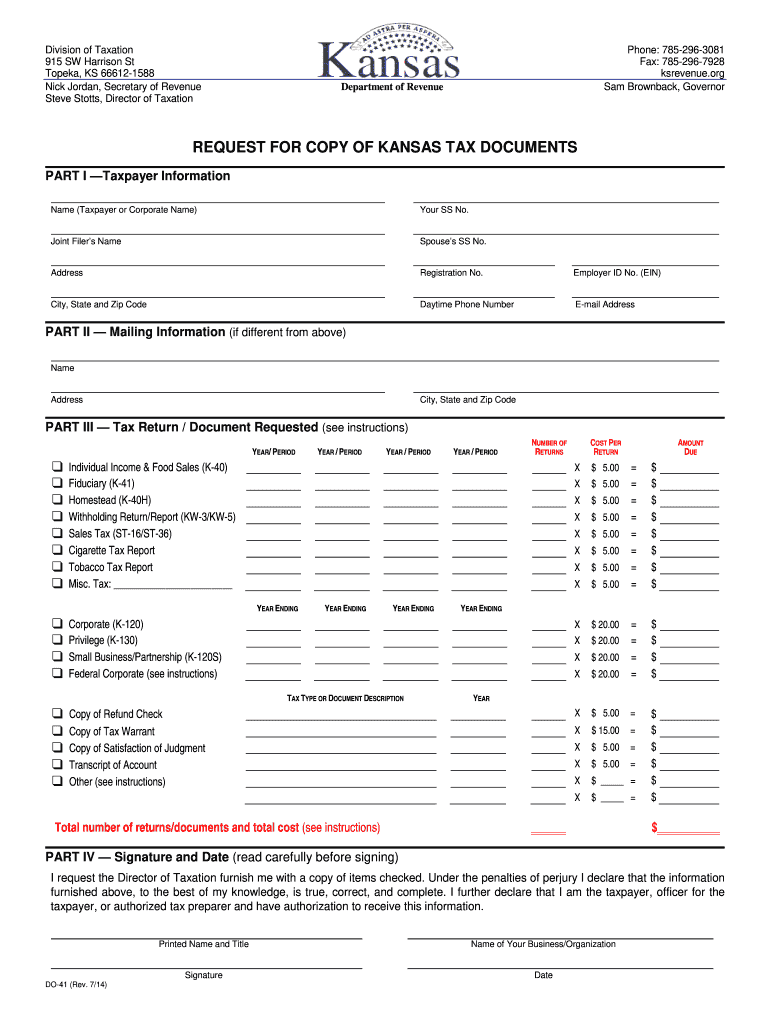

DO 41 Request for Copy of Kansas Tax Documents or Access Rev 7 14 Copy

What are my payment options? If any tax due to the state of. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. If you have a state of kansas tax warrant that means the kansas department of.

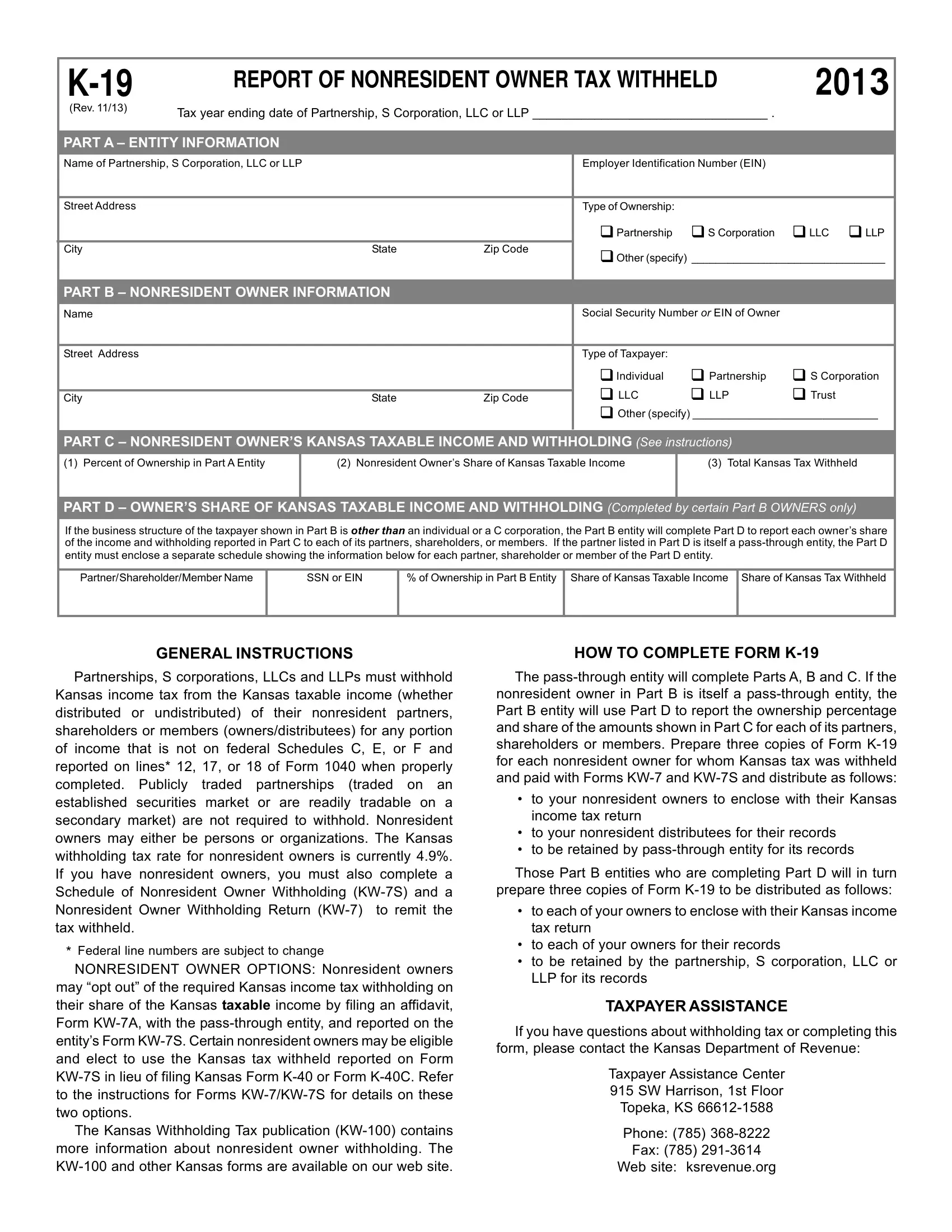

Kansas Form K 19 ≡ Fill Out Printable PDF Forms Online

If any tax due to the state of. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. Kdor seizes assets in execution of douglas county tax warrants; Kdor seizes assets in execution of johnson county tax warrants;. Tax warrants are filed by the kansas department.

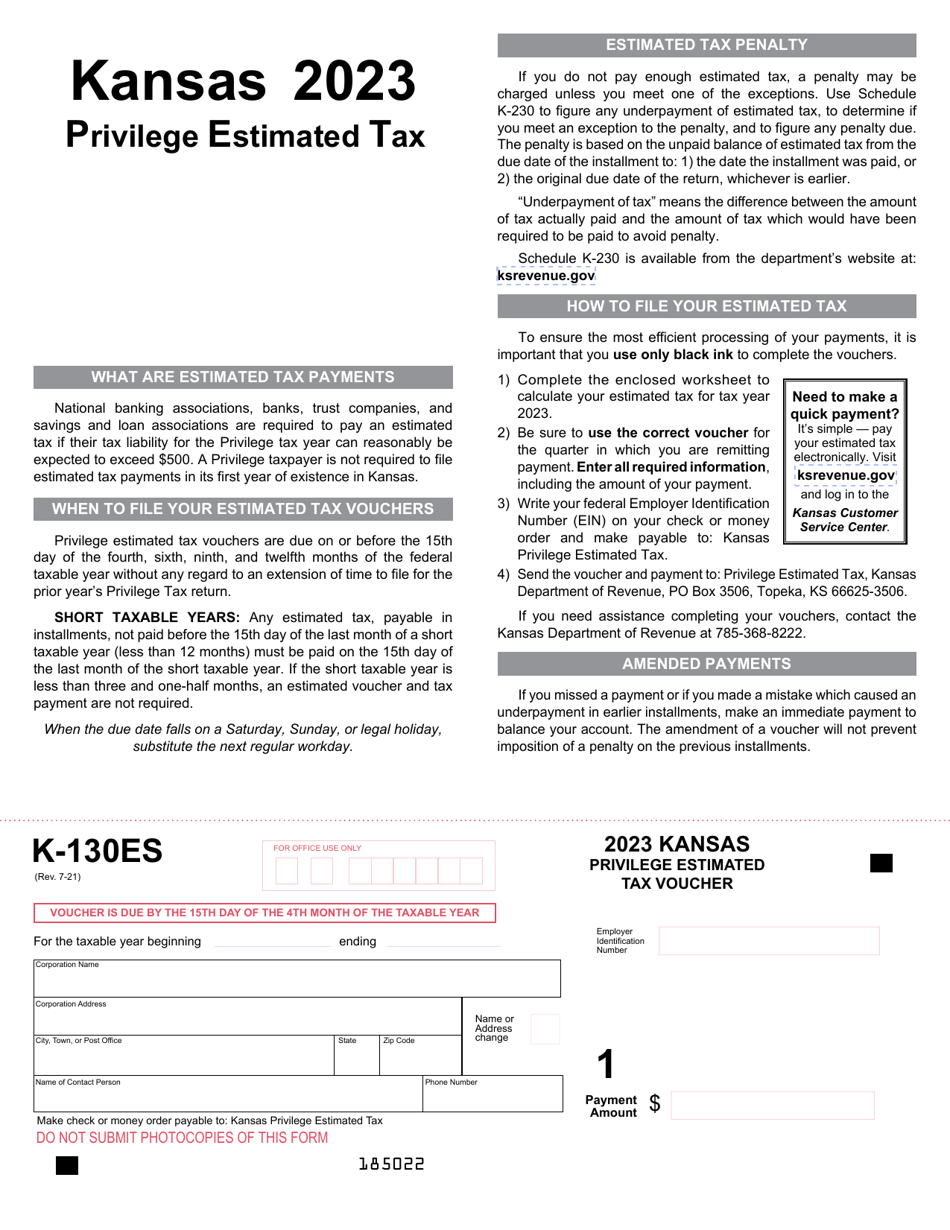

Form K130ES 2023 Fill Out, Sign Online and Download Fillable PDF

Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. The kansas department of revenue (kdor) can. What are my payment options? If any tax due to the state of. Kdor seizes assets in execution of douglas county tax warrants;

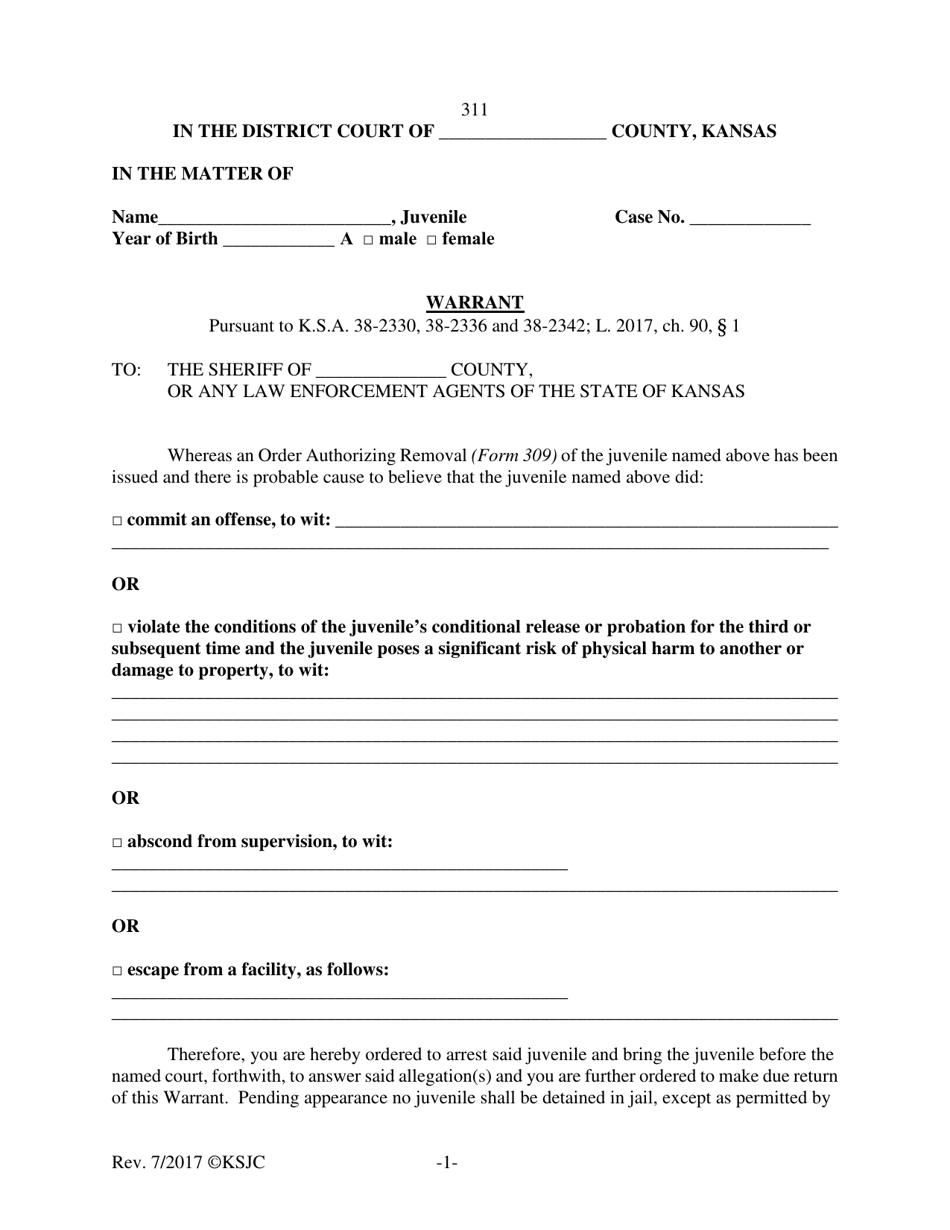

Form 311 Fill Out, Sign Online and Download Printable PDF, Kansas

(a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. If any tax due to the state of. The kansas department of revenue (kdor) can. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or.

Sample Kansas Warranty Deed Template » Forms 2025

Kdor seizes assets in execution of douglas county tax warrants; Kdor seizes assets in execution of johnson county tax warrants;. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. If any tax due to the state of. Tax warrants are filed by the kansas department.

(A) Whenever A Taxpayer Liable To Pay Any Tax, Penalty Or Interest Assessed Pursuant To K.s.a.

The kansas department of revenue (kdor) can. If any tax due to the state of. In some cases where the pay plan exceeds six months, a tax warrant will be filed with the district court to protect the state's. Kdor seizes assets in execution of douglas county tax warrants;

If You Have A State Of Kansas Tax Warrant That Means The Kansas Department Of Revenue (Kdor) Believes You Owe Delinquent Taxes.

In kansas, tax warrants are issued based on criteria outlined in state statutes. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Whenever any taxpayer liable to pay any sales or compensating tax, refuses or neglects to pay the tax, the amount, including any interest or. Kdor seizes assets in execution of johnson county tax warrants;.