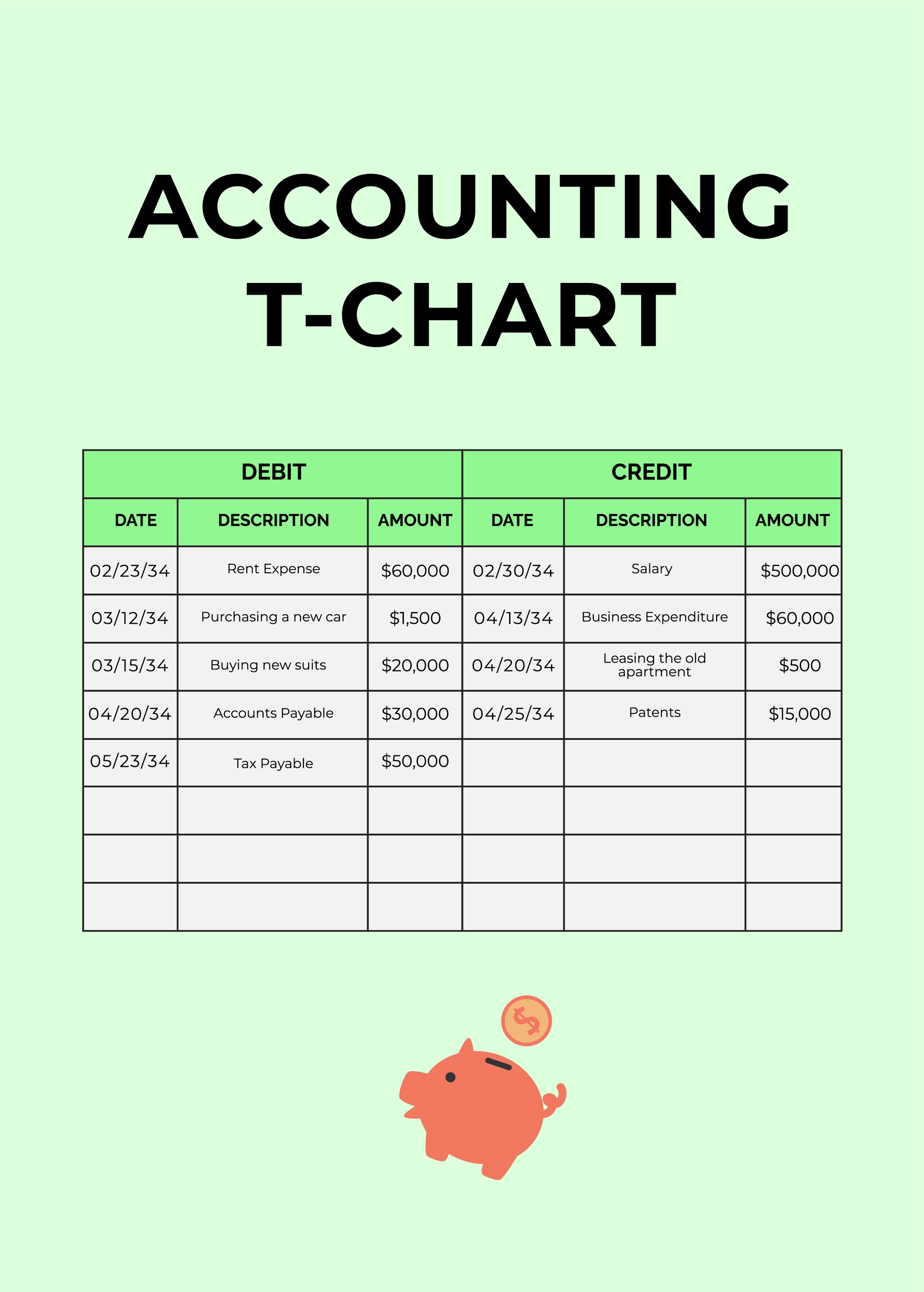

T Account Balance Sheet - Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. T accounts help you total the debits and credits for each of these accounts. The final balances are then used to calculate your net profit or loss.

T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. The final balances are then used to calculate your net profit or loss.

The final balances are then used to calculate your net profit or loss. T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

38 Free Balance Sheet Templates & Examples Template Lab

T accounts help you total the debits and credits for each of these accounts. The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

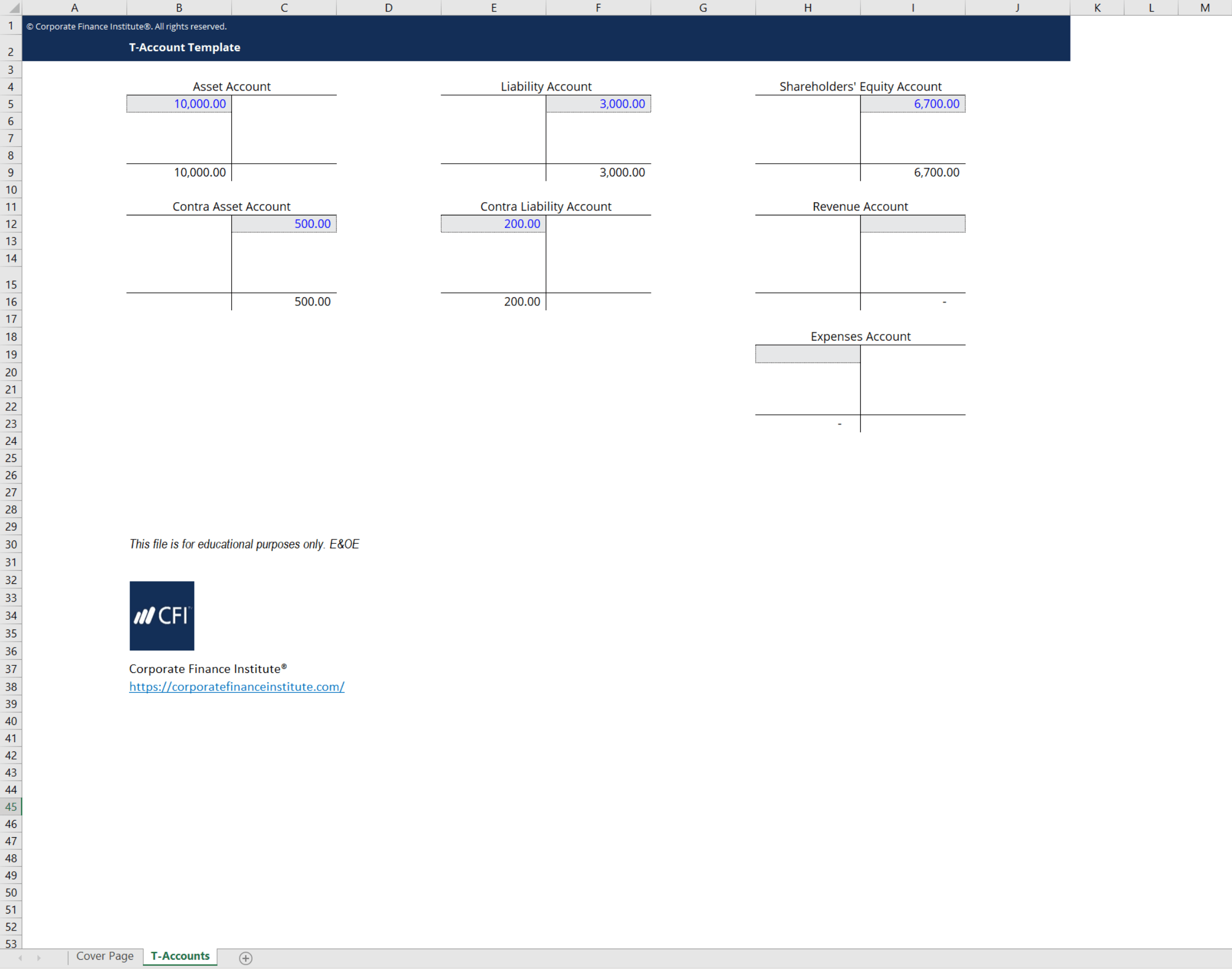

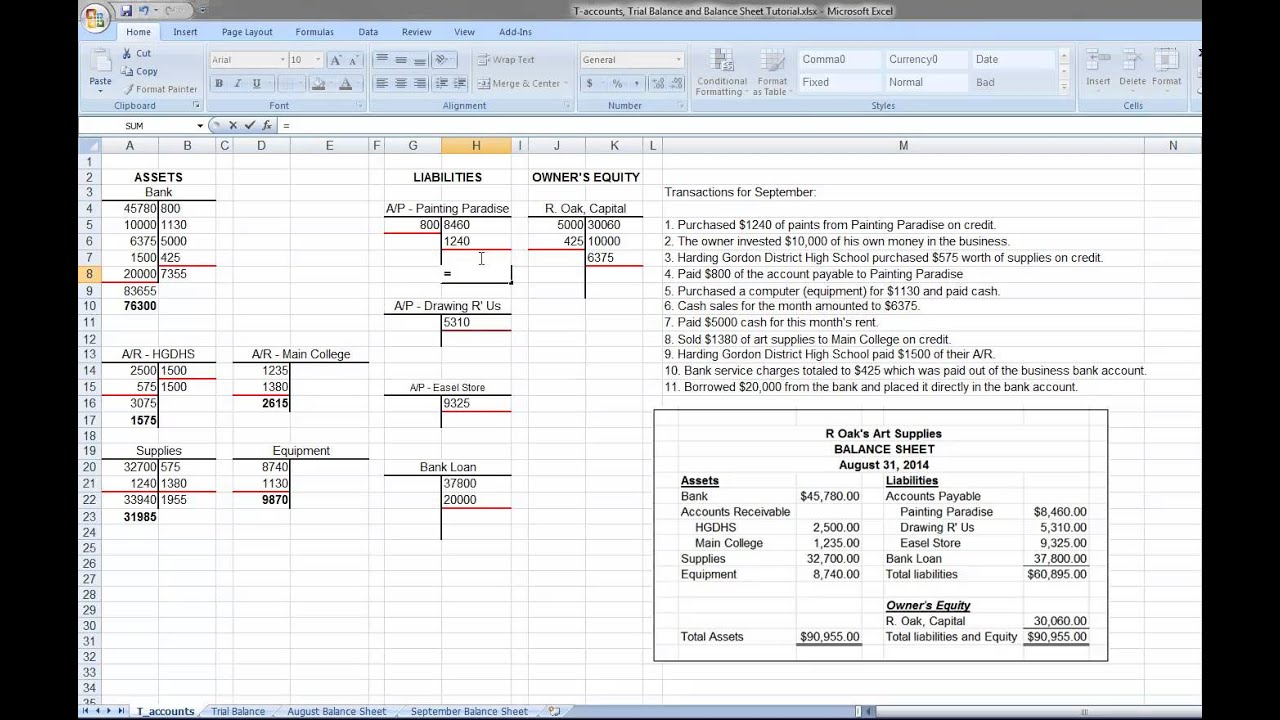

T Accounts Excel Template

T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. The final balances are then used to calculate your net profit or loss.

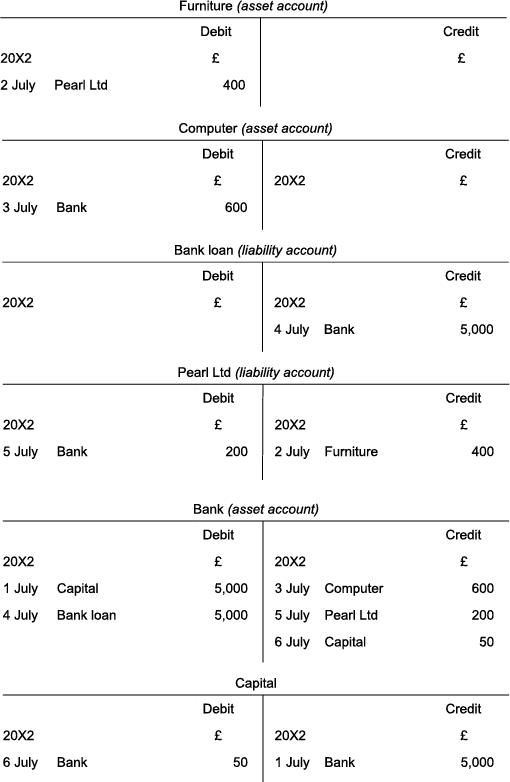

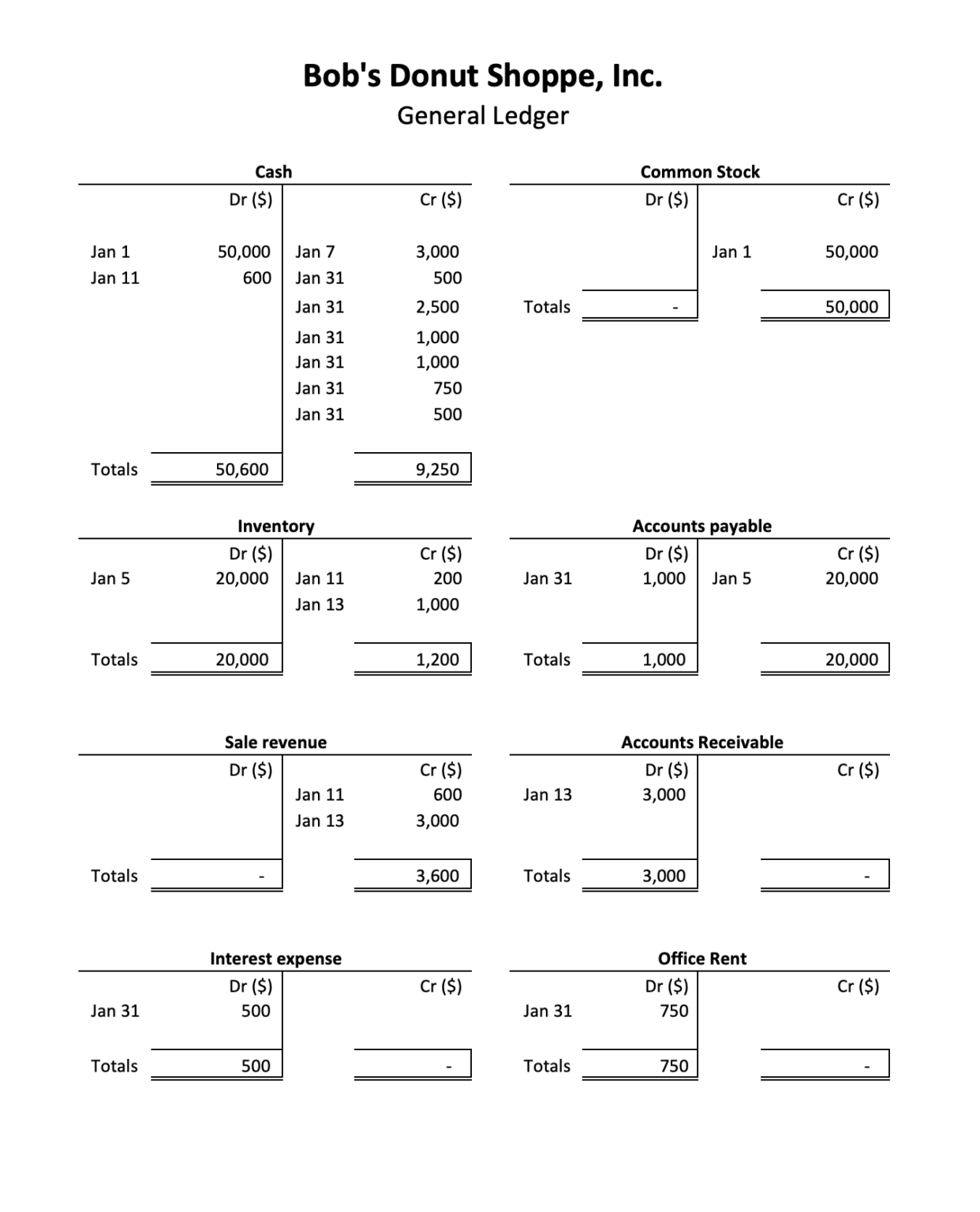

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. The final balances are then used to calculate your net profit or loss.

Balance Sheet T Account Format at Eileen Towner blog

The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. T accounts help you total the debits and credits for each of these accounts.

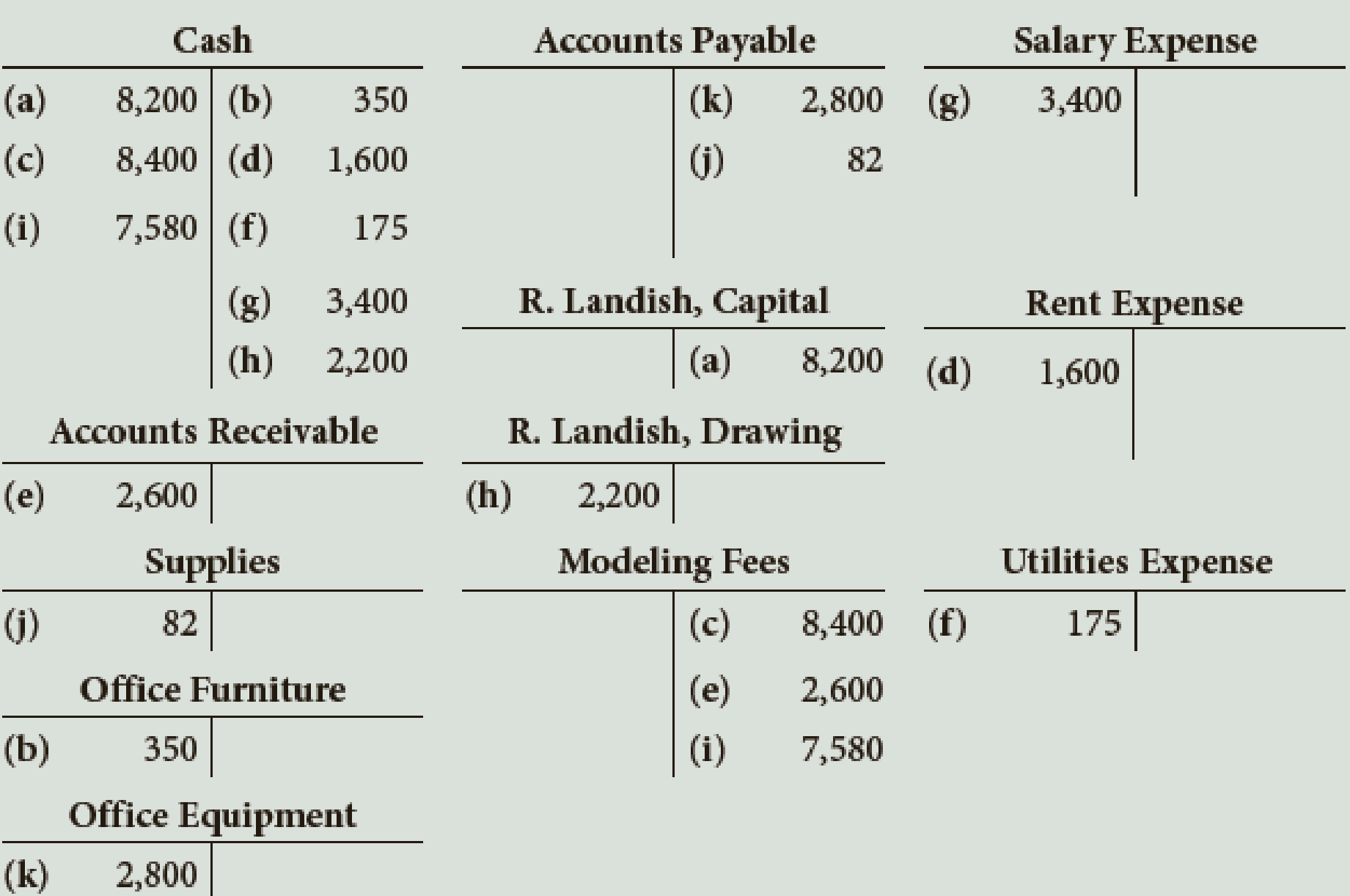

T Account Examples Step by Step Guide to TAccounts with Examples

The final balances are then used to calculate your net profit or loss. T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

Week 4 Preparing the trial balance and the balance sheet View as

The final balances are then used to calculate your net profit or loss. T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

T Account Template

T accounts help you total the debits and credits for each of these accounts. The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

T accounts, Trial Balance and Balance Sheet Tutorial YouTube

The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. T accounts help you total the debits and credits for each of these accounts.

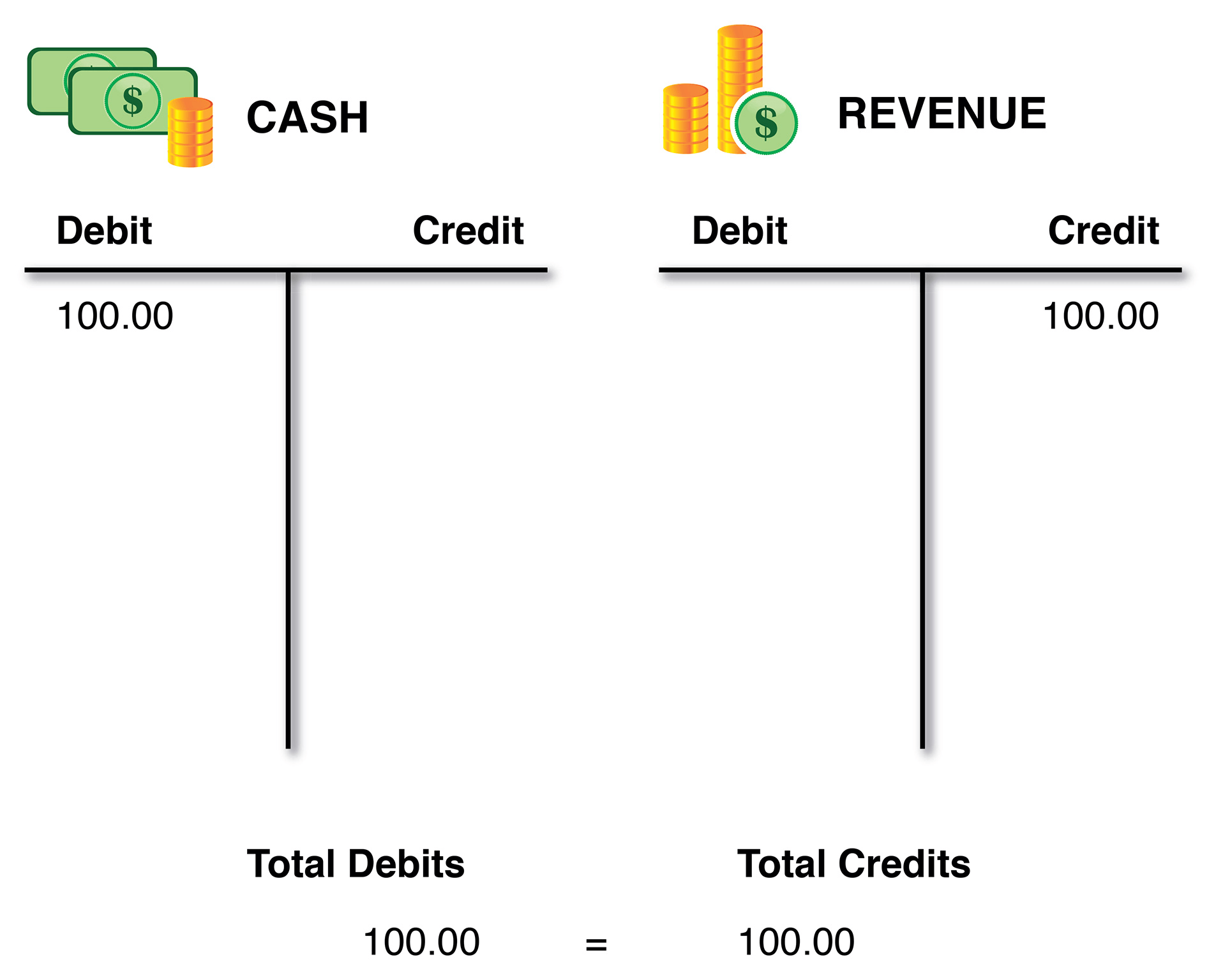

What are TAccounts Example, Debits and Credits of TAccounts, Rules

T accounts help you total the debits and credits for each of these accounts. The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

During the first month of operations, Landish Modeling Agency recorded

The final balances are then used to calculate your net profit or loss. T accounts help you total the debits and credits for each of these accounts. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.

T Accounts Help You Total The Debits And Credits For Each Of These Accounts.

The final balances are then used to calculate your net profit or loss. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc.