Trailer Depreciation Life - Find out the factors that affect. The table specifies asset lives for property subject. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence.

The table specifies asset lives for property subject. Find out the factors that affect. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. Determining the depreciable life of a trailer involves assessing its expected useful life in business operations.

The table specifies asset lives for property subject. Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Find out the factors that affect. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction.

How Depreciation Affects Travel Trailer Value Travel trailer, New

The table specifies asset lives for property subject. Find out the factors that affect. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Learn how to determine the depreciable life of.

Guide On RV Depreciation in 2020 Rv types, Rv, Rv trailers

Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Find out the factors that affect. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period..

RV Depreciation // How Much Do Campers Really Depreciate?

Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Find out the.

RV Depreciation What you Need to Know? Travel trailer floor plans

Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period..

Travel Trailer Depreciation What's My Travel Trailer Worth? RVBlogger

Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. The table specifies asset lives for property subject. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Find out the factors that affect. Determining the depreciable life of.

an rv parked in front of a green background with the words average

Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Find out the factors that affect. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence..

RV Depreciation Rates Per Year + Method To Calculate 2023 Rv, Class a

Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. The table specifies asset lives for property subject. Determining the depreciable life of a trailer involves assessing its expected useful life in business operations. Learn how to determine the depreciable life of a trailer that is rented long.

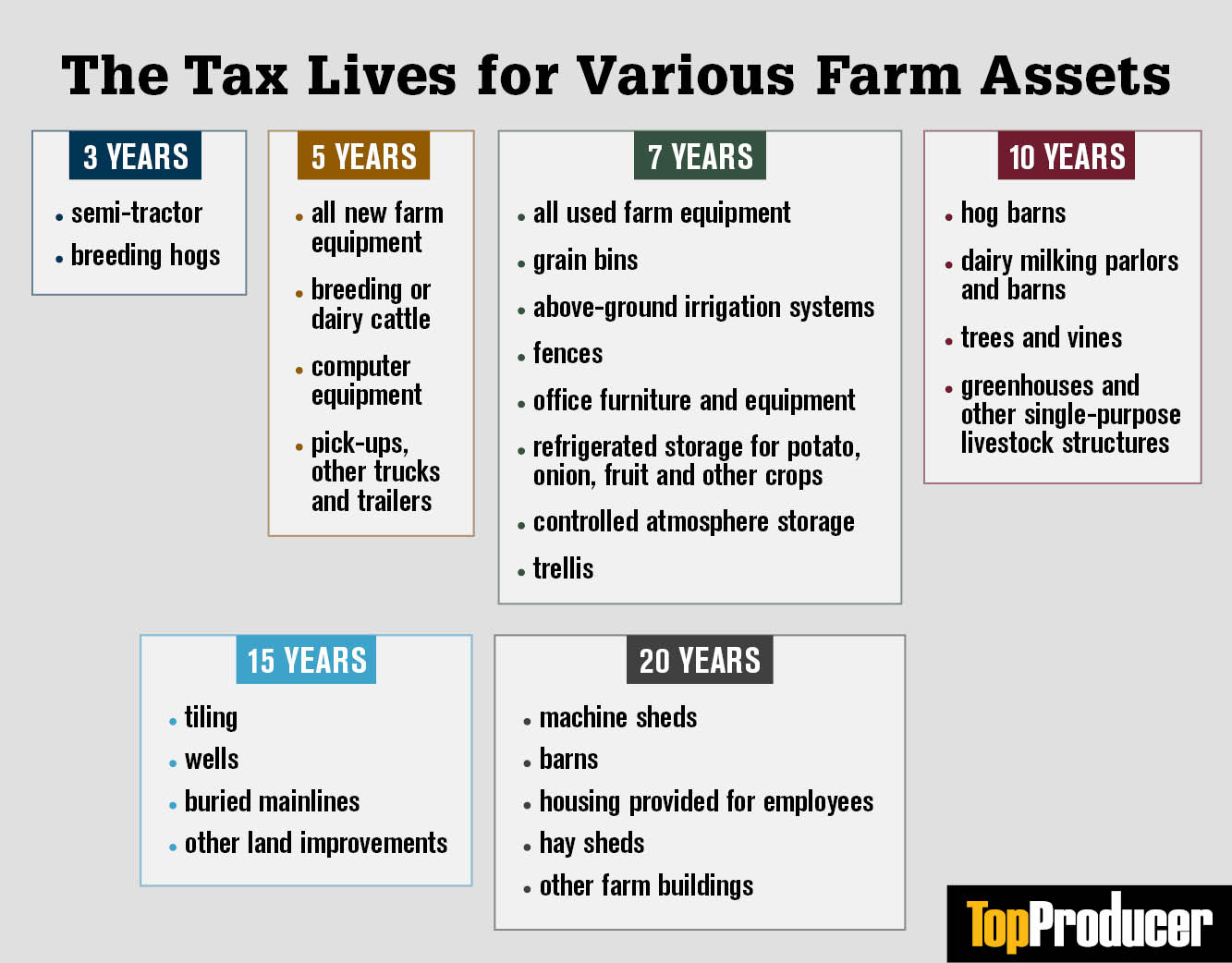

Farm Vehicle Depreciation Life at Christy Sample blog

The table specifies asset lives for property subject. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to depreciate a tractor trailer over 5 years as a business asset.

How Depreciation Affects Travel Trailer Value Travel trailer, New

Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction. The table specifies asset lives for property subject. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Find out the factors that affect. Determining the depreciable life of.

How Depreciation Affects Travel Trailer Value Travel trailer, New

Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. Learn how to depreciate a tractor trailer over 5 years as a business asset and avoid taking bonus depreciation or 179 deduction..

Determining The Depreciable Life Of A Trailer Involves Assessing Its Expected Useful Life In Business Operations.

Find out the factors that affect. Depreciation is representational expense that a company records to show the use for a trailer during the accounting period. The table specifies asset lives for property subject. Learn how to determine the depreciable life of a trailer that is rented long term as a primary residence.