What Are Calendar Spreads - Calendar spreads combine buying and selling two contracts with different expiration dates. What is a calendar spread? With calendar spreads, time decay is. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread is an options or futures strategy where an investor simultaneously enters long.

With calendar spreads, time decay is. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. Calendar spreads combine buying and selling two contracts with different expiration dates.

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. With calendar spreads, time decay is. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long.

Long Calendar Spreads for Beginner Options Traders projectfinance

What is a calendar spread? A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread is an options or futures strategy where an investor simultaneously enters long. Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread.

Calendar Spread Options Examples Mavra Sibella

A calendar spread is an options or futures strategy where an investor simultaneously enters long. What is a calendar spread? A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

With calendar spreads, time decay is. A calendar spread is an options or futures strategy where an investor simultaneously enters long. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread, also.

Long Calendar Spreads for Beginner Options Traders projectfinance

Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar.

Long Calendar Spreads for Beginner Options Traders projectfinance

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. With calendar spreads, time decay is. What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also known as a time spread, is an.

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. What is a calendar spread? In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade.

Calendar Spreads 101 Everything You Need To Know

What is a calendar spread? With calendar spreads, time decay is. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread.

Everything You Need to Know about Calendar Spreads

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. Calendar spreads combine buying and selling two contracts with different expiration dates. With calendar spreads, time decay is. A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also.

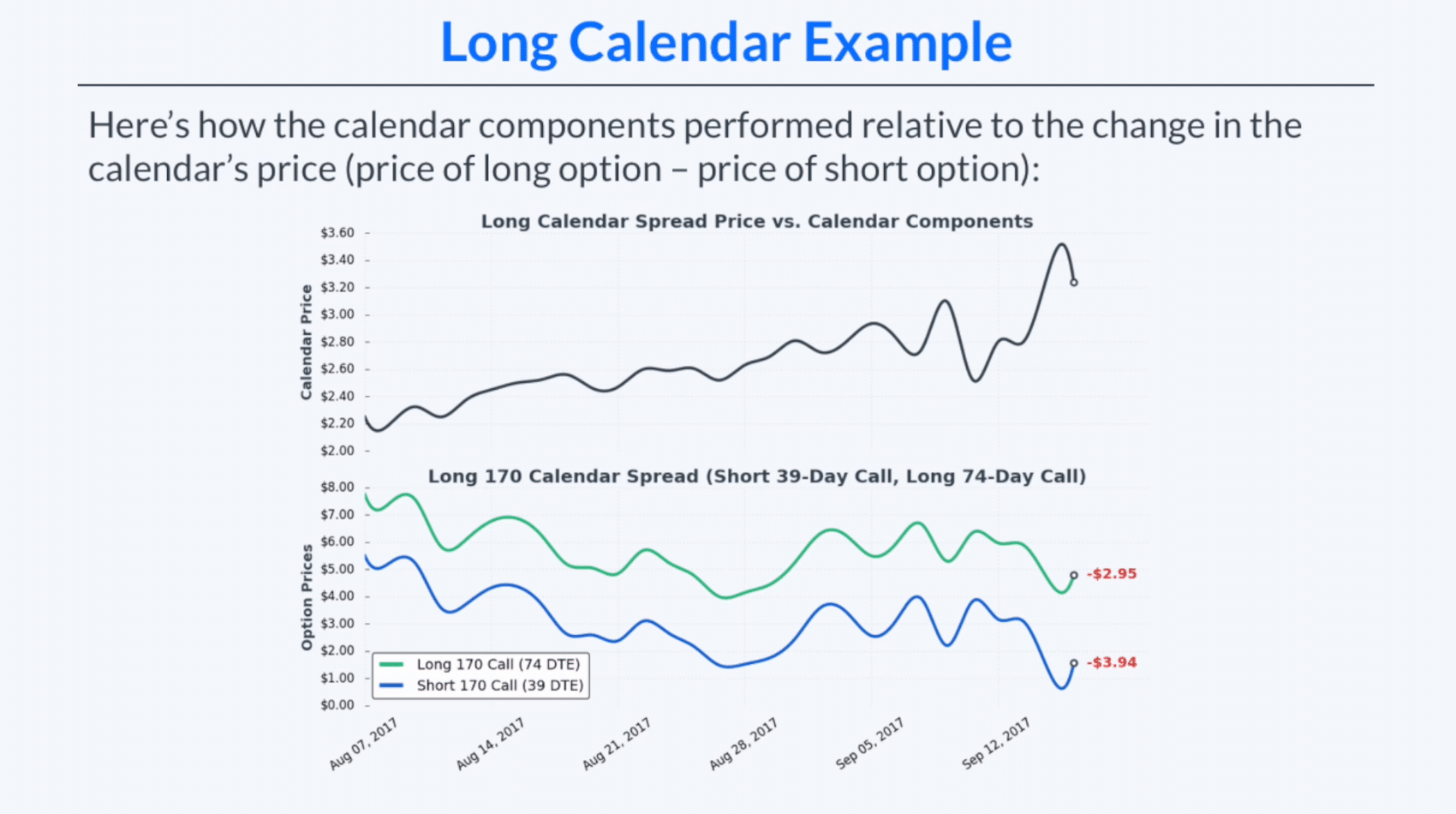

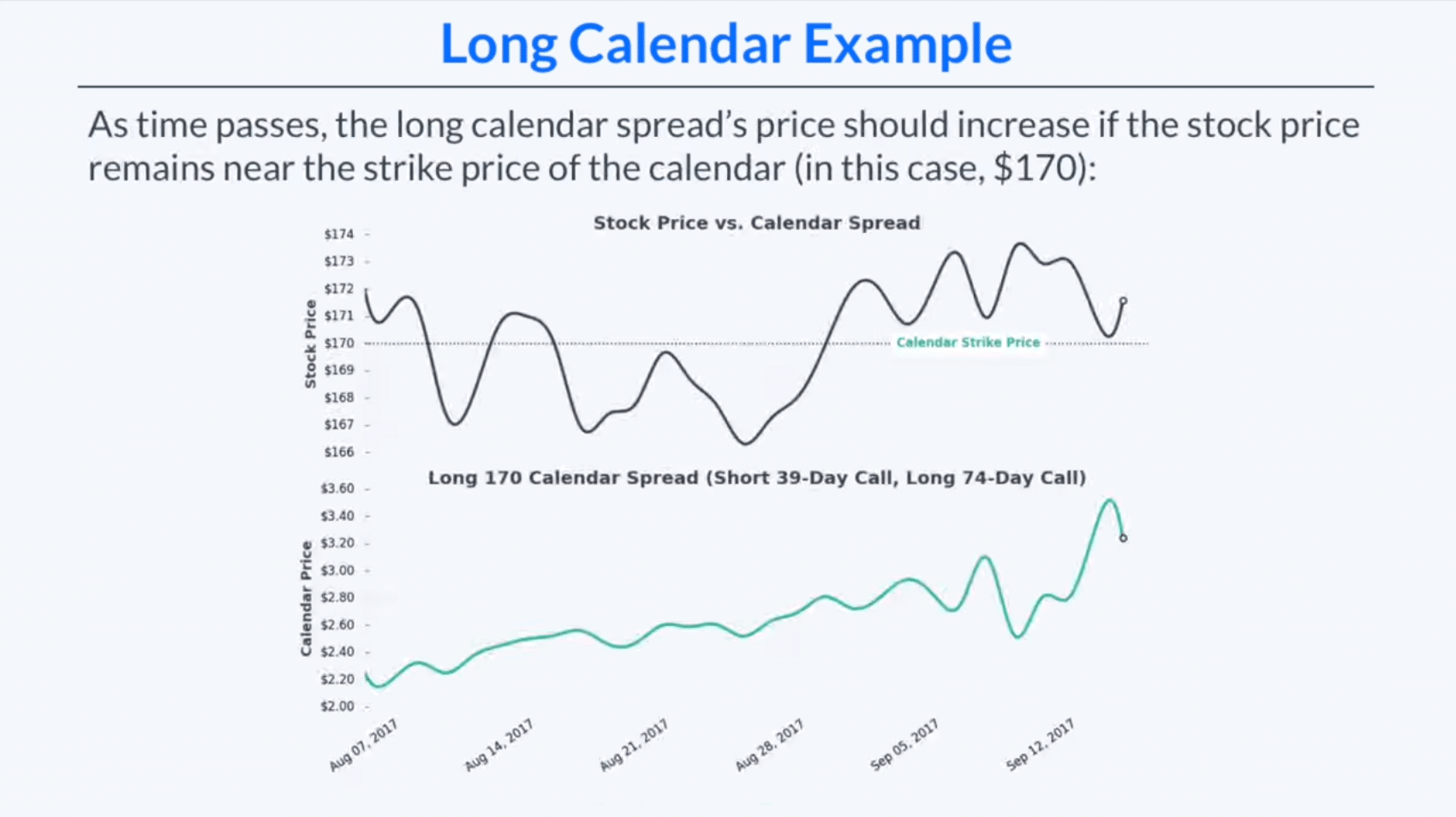

How Long Calendar Spreads Work (w/ Examples) Options Trading

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar.

Calendar Call Spread Option Strategy Heida Kristan

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. What is a calendar spread? In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread is an options or futures strategy.

Calendar Spreads Combine Buying And Selling Two Contracts With Different Expiration Dates.

What is a calendar spread? A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. With calendar spreads, time decay is. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures.