What Are Financial Warrants - Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the.

A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential.

Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the.

Warrants Illustration Explained Explanation View Financial Stock

A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such.

What is a Financial Warrant? A Guide to Exploring the Risks and Rewards

A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility.

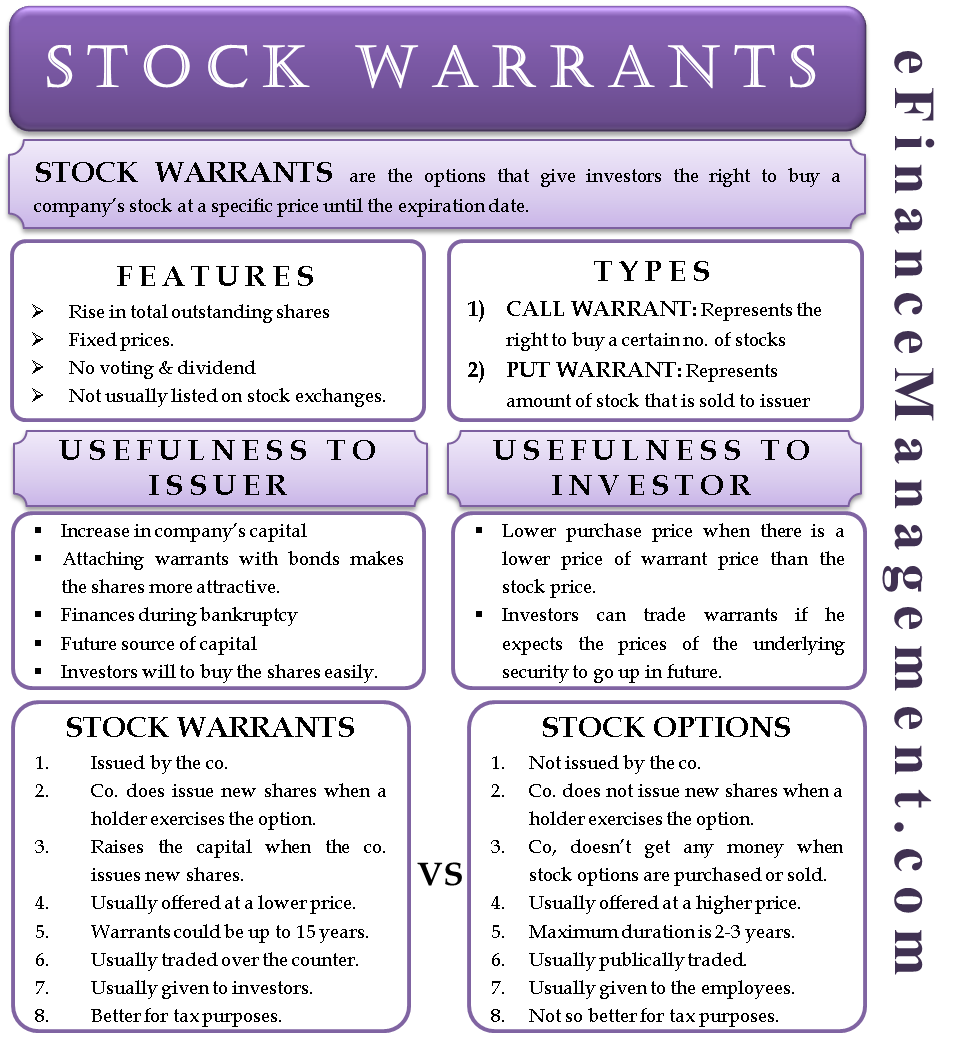

Stock Warrants Features, Types, Benefits, Stock Options And More

A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such.

Warrants What are they and how do they work? Dandy Law

Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price.

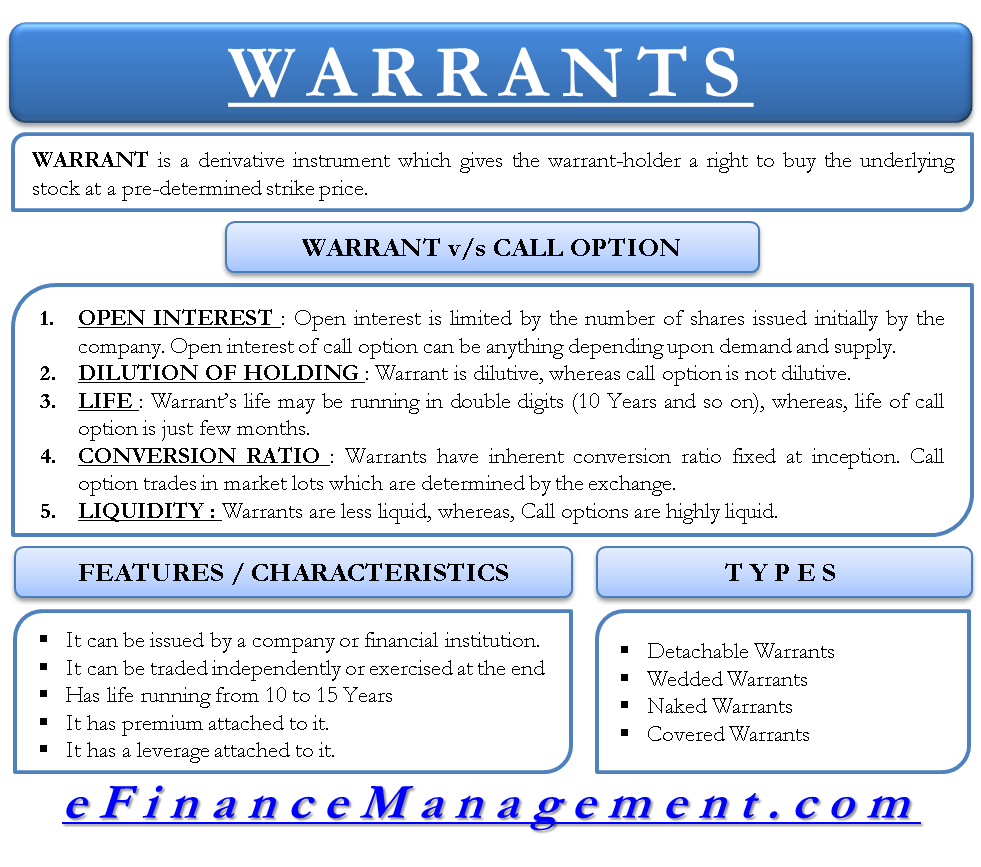

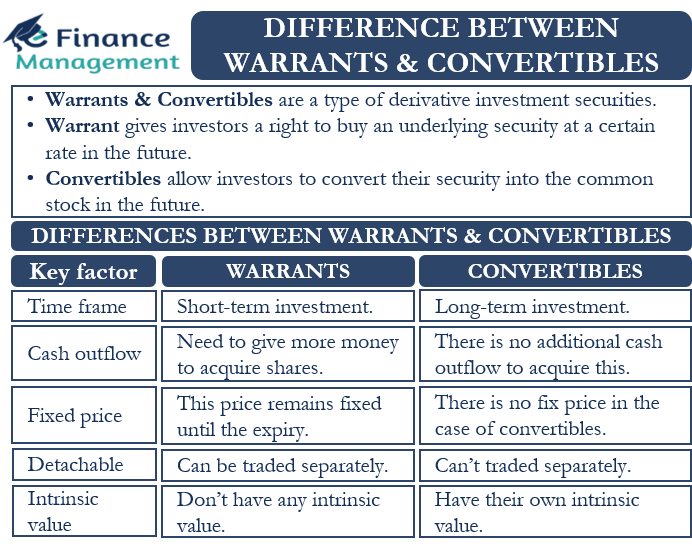

Warrant Define, Vs Options, Features Types eFinanceManagement

Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such.

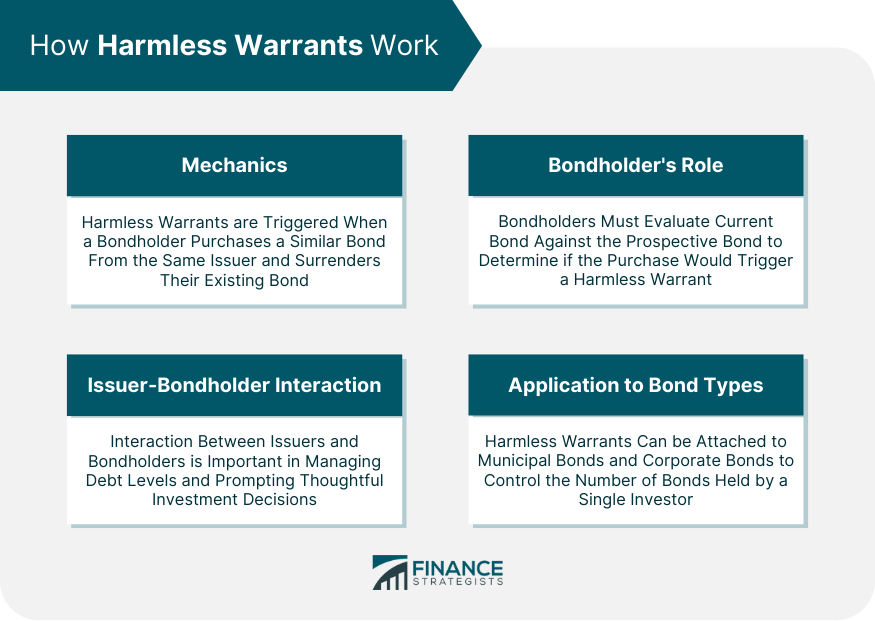

Harmless Warrants Definition, How It Works, and Effects

Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility.

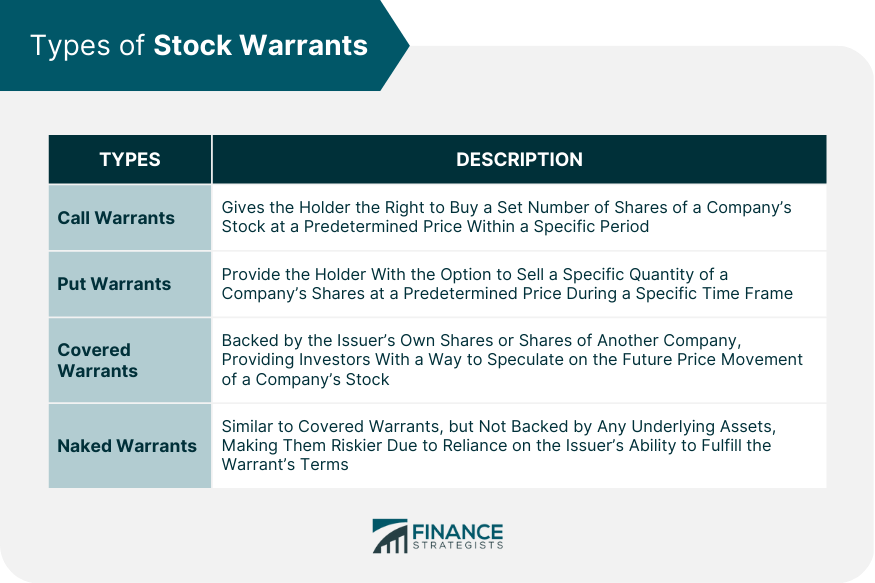

Stock Warrants Definition, How They Work, Types, Pros & Cons

Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price.

Derivatives Definition, Types Forwards, Futures, Options, Swaps, etc

Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such.

Characteristics and Role of warrants EBC Financial Group

A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such as shares,. Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility.

Warrants Free of Charge Creative Commons Financial 3 image

Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the. Warrants are derivative financial instruments that offer investors the opportunity to buy or sell an underlying asset (such.

Warrants Are Derivative Financial Instruments That Offer Investors The Opportunity To Buy Or Sell An Underlying Asset (Such As Shares,.

Warrants grant the holder the right to buy shares at a predetermined price before expiration, offering flexibility and potential. A warrant is a financial security that permits the holder to purchase the issuing company’s underlying shares at a fixed price called the.