What Fire Insurance And Liability Policies Are Available In California - Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

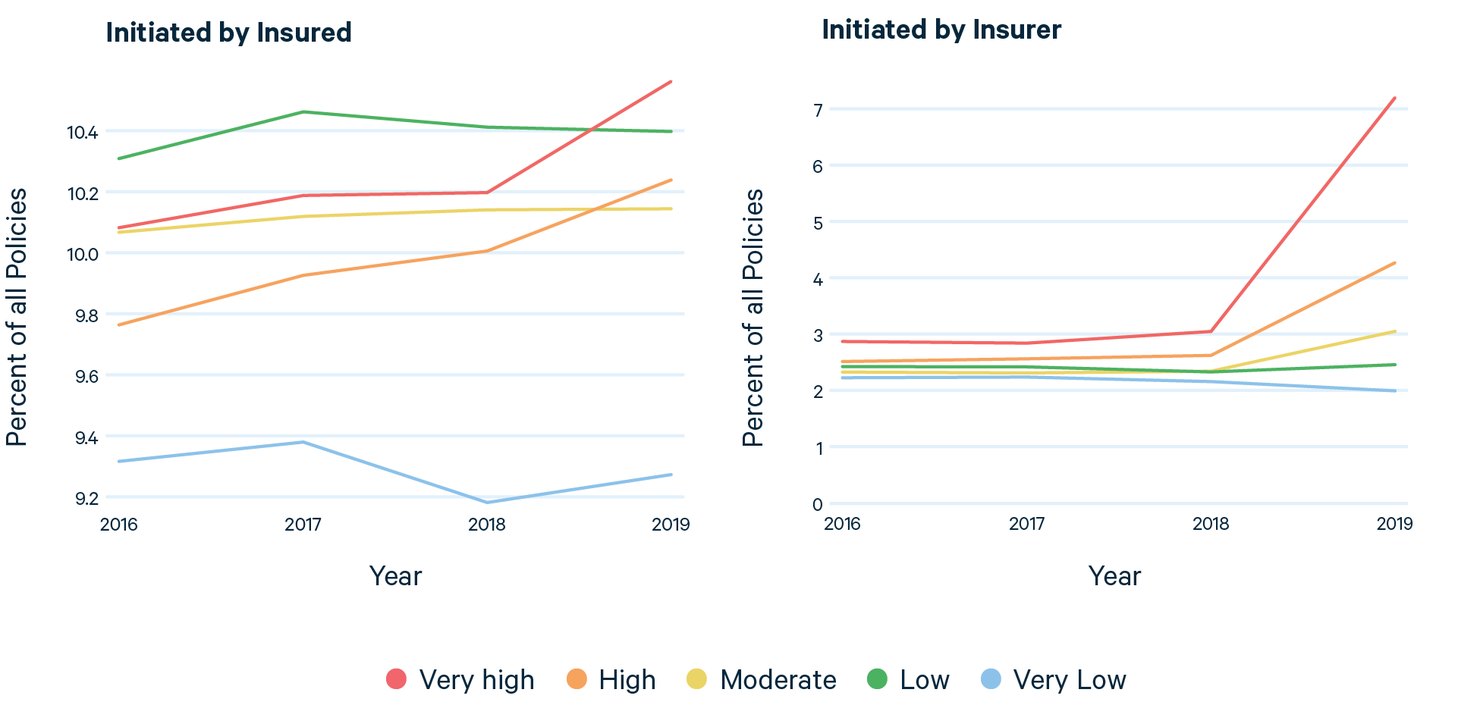

Insurance Availability and Affordability under Increasing Wildfire Risk

Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

Insurance Availability and Affordability under Increasing Wildfire Risk

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

Column California's fire insurance market reaches a crisis Los

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

CA Fire Insurance 8 The Avenue Central Coast Realty Best Real

Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

Fire Insurance Meaning, Principles, Types, Process, Examples

Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

Insurance Availability and Affordability under Increasing Wildfire Risk

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

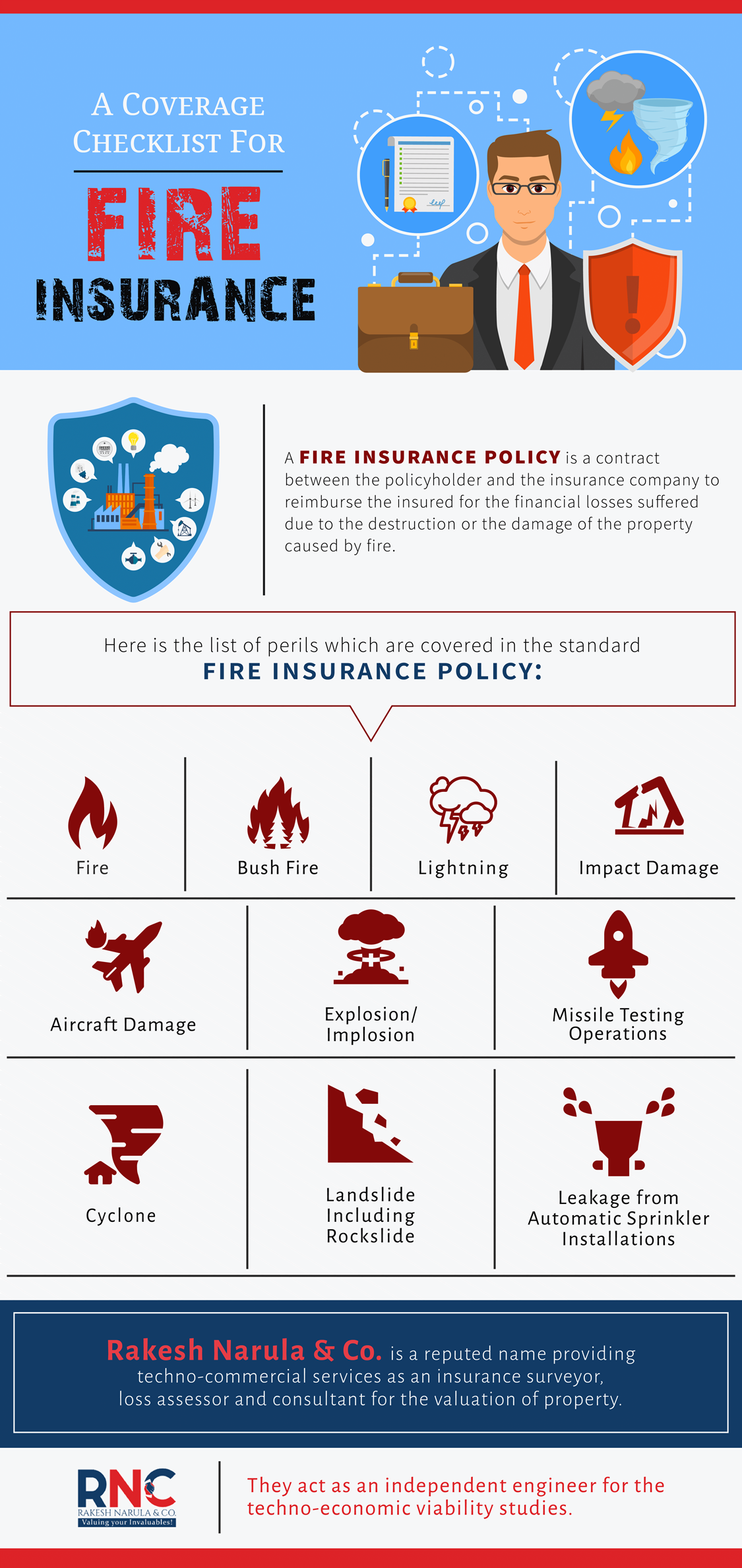

A Coverage Checklist For Fire Insurance Infographic Plaza

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

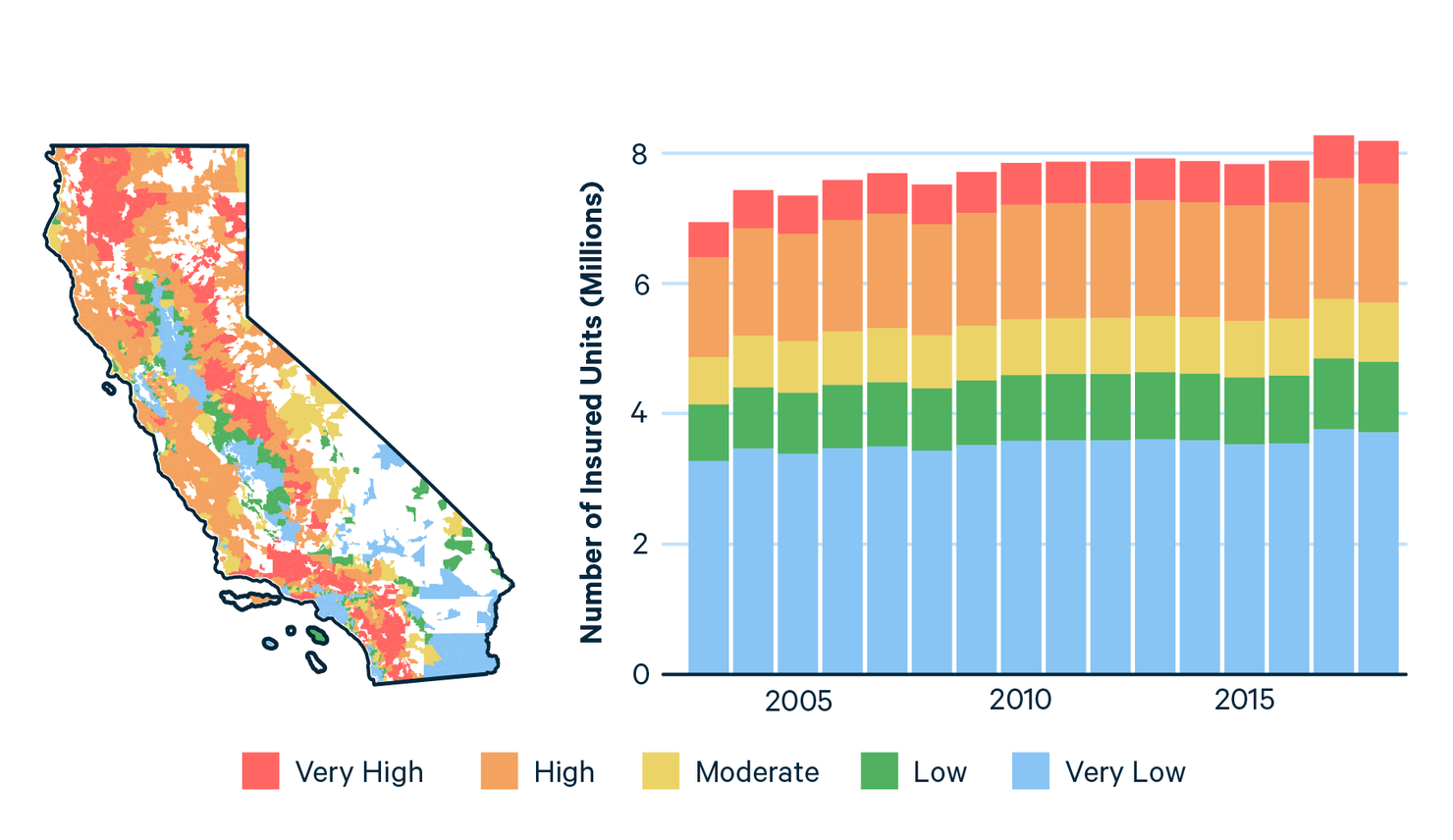

Chart California Homeowners Insured No More Amid Fire Danger Statista

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the. Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of.

Insurance Availability and Affordability under Increasing Wildfire Risk

Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

California Fire Insurance Map Life Insurance Quotes

Standard homeowners insurance policies in california typically cover fire damage under dwelling, personal property, and loss of. Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.

Standard Homeowners Insurance Policies In California Typically Cover Fire Damage Under Dwelling, Personal Property, And Loss Of.

Every homeowner in california, must provide sufficient insurance to protect his/her property against fire, liability, and cost of rebuilding the.