What Is Prepaid Expenses On A Balance Sheet - Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but.

Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but.

One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but.

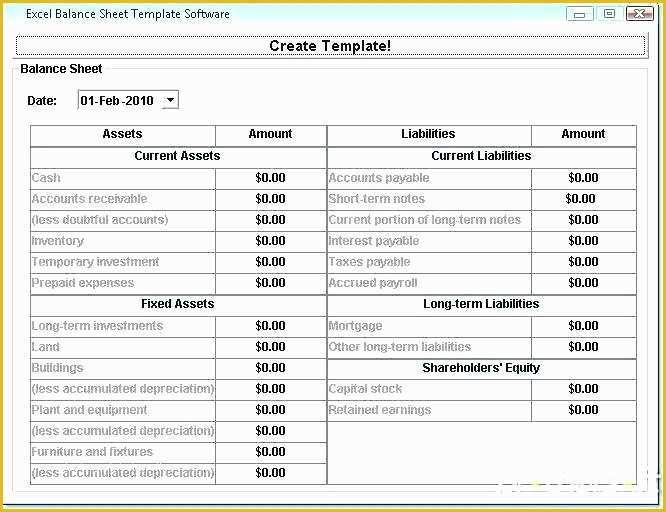

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. One of the.

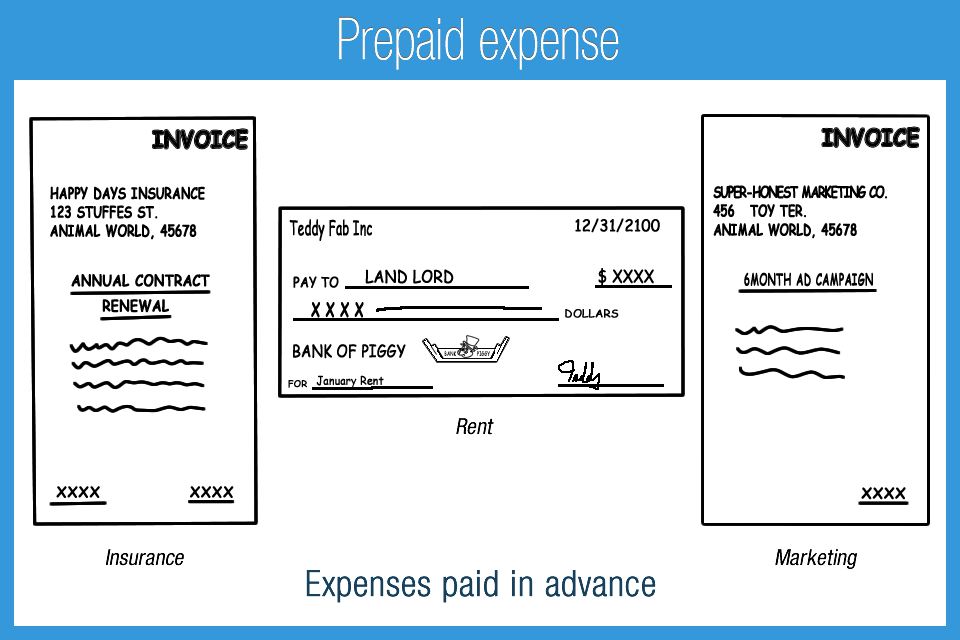

Prepaid Expenses Balance Sheet Ppt Powerpoint Presentation Infographics

Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. One of the.

Prepaid Expenses on Balance Sheet Quant RL

Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses are expenses.

Prepaid Expenses on the Balance Sheet Quant RL

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. One of the.

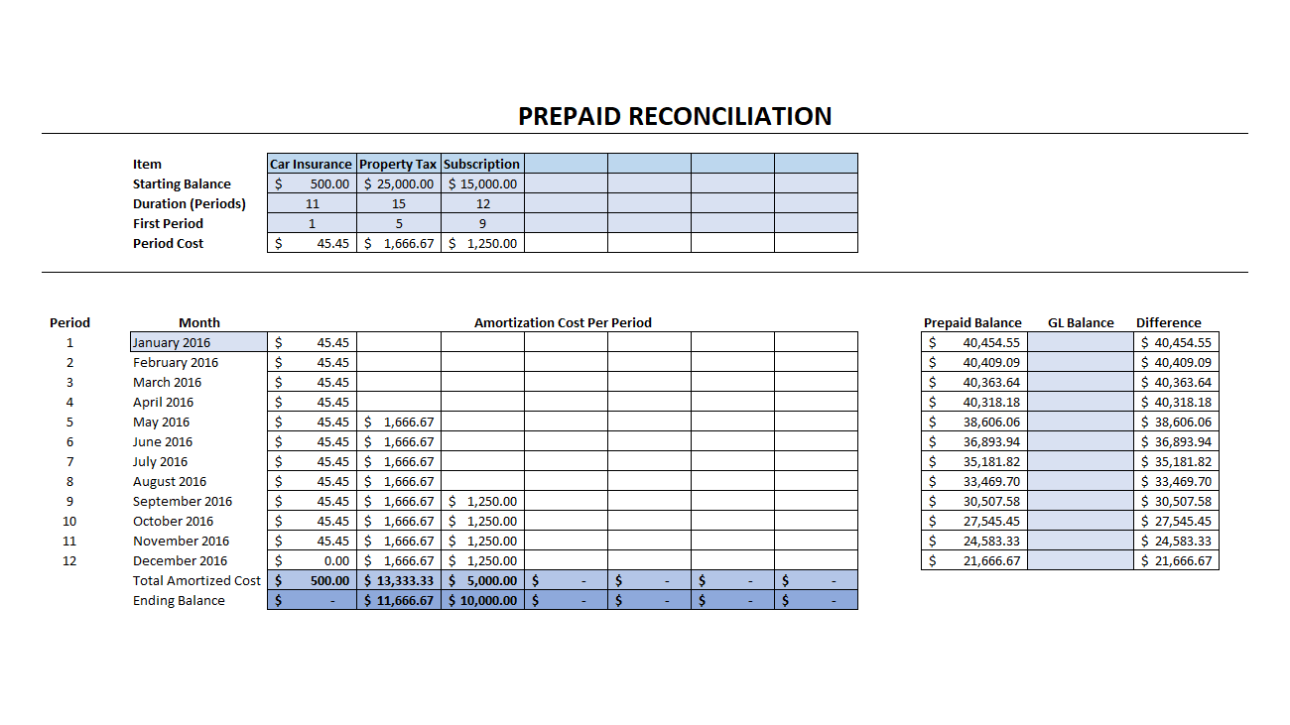

50 Free Prepaid Expense Schedule Excel Template Heritagechristiancollege

Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses.

Prepaid expense Accounting Play

Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. One of the.

Prepaid Expenses Template

Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. One of the.

Prepaid Expense Definition and Example

Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses.

Prepaid Expense Template

One of the most overlooked yet essential aspects of accurate accounting is how companies manage balance sheet prepaid. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes. Prepaid expenses refer to payments made.

One Of The Most Overlooked Yet Essential Aspects Of Accurate Accounting Is How Companies Manage Balance Sheet Prepaid.

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but. Prepaid expenses refer to payments made in advance for products or services expected to be received on a later date, most. Prepaid expenses are expenses that have been paid in advance, whereas accrued expenses are expenses that the organization owes.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)