What Is Tax Warrant - If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. When a tax warrant is. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a state tax warrant? What is a tax warrant?

What is a tax warrant? What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant is a document that the department uses to establish the debt of a taxpayer. When a tax warrant is.

What is a tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. When a tax warrant is. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a state tax warrant?

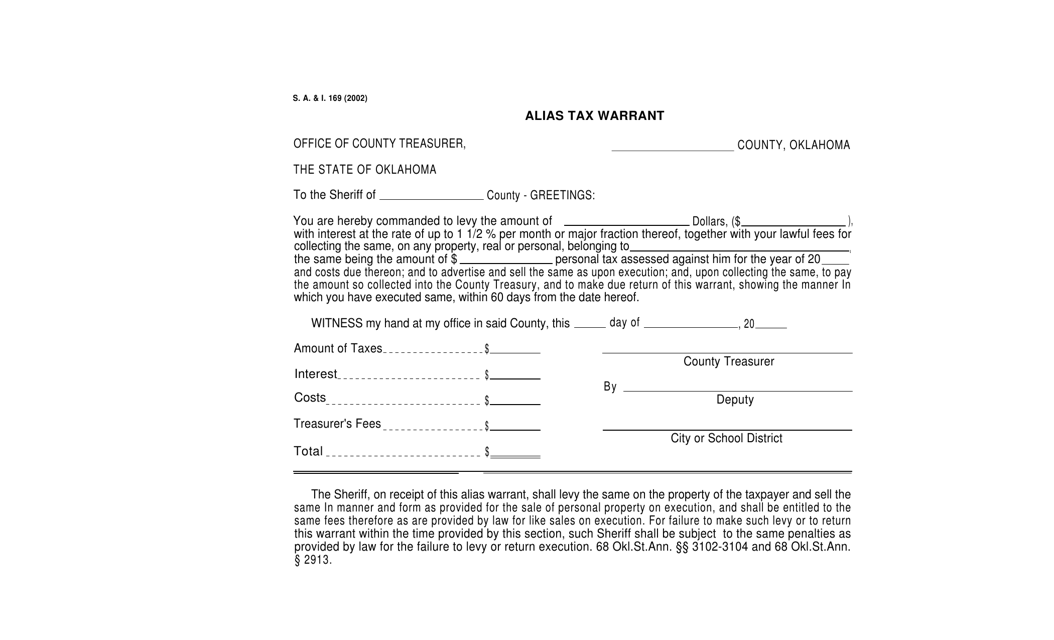

Form S.A.& I.169 Fill Out, Sign Online and Download Printable PDF

A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. What is a tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. What is a state tax warrant? A tax warrant.

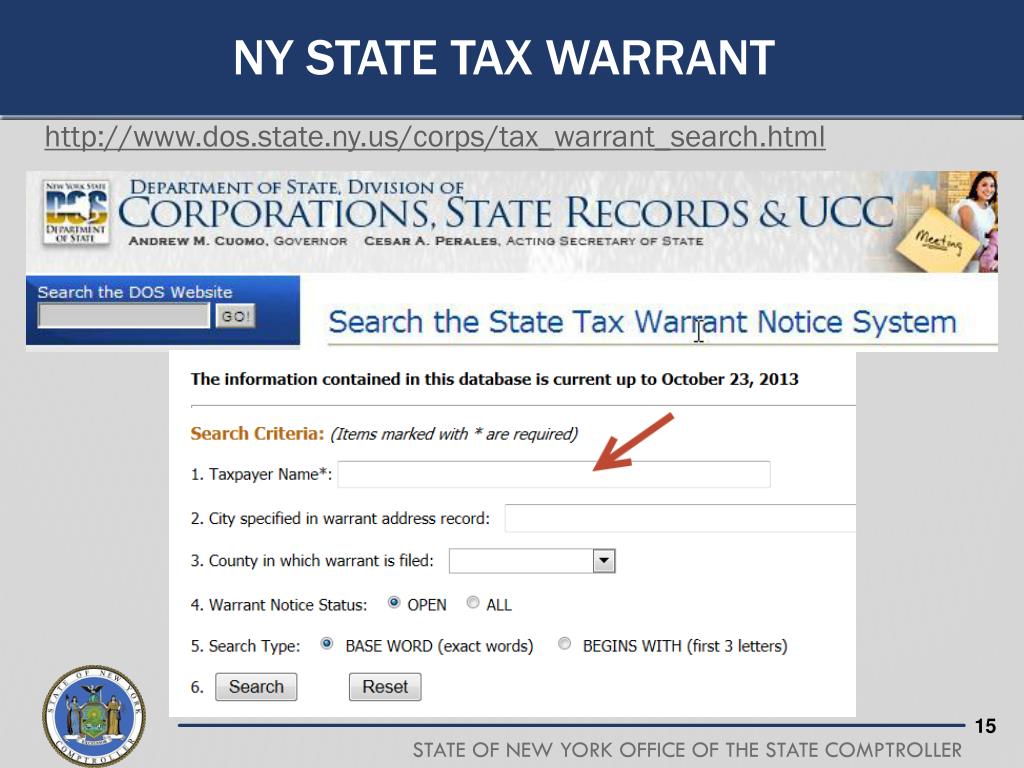

PPT State Authorities Vendor Responsibility PowerPoint Presentation

A tax warrant is a document that the department uses to establish the debt of a taxpayer. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. When a tax warrant is. A tax warrant is equivalent to a civil judgment against you, and protects new york.

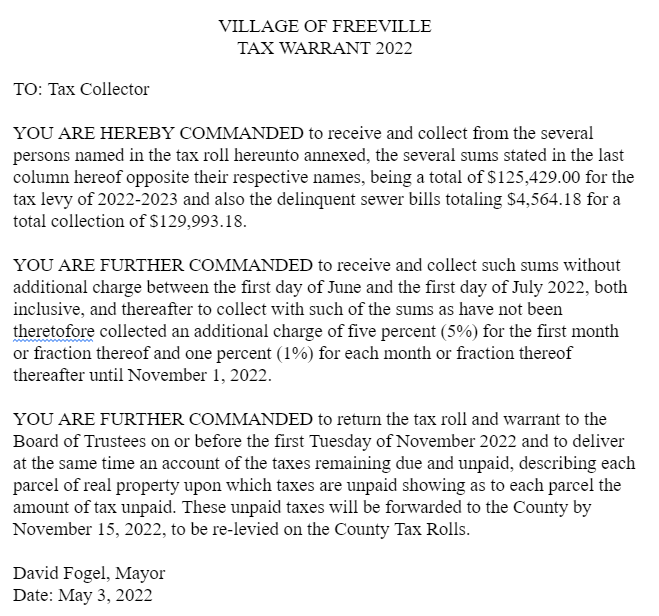

Legal Notice Tax Warrant Freeville NY

When a tax warrant is. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. What is a state tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant.

New York State Tax Collections When NYS Wants Back Due Tax Debt

A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. When a tax warrant is. What is a tax warrant? A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a state tax warrant?

How to Handle a Sales Tax Warrant Effectively Sales Tax Defense

A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a tax warrant? If you fail to pay your state taxes or resolve the past due balance within.

Tax Warrants — DeKalb County Sheriff's Office

What is a state tax warrant? What is a tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant.

What Is An Tax Warrant RONGOQ

When a tax warrant is. What is a state tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant is a document that the department uses to establish the debt of a taxpayer. If you fail to pay your state taxes or.

Warrant Taxpayer Taxes

What is a tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. When a tax warrant is. What is a state tax warrant? A tax warrant is a document that the department uses to establish the debt of a taxpayer.

What Happens When A Tax Warrant Is Issued? Beem

What is a state tax warrant? When a tax warrant is. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. A tax warrant.

What Happens When the IRS Issues a Tax Warrant Against Me?

When a tax warrant is. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is equivalent to a civil judgment against.

What Is A State Tax Warrant?

When a tax warrant is. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of.