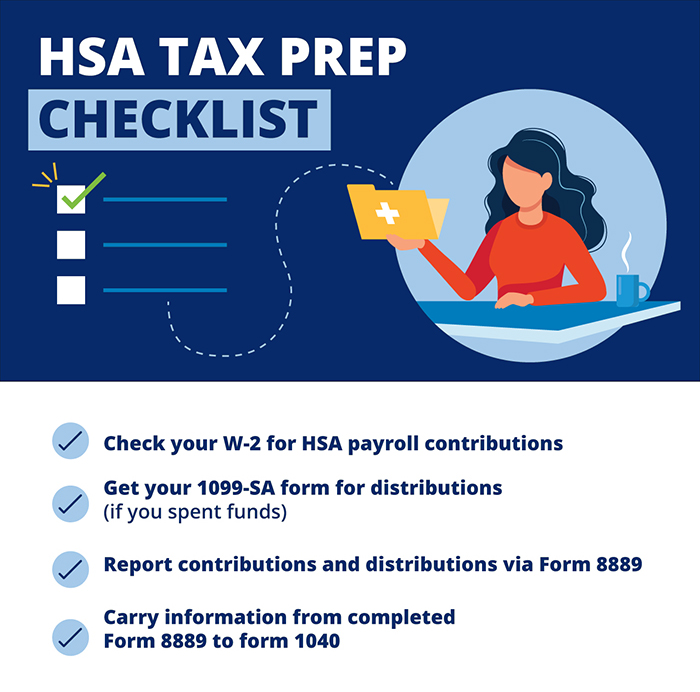

When Are Hsa Tax Forms Available - Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Hsa tax forms can be found in your online account starting january 31. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account (hsa) tax. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Refer to your w2 for hsa contributions.

The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Hsa tax forms can be found in your online account starting january 31. Healthequity provides the health savings account (hsa) tax. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Refer to your w2 for hsa contributions. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax.

Hsa tax forms can be found in your online account starting january 31. Refer to your w2 for hsa contributions. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Healthequity provides the health savings account (hsa) tax. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax.

Hsa Savings Account Form

Refer to your w2 for hsa contributions. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can.

How HSA Distributions and Contributions Affect Your Tax Return

Refer to your w2 for hsa contributions. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need.

HSA, Health Savings Account, and Tax Forms. Editorial Photo

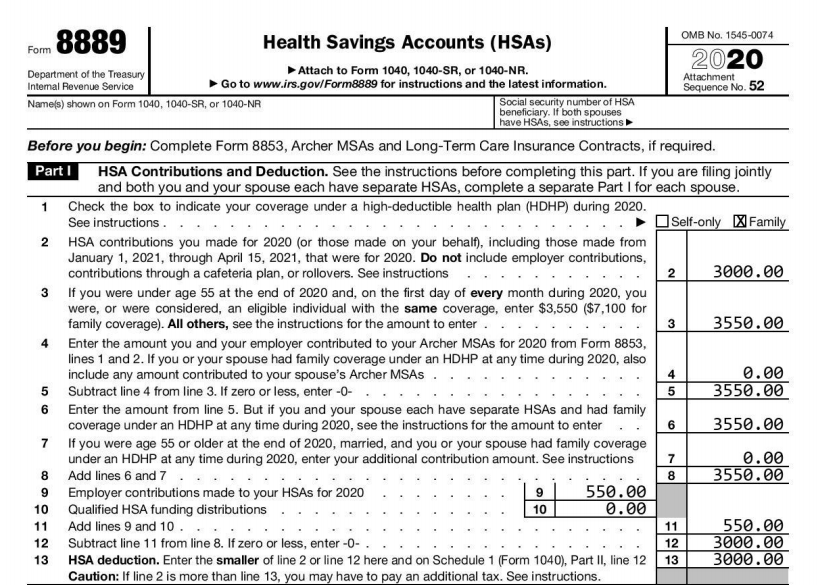

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Refer to your w2 for hsa contributions. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account.

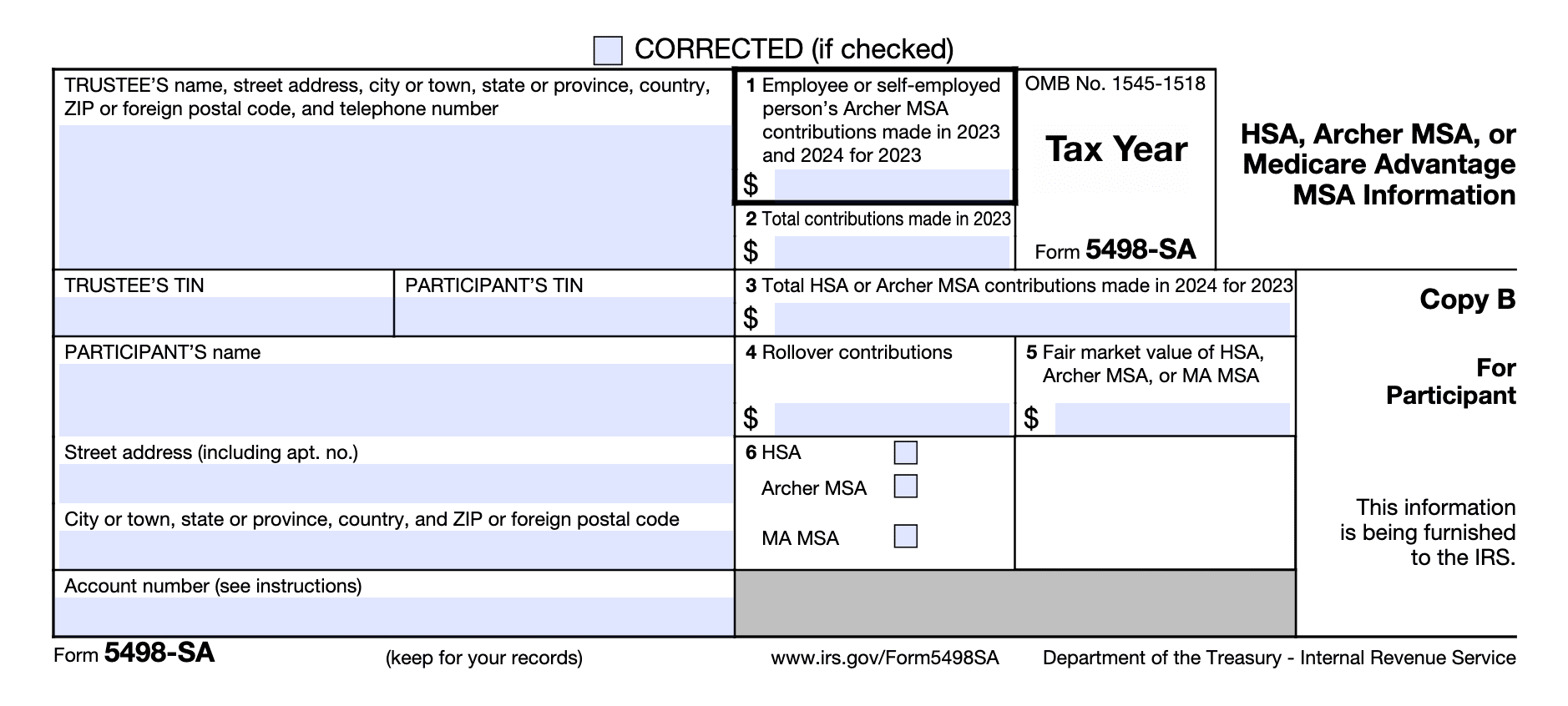

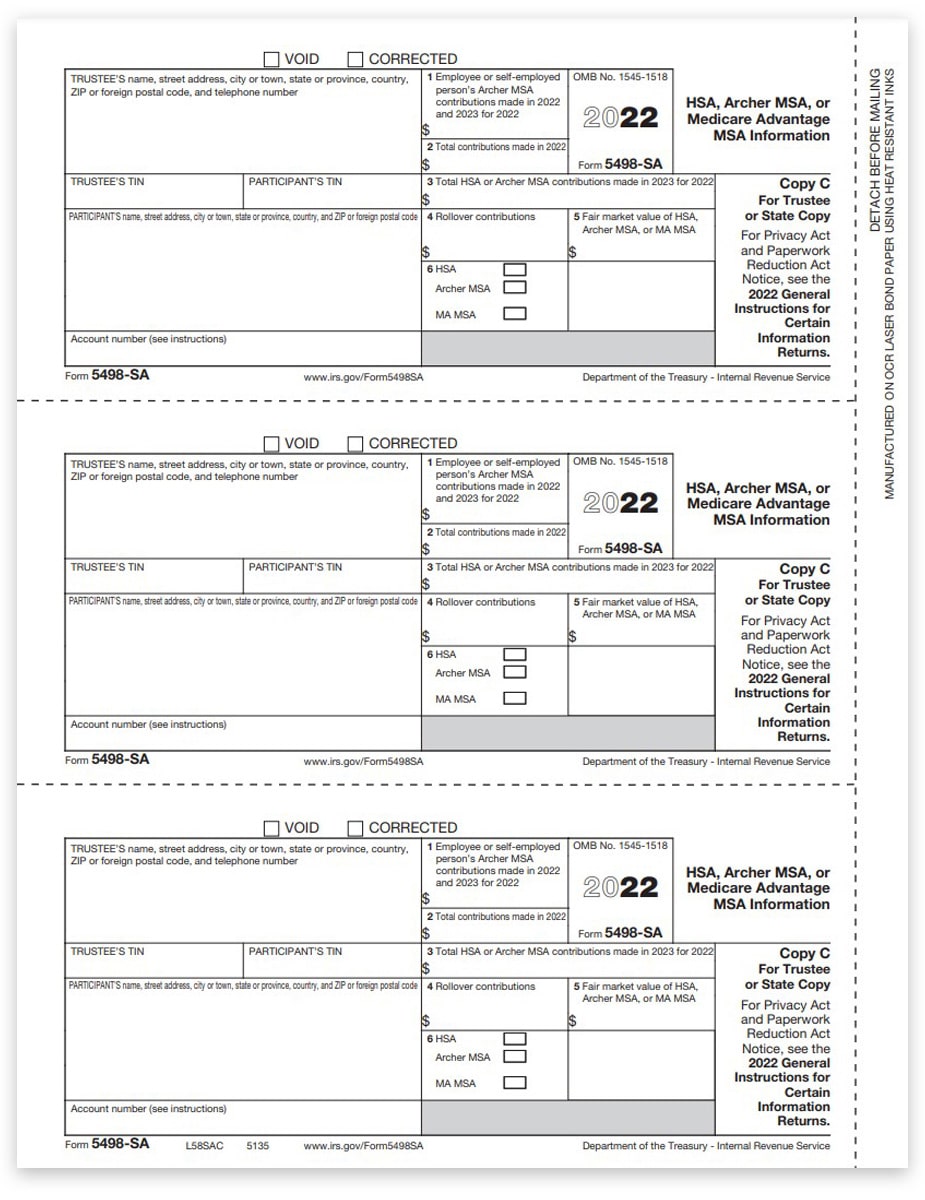

IRS Form 5498SA walkthrough (HSA, Archer MSA, or Medicare Advantage

Healthequity provides the health savings account (hsa) tax. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Hsa tax forms can be found in your online account starting january 31. The irs does not require separate hsa tax forms because the information related to your hsa.

HSA Edge

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured.

4 Important Tips About Tax Returns & HSAs First American Bank

The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form.

2023 Hsa Form Printable Forms Free Online

Refer to your w2 for hsa contributions. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Healthequity provides the health savings account (hsa) tax. The irs does not require separate hsa tax forms.

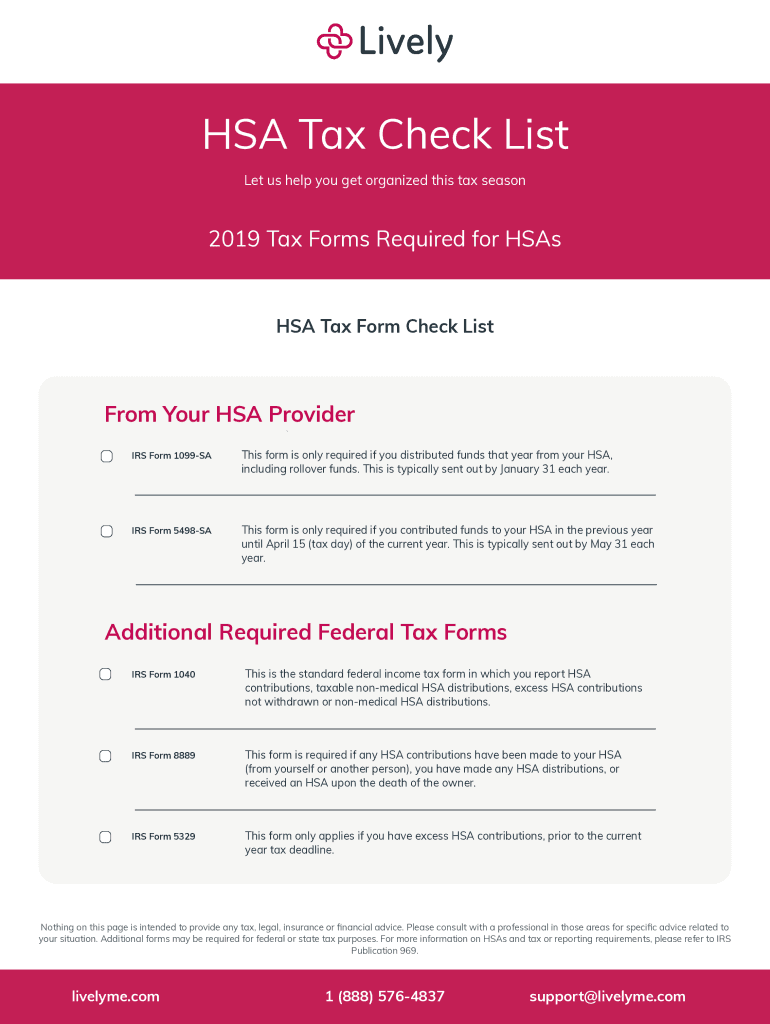

Fillable Online HSA and Tax Forms

Healthequity provides the health savings account (hsa) tax. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Refer to your w2 for hsa contributions. Hsa tax forms can be found in your online account starting january 31. The irs does not require separate hsa tax forms because the information related to your.

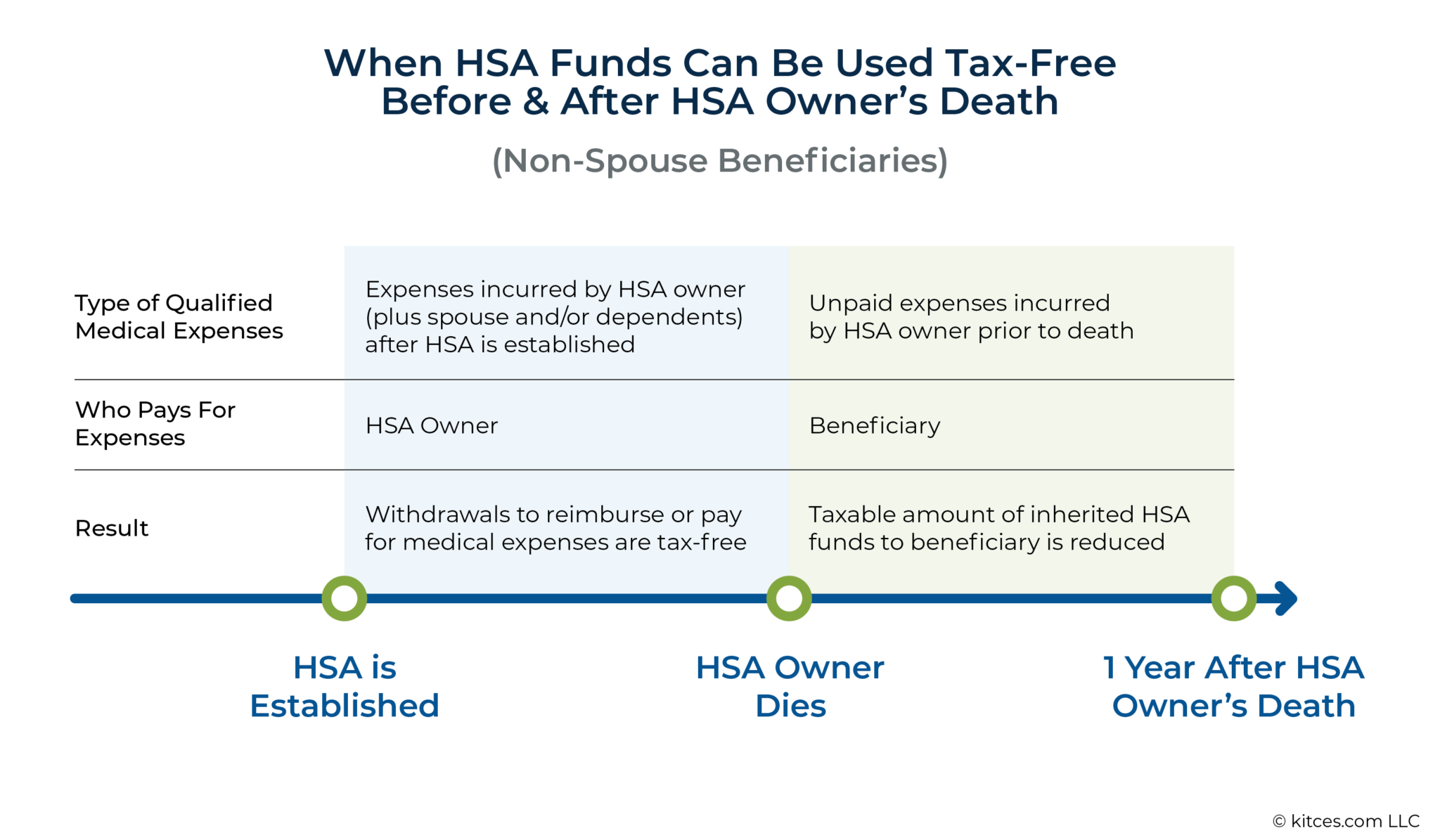

How To Quickly (And TaxEfficiently) Draw Down HSA Assets

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Health savings accounts (hsas) offer tax advantages for medical expenses but come with.

Fillable Online Form 5498, Form 1099, Form 8889 HSA Tax Forms

The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax..

Health Savings Accounts (Hsas) Offer Tax Advantages For Medical Expenses But Come With Specific Tax Reporting Requirements.

Hsa tax forms can be found in your online account starting january 31. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account (hsa) tax. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax.