Your Information Is Not Available At This Time Irs 2024 - If errors are identified, taxpayers can correct their records through the social security administration or file an amended return with. For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. If you requested an adjustment to your account your information will not be available. Under the current year to pay (2024) it says: For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard.

For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. If errors are identified, taxpayers can correct their records through the social security administration or file an amended return with. If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard. Under the current year to pay (2024) it says: For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. If you requested an adjustment to your account your information will not be available.

The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard. Under the current year to pay (2024) it says: For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. If errors are identified, taxpayers can correct their records through the social security administration or file an amended return with. If you requested an adjustment to your account your information will not be available. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an.

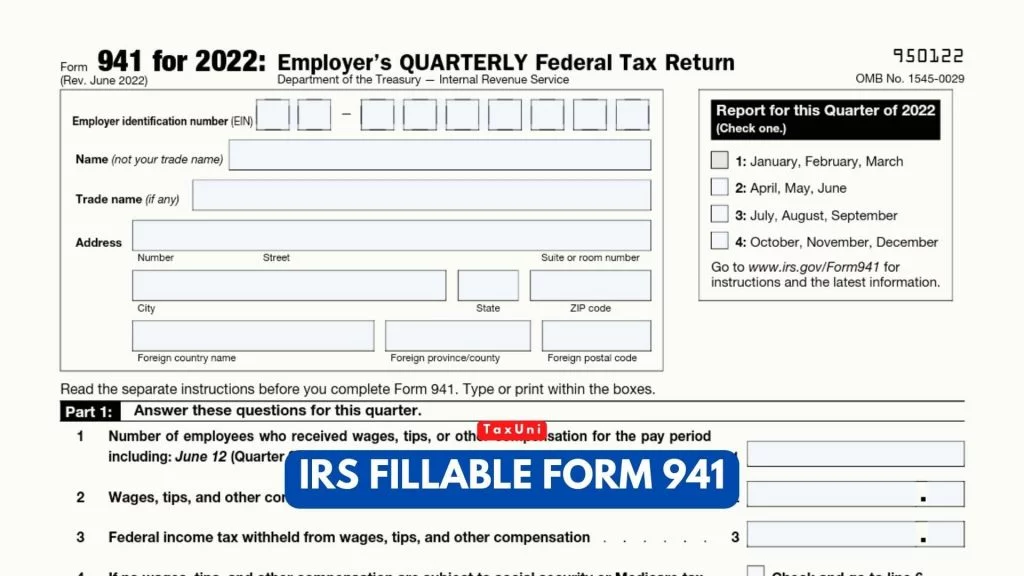

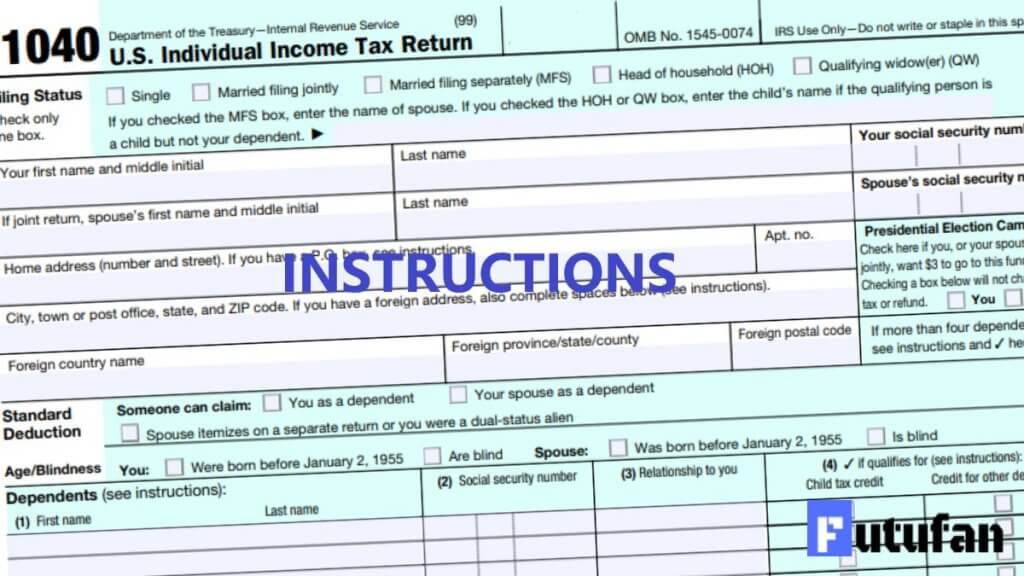

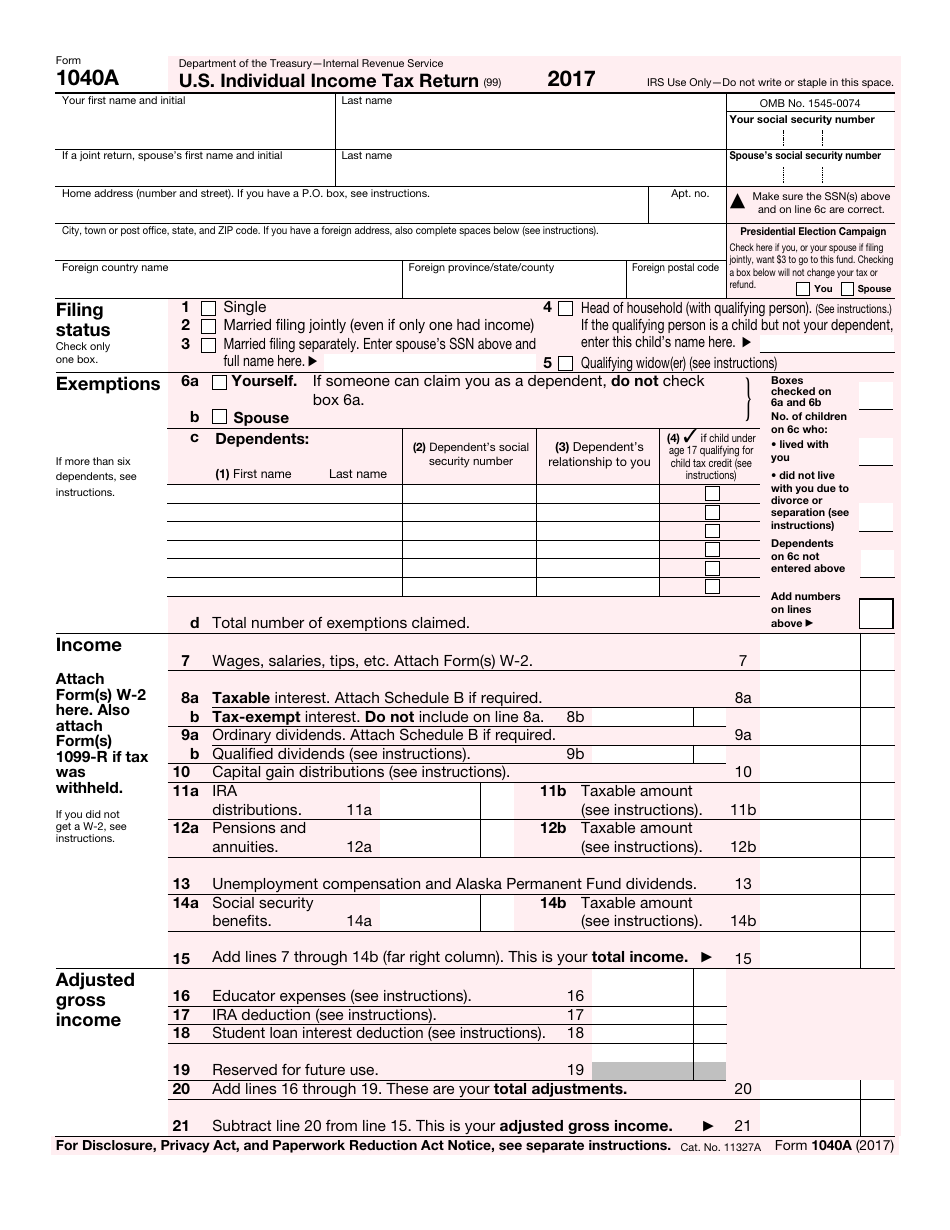

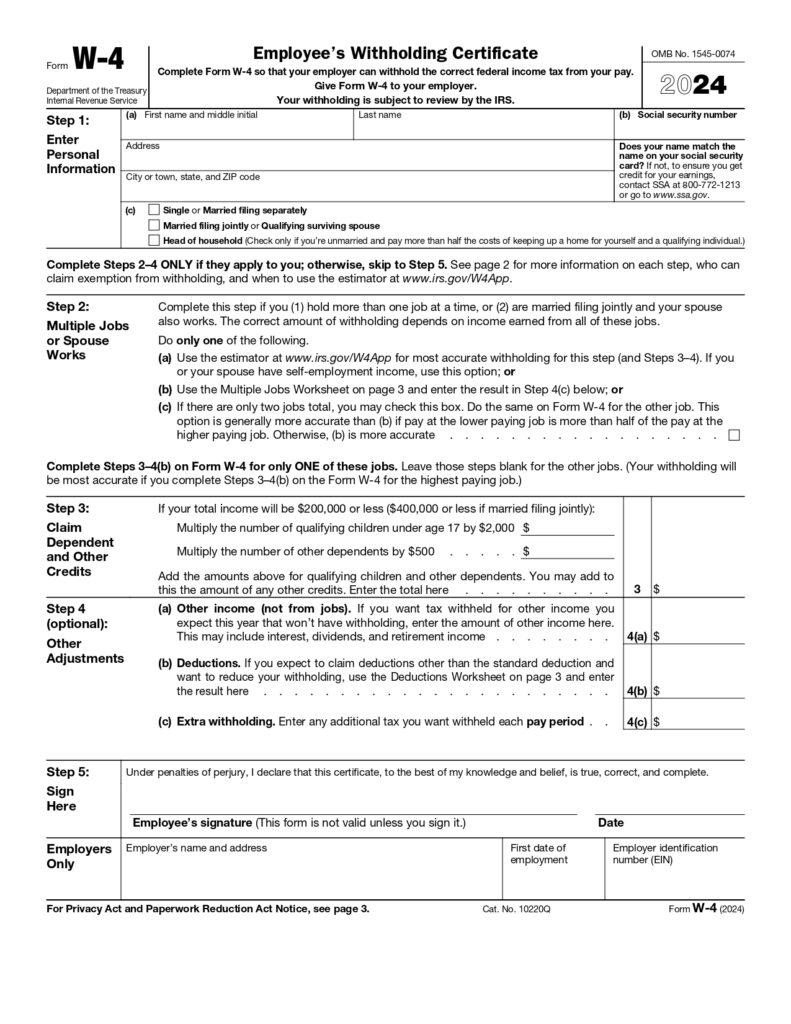

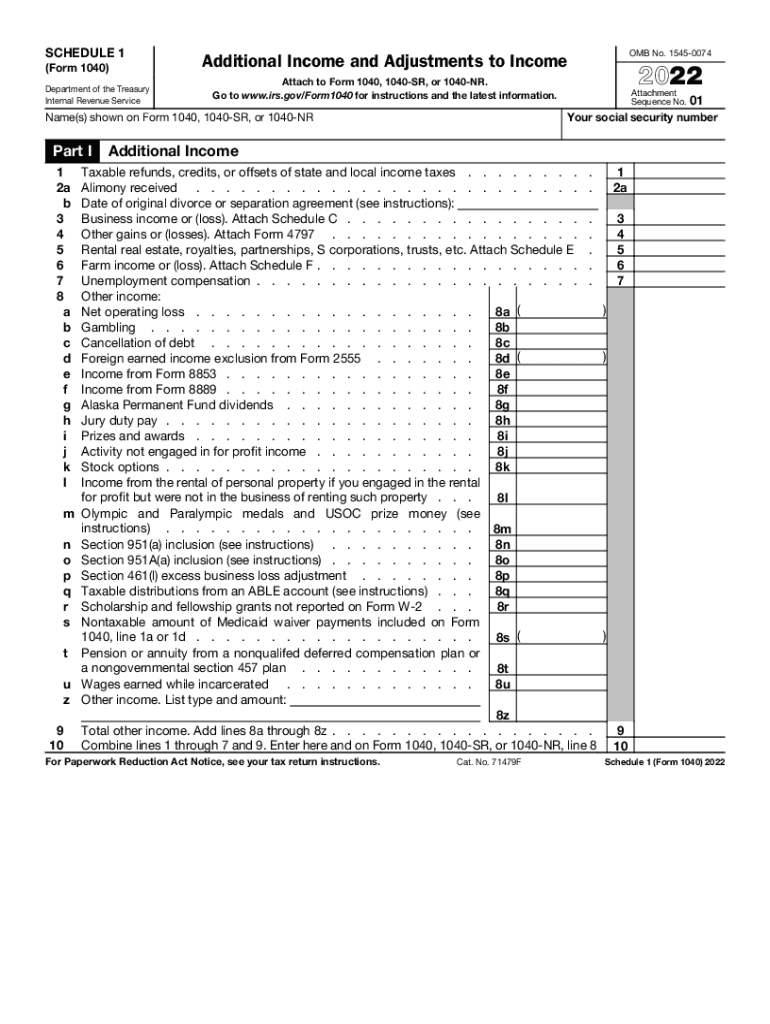

W9 2024 Fillable Irs Sib Lethia

If you requested an adjustment to your account your information will not be available. The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard. For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. Under the.

Irs Estimated Tax Forms 2024 Printable Casie Carlynn

If you requested an adjustment to your account your information will not be available. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. Under the current year to pay (2024) it says: If you filed your original tax return using an incorrect information return document, you may need to.

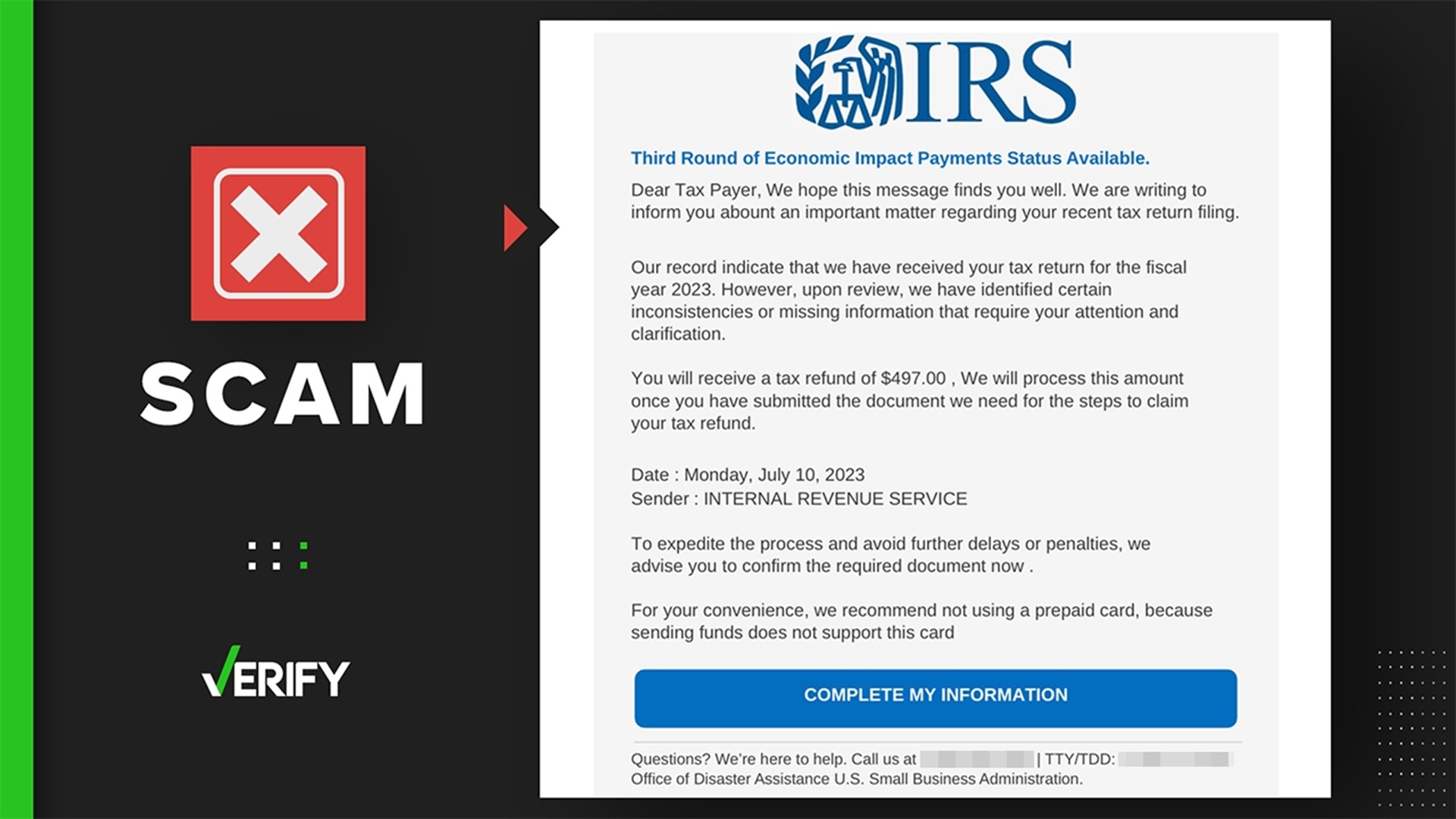

IRS fake stimulus check tax refund email scam

If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. The irs account screen shows a temporary information block for your 2024 tax year, which is displaying.

Irs 2024 Tax Forms Elsi Nonnah

If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. For 2 tax seasons, there has been a message on my tax records page on my irs.

2024 2024 Forms And Instructions Irs Vevay Jennifer

Under the current year to pay (2024) it says: If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. If you requested an adjustment to your account your information will not be available. For 2 tax seasons, there has been a message on my tax records page.

Second stimulus check problems What to do if IRS 'Get My Payment

For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard. Under the current year to pay (2024) it says: If you filed your original tax return.

Irs Fillable Forms 2024 Schedule C Lyndy Stephenie

For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. If you filed your original tax return using an incorrect information return document, you may.

When Will Irs Forms For 2024 Be Available Joana Lyndell

For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. Under the current year to pay (2024) it says: If you requested an adjustment to your account your information will not be available. If errors are identified, taxpayers can correct their records through the social.

Went from saying information not available for 4 weeks straight to this

If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. If you requested an adjustment to your account your information will not be available. If errors are identified, taxpayers can correct their records through the social security administration or file an amended return with. For 2 tax.

TSF Service 3/10/2024 SERMON Fruit Inspection Pastor David Hara

Under the current year to pay (2024) it says: If errors are identified, taxpayers can correct their records through the social security administration or file an amended return with. If you requested an adjustment to your account your information will not be available. If you filed your original tax return using an incorrect information return document, you may need to.

Under The Current Year To Pay (2024) It Says:

For 2 tax seasons, there has been a message on my tax records page on my irs online account that my tax records are unavailable. If you filed your original tax return using an incorrect information return document, you may need to correct your information by filing an. For 2024, there's a specific informational notice instead of a balance, stating your information is not available at this time. If you requested an adjustment to your account your information will not be available.

If Errors Are Identified, Taxpayers Can Correct Their Records Through The Social Security Administration Or File An Amended Return With.

The irs account screen shows a temporary information block for your 2024 tax year, which is displaying the standard.